Mt. Gox moved 47,229 $BTC($3.13B) to 3 unknown wallets again in the past 3 hours!#MtGox has moved 61,559 $BTC($3.89B) to #Bitstamp, #Kraken, #Bitbank, and SBI VC Trade for repayment since July 5.https://t.co/f2q66eQNuk pic.twitter.com/3G1tp47rav

— Lookonchain (@lookonchain) July 31, 2024

A

A

Mt. Gox Transfers 3 Billion in Bitcoin: Why the Price Barely Moved

Wed 31 Jul 2024 ▪

3

min read ▪ by

Getting informed

▪

Event

Mt. Gox’s movements have not left the crypto market unscathed, even influencing investor morale. The recent transfer of 3 billion dollars in Bitcoin by Mt. Gox surprised many but did not have the expected effect on Bitcoin’s price. With a market that now seems immune to Mt. Gox’s antics, it is pertinent to understand why and how this affects investor sentiment and future market trends.

Bitcoin and Mt. Gox: A Tempered Impact on the Market

The time for repayments has come for Mt. Gox. On July 30, the Japanese firm moved approximately 47,229 BTC to three unknown wallets, notes Lookonchain. Although this transaction briefly dropped Bitcoin’s price below $66,000, the market quickly recovered. According to experts, this move was anticipated by investors.

“Mt. Gox holders are here to HODL,” explains Ben Simpson, founder of Collective Shift.

This “hodling” strategy – holding assets for the long term – seems to have reduced selling pressure in the market. Glassnode analysts confirm that only a few Mt. Gox creditors plan to sell their bitcoins.

- More than 41.5% of the 141,686 BTC redistributed to Mt. Gox creditors since July 5.

The lack of panic among investors indicates a growing market maturity.

Mt. Gox creditors, having chosen to receive BTC rather than fiat currencies, show their confidence in Bitcoin’s long-term value. Thus, despite massive transactions, the impact on the price remains limited.

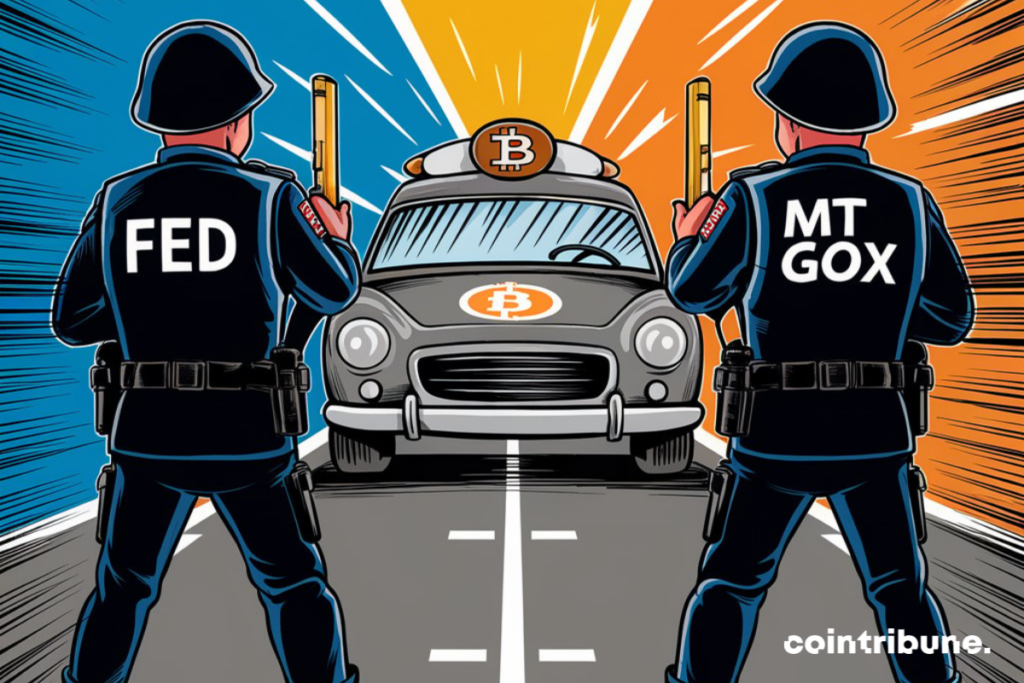

Bitcoin Volatility: Between Mt. Gox and the Fed

While the market was digesting Mt. Gox’s movements, another threat loomed: the imminent decision by the US Federal Reserve on interest rates.

This double threat could have created a whirlwind of volatility, but the Bitcoin market remained relatively stable.

The FOMC meeting, with a possible rate cut in September, added a dose of uncertainty. Nonetheless, the queen of cryptos showed notable resilience.

Analysts believe this relative stability is due to increased confidence in Bitcoin’s fundamentals and an expectation of more accommodative monetary policies.

“The market seems to be taking the news well for now,” observes Pav Hundal, chief analyst at Swyftx.

Indeed, BTC briefly dropped to $65,500 before rebounding. This measured reaction illustrates the market’s robustness in the face of potentially destabilizing news.

Yet, Donald Trump, with his historic Nashville speech, has already contributed to investor optimism and boosted Bitcoin’s price.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

A

A

La révolution blockchain et crypto est en marche ! Et le jour où les impacts se feront ressentir sur l’économie la plus vulnérable de ce Monde, contre toute espérance, je dirai que j’y étais pour quelque chose

DISCLAIMER

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.