Finance: What does it mean to be wealthy in France in 2024?

Being rich in France is more than just a number on a payslip. It’s a standard of living, substantial wealth, and a distinct social status. The 2024 edition of the report on the rich in France offers us a clear vision of this reality. We will explore the main findings of this revealing report.

Finance and Income Wealth

France, the European leader in attractiveness, surprises us with this 2024 wealth report. Indeed, it reveals that 4.7 million French people (out of 68 million) are considered rich in income. These individuals have a monthly post-tax income of over 3,860 euros for a single person, 5,790 euros for a couple, or 9,650 euros for a family with two children over the age of fourteen. This represents about 7.4% of the French population.

Despite a 1.5-point drop since 2011, the wealthy in France have seen their standard of living increase. Indeed, half of them have a standard of living more than 1.28 times the wealth threshold in 2021, compared to 1.26 times in 2011.

The income growth of the wealthy is particularly marked at the top of the income scale. The top 1% of France captured 7.7% of all pre-tax incomes in the early 1980s. This share reached 12.7% in 2022, according to the World Inequality Database.

Thus, finance plays a crucial role, as income from investments (including Bitcoin and other cryptocurrencies) and financial placements reinforce this wealth. The wealthy in France are therefore supported by a combination of high salaries and diverse financial flows. And unfortunately fraudsters.

Wealth in Assets

In terms of assets, the report reveals that 16.9% of French households have a net asset worth over 531,000 euros, which is more than three times the median asset value (excluding debt). Among these households, the wealthiest 10% own more than 716,300 euros.

The highest asset values are quite substantial: millionaires represent 5% of households, and the top 1% holds at least 2.2 million euros per household.

The concentration of wealth in the hands of the wealthiest has increased to the detriment of the rest of the population. The share of the top 10% has risen from 41% to 47% of all households’ assets between 2010 and 2021.

Meanwhile, the wealth of the top 500 professional fortunes has nearly tenfolded in 20 years, increasing from 124 billion euros in 2003 to 1,170 billion euros in 2023. This wealth concentration is largely attributed to the massive profits drawn from finance and major French corporations (like LVMH), creating significant economic disparities.

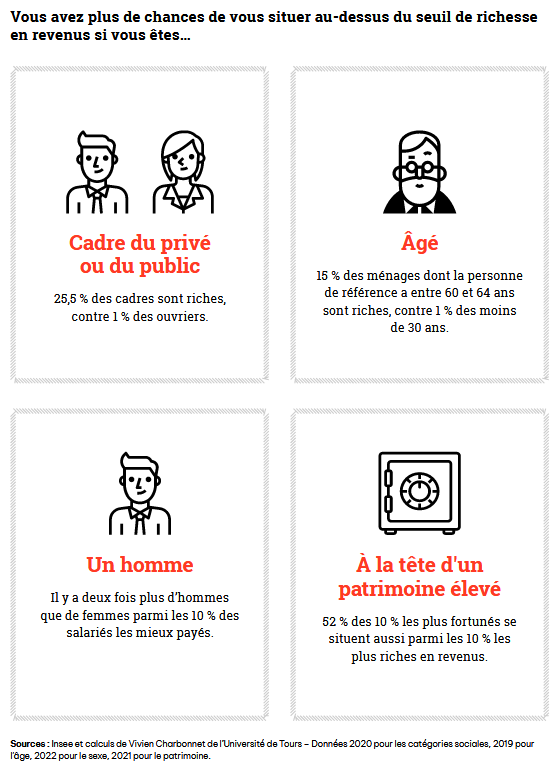

Senior Executives, Aged and Male

The report also highlights the demographic characteristics of the rich in France. In 2020, 25.5% of executives were considered rich, nearly twice the proportion of the self-employed, and incomparable to the likelihood of being rich for a worker (1%) or employee (2%).

Senior executives, particularly those in the private sector, dominate this category, with 43% of the wealthy in income being private sector senior executives and 21% being public sector executives.

Wealth is also related to age: the share of wealthy in the population increases with age, from 1% of households under 30 years old to 10% among those aged 55-59, peaking at 15% between 60 and 64 years old. Additionally, the resources of wealthy couples predominantly come from men’s incomes.

Men are twice as likely as women to occupy positions offering salaries in the top 10% of the hierarchy, and 3.4 times more present than women in the top 1%. Thus, the rich in France are often older men (like Bernard Arnault), holding senior executive positions, and deriving significant income from finance and financial placements.

The 2024 report on the rich in France reveals marked disparities in terms of income and wealth, highlighting the importance of finance in wealth accumulation and raising many questions about economic fairness.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

La révolution blockchain et crypto est en marche ! Et le jour où les impacts se feront ressentir sur l’économie la plus vulnérable de ce Monde, contre toute espérance, je dirai que j’y étais pour quelque chose

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.