Crypto: Why Does Ethereum's Inflation Continue to Be a Concern?

The cryptocurrency market is going through a tumultuous period, with a majority of crypto assets in decline. Ethereum, despite its transition to Proof of Stake (PoS), is not escaping the general trend. As Ethereum’s supply continues to grow, concerns are arising over its inflation and its impact on the price of ETH. In this article, we will explore these challenges and the prospects for the number two crypto.

Ethereum: Inflation Persists Despite PoS

Unlike Bitcoin with its cap of 21 million tokens, Ethereum’s supply remains unlimited. Despite hope that the transition to the Proof-of-Stake heavily advocated by founder Vitalik Buterin would reduce inflation, the reality is different.

Indeed, while the transition has eliminated miner rewards and introduced a more reasonable staking system, inflation has returned.

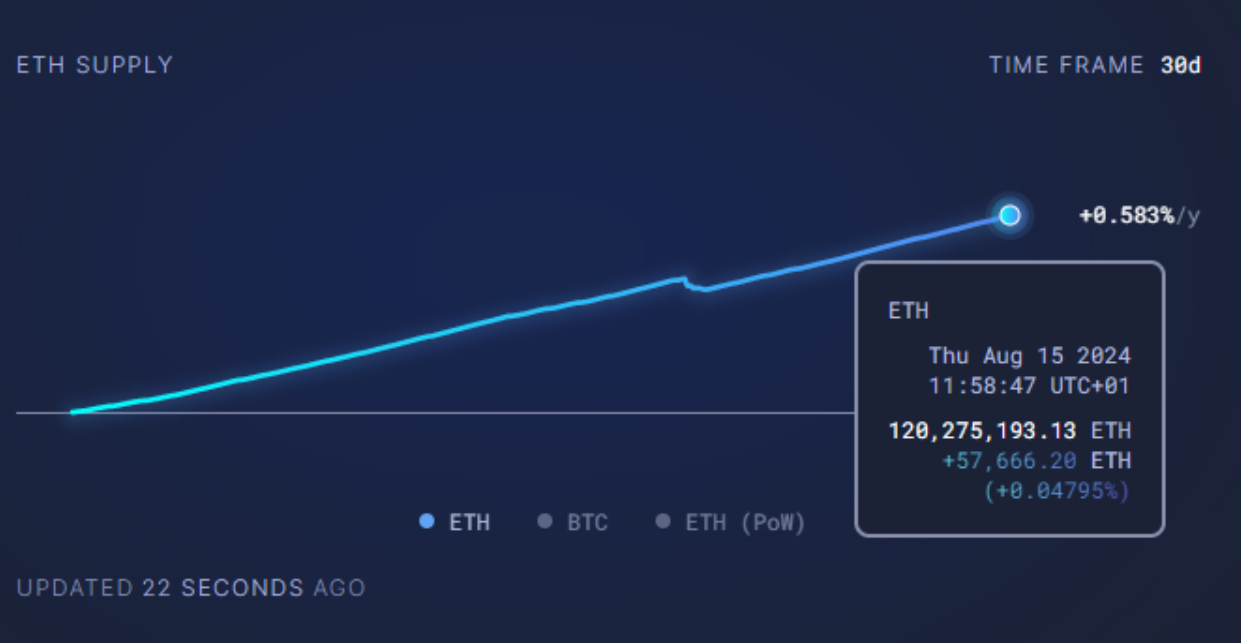

In the last 30 days, Ethereum’s supply has increased by 77,091 ETH, reaching a total of 120.28 million ETH.

The burn mechanism, put in place to counterbalance this increase, has only managed to burn 19,438 ETH during the same period, leaving a net surplus of 57,653 ETH in circulation.

The reduction in transaction fees following the establishment of a booming competitive landscape of Layer 2 solutions has also contributed to this inflationary environment.

What Direction for Ethereum in the Crypto Universe?

The future seems uncertain for Ethereum, with inflation that could continue to rise. The success of restaking platforms, such as EigenLayer, is accelerating the growth of supply, with an 11% increase in total value locked on EigenLayer in just one week. Analysts noted in April that restaking has shaken Ethereum.

This situation helps keep inflation at a moderate level.

However, the development of ETFs for Ethereum could offer some respite. Even in the worst-case scenario where inflation reaches between 1% and 5% per year, the impact on the price should not be catastrophic.

Other cryptocurrencies have thrived despite much higher inflation rates. However, the idea that inflation would support the price or cause a long-term shortage now seems illusory.

Meanwhile, Cardano is causing some discontent with 2.5% inflation, enough to annoy the competition.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

La révolution blockchain et crypto est en marche ! Et le jour où les impacts se feront ressentir sur l’économie la plus vulnérable de ce Monde, contre toute espérance, je dirai que j’y étais pour quelque chose

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.