Our latest Data Debrief just dropped.

— Kaiko (@KaikoData) August 19, 2024

This week we discuss how rate cuts will impact tokenized Treasuries, $ETH gas fees, AI tokens, and more. https://t.co/TdnkmRATSP

A

A

Crypto: Record Drop in Gas Fees, Ethereum in Trouble

Wed 21 Aug 2024 ▪

4

min read ▪ by

Getting informed

▪

Event

Summarize this article with:

What’s working really well with Ethereum these days? The crypto ETH is still in freefall, and the spot Ethereum ETFs have not had the expected effect. However, the recent drop in gas fees might just be the boost needed to restart the engine. This downward movement hides more complex stakes that could influence the future trajectory of the crypto.

Ethereum gas fees in freefall: opportunity or mirage?

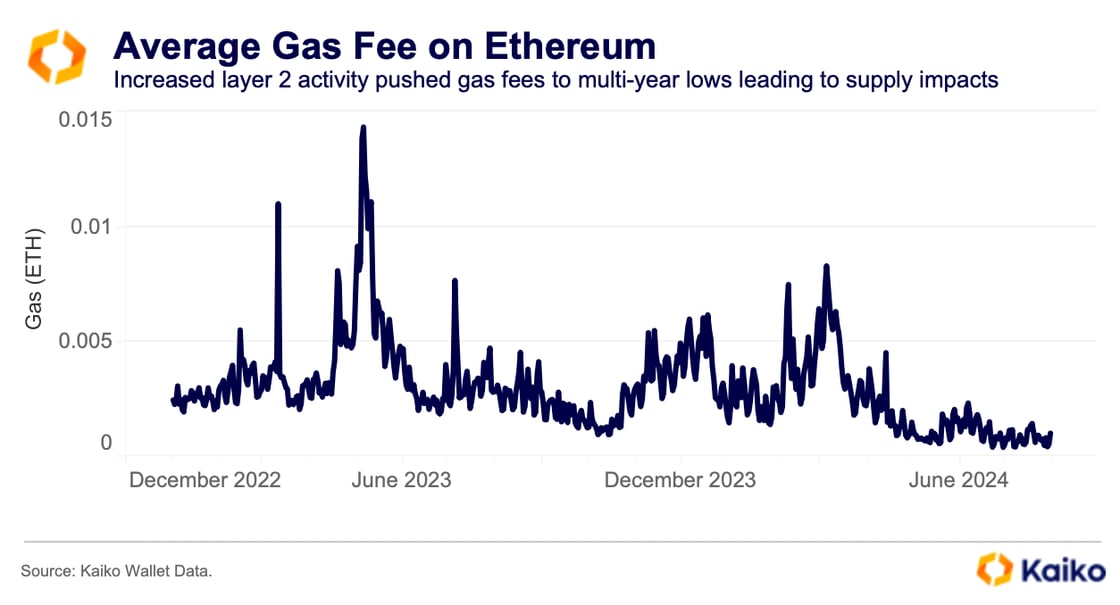

The gas fees on Ethereum, in freefall since last week, have recently reached their lowest level in five years, and while this seems like good news for users, it hides significant implications for the crypto.

This spectacular drop, largely attributed to the growing adoption of Layer 2 solutions and the Dencun update from last March, has significantly reduced transaction costs. Indeed, thanks to the introduction of new features such as “Blobs,” Layer 2 networks like Arbitrum or Base can now post data on the main blockchain at a lower cost.

One might think that this reduction in gas fees is a blessing, but it raises a major issue: lower fees also mean less ETH being burned.

Since April, the continuous drop in fees has led to a steady increase in the total supply of Ethereum, an inflation situation that continues to worry and could, in the long run, compromise the stability of its price.

According to Kaiko, the relationship between gas fees and the supply of crypto is crucial:

“Despite demand drivers like spot ETFs, this supply growth could limit potential short-term price hikes. “

An increase of 223,000 ETH in circulation, or about $591 million at the current price, has been recorded since April 2024. This surge in supply is a warning signal for investors, as an oversupply could maintain downward pressure on ether’s price.

The impact of new dynamics on Ethereum crypto

While the price of ether struggles to regain positive momentum, the impact of falling gas fees is being felt on several fronts. This situation, which may seem beneficial at first glance, hides perverse effects that threaten market stability.

On the one hand, the drop in gas fees makes transactions more accessible, but on the other hand, it reduces the ETH burn rate, contributing to the increase in overall supply. This surplus of ether has a direct effect on inflationary pressure, thus threatening the efforts to keep the crypto’s price on an upward trajectory.

To illustrate the scope of this dynamic, here are some key figures:

- Since April, ETH supply has increased by 0.2%, reaching 120.286 million units;

- ETH’s inflation rate is currently 0.71% per year;

- 16,500 ETH are added to the supply each week, which represents a significant amount on the market.

Despite the hopes placed in Ethereum ETFs, investors are cautious. The recent spot ETFs have not yet had the expected effect, and demand has not increased enough to offset this supply growth.

The drop in fees could signal a potential “floor price,” but in a context where supply fundamentals are not controlled, this outlook remains uncertain. A savvy trader would say that “the road to the top is paved with good intentions and falling gas fees. “

The drop in gas fees on Ethereum could well be a double-edged sword, capable of propelling ether crypto while posing challenges to its future valuation.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

A

A

La révolution blockchain et crypto est en marche ! Et le jour où les impacts se feront ressentir sur l’économie la plus vulnérable de ce Monde, contre toute espérance, je dirai que j’y étais pour quelque chose

DISCLAIMER

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.