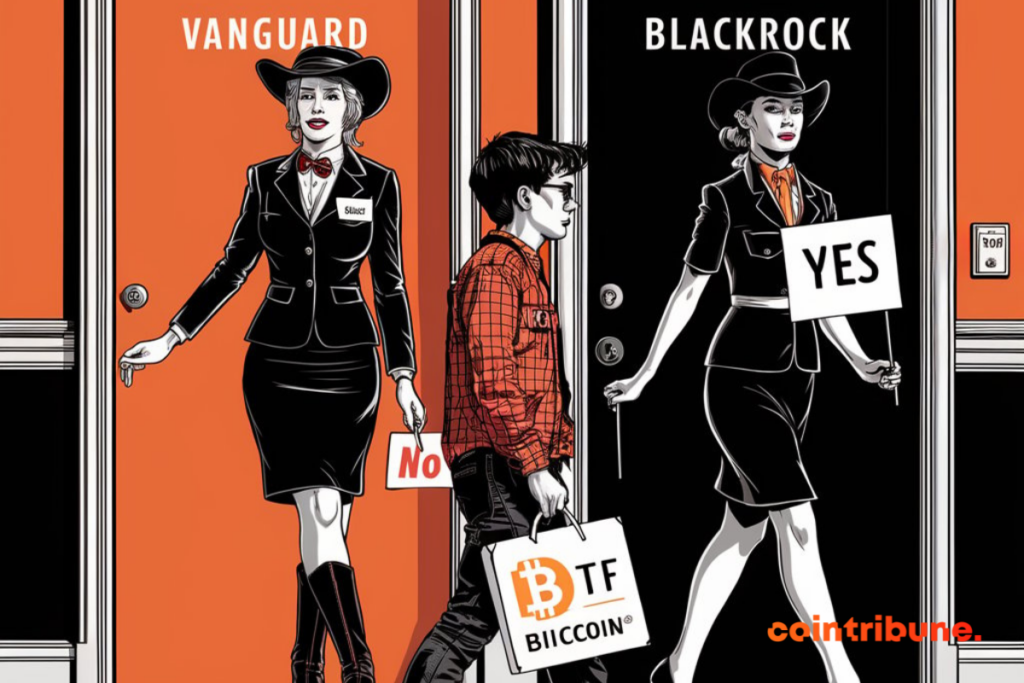

Crypto: Here's Why Vanguard Rejects ETFs!

Vanguard, under the leadership of its CEO Salim Ramji, remains firmly opposed to the idea of launching a Bitcoin ETF. For Ramji, cryptocurrencies are “immature assets” and too volatile to fit into the company’s long-term investment strategy. Vanguard, despite the success of BlackRock’s Bitcoin ETF, does not wish to follow this path, favoring the long-term interests of its clients.

Vanguard and Cryptos: An Improbable Alliance

Vanguard already said NO to Bitcoin ETFs last March and is not ready to revise its decision. For Salim Ramji, copying BlackRock would only betray the very essence of Vanguard, which aims to be a reliable player for its long-term investors above all.

Cryptocurrencies like Bitcoin, Ethereum, and Solana are considered too risky and volatile to integrate into a stable and sustainable investment strategy.

As Ramji says in an interview given to Allan Roth, “Vanguard must stay true to what it is.”

By refusing to include crypto products in its offer, Vanguard remains consistent with its history of avoiding speculative trends, even if it means forgoing potential short-term profit opportunities.

BlackRock, for example, reaped more than $1 billion in a month with its Bitcoin ETF. Vanguard, on the other hand, prefers to focus on investments deemed safer, even if it means missing out on the cryptocurrency windfall.

Bitcoin: BlackRock’s Choice, Vanguard’s Rejection

While BlackRock, with its iShares Bitcoin Trust, rides the wave of Bitcoin ETFs and attracts billions, Vanguard persists in its rejection of cryptos.

Ramji does not want to sacrifice Vanguard’s reputation for stability for quick gains. Vanguard has a long tradition of prudence: it resisted the internet bubble of the 2000s and also stays away from other speculative investments.

For Vanguard, the absence of solid economic fundamentals behind cryptocurrencies like Bitcoin, Ethereum, and Solana reinforces their decision.

“Crypto ETFs do not align with our philosophy,” says Ramji. Unlike its competitors, Vanguard prefers to forgo this market rather than risk losses for its clients.

Despite its rejection of cryptos, Vanguard might observe from afar the rise of Bitcoin ETFs that, in just a few months, have already generated more than $17 billion in net inflows.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

La révolution blockchain et crypto est en marche ! Et le jour où les impacts se feront ressentir sur l’économie la plus vulnérable de ce Monde, contre toute espérance, je dirai que j’y étais pour quelque chose

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.