$200 million evaporates from Bitcoin ETFs! Here's why?

Bitcoin ETFs experienced significant net outflows of more than $200 million! As uncertainty surrounding inflation data in the United States gripped the market. Investors are reassessing their positions in risk assets, including Bitcoin ETFs, as inflation fears rise.

US Inflation: Fear Causes Bitcoin ETF Hemorrhage!

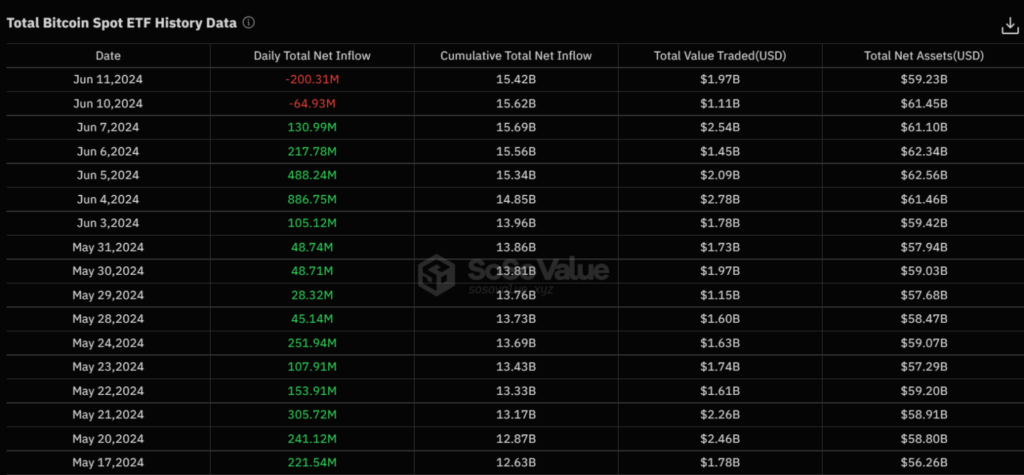

Daily net outflows of $200.31 million were recorded by U.S. spot Bitcoin ETFs on June 11! The Grayscale Bitcoin Trust (GBTC) and the ARK 21Shares Bitcoin ETF (ARKB) being the most affected, with outflows of $121 million and $56 million respectively. Meanwhile, BlackRock’s iShares Bitcoin Trust (IBIT) recorded no flows during the same period.

This trend is notable, as these ETFs had experienced positive net inflows since May 13. However, outflows began to occur from June 10, as market participants anticipated the release of the U.S. Consumer Price Index (CPI) data for May.

Upcoming Perspectives on Inflation

Jesse Cohen, global market analyst, highlighted the increased market volatility surrounding the upcoming CPI report. He indicated that a cooler-than-expected CPI report could extend the ongoing market rally. However: “a surprisingly strong inflation reading could trigger market volatility, as it could delay expectations of rate cuts and raise concerns about inflationary pressures,” he added.

The research firm The Kobeissi Letter noted divided expectations regarding the CPI data. It highlights that while large banks expect CPI inflation to be 3.4%, prediction markets indicate a 17% chance of inflation above 3.4% and a 41% chance below 3.4%.

In conclusion, the net outflows from spot Bitcoin ETFs reflect global economic uncertainty. Upcoming inflation data could influence market trends, highlighting the importance of investor vigilance in the face of fluctuating economic indicators.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The world is evolving and adaptation is the best weapon to survive in this undulating universe. Originally a crypto community manager, I am interested in anything that is directly or indirectly related to blockchain and its derivatives. To share my experience and promote a field that I am passionate about, nothing is better than writing informative and relaxed articles.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.