📸PICTURE OF THE DAY: 📸🇷🇺 Vladimir Putin flashes a symbolic ‘BRICS banknote’ at Kazan summit 👇 #BRICS2024 pic.twitter.com/6ssHomfm8E

— Sputnik India (@Sputnik_India) October 23, 2024

A

A

The BRICS Challenge The Empire

Fri 25 Oct 2024 ▪

8

min read ▪ by

Getting informed

▪

Investissement

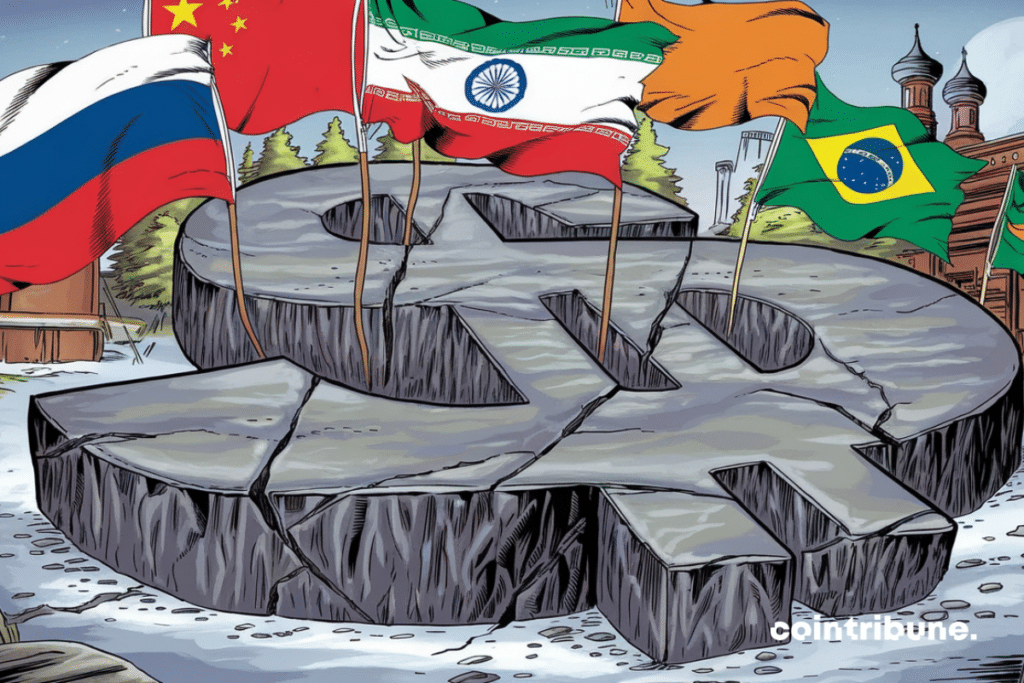

Poutine returns to the international stage by hosting 36 leaders at the BRICS summit in Kazan. The imperial currency is still on the menu.

Requiem for the Dollar

Despite the threat of 100% tariffs wielded by Donald Trump, the dollar has remained in the crosshairs of the BRICS heads of state.

“The United States abuses the privilege of the dollar and has turned it into a weapon,” stated last year Dilma Rousseff, president of the “Bank of the BRICS”, at the Global Peace Forum at Tsinghua University in Beijing. A repeated accusation at the BRICS table this week.

The former president of Brazil extended a hand to the Russian president, who did not hide his intention to proceed without the greenback:

“You just said that the dollar is used as a weapon. That’s true, and we are experiencing it. I think those who decided this are making a serious mistake […]. Its use for political purposes reduces trust in this currency, thereby diminishing its scope. We are not responsible for it and do not reject the dollar nor fight against it, but what should we do if they do not let us work with it? Seek alternatives, and that’s exactly what we are doing. We aspire to cooperation, but we must understand that the longer we remain under the aegis of foreign systems, the longer the transition to a new, fairer economic and financial system will take. And the more turbulence we will suffer, as we are currently witnessing in the Middle East…”

Vladimir Putin even showcased a symbolic bill stamped with the BRICS seal during the summit:

This bill, however, is merely a joke. No new common currency is under consideration. “Regarding the question of a common currency, we are not working on that at the moment. We must be cautious. We need to act gradually and without haste on this issue,” Vladimir Putin stated a few days before the summit.

BRICS and the Currency War

Chinese President Xi Jinping also advocated for the emergence of a new financial system.

“It is urgent to reform the international financial architecture. The BRICS must play a leading role in promoting a new system that better reflects the profound changes that have occurred in the balance of international economic forces,” he declared.

The Indian president echoed the sentiments of his Chinese counterpart:

“Trade in national currencies and smooth cross-border payments will strengthen our economic cooperation. The unified payment interface (UPI) developed by India is a significant success adopted by many countries,” he stated.

Thus, no new currency in sight, but rather an alternative to the SWIFT network from which Russian and Iranian banks are disconnected. It is about connecting the payment systems of different countries, which requires a new clearinghouse and connections between large banks.

China is evidently not lagging behind. Beijing now trades more in yuan than in dollars with abroad. Its equivalent of the SWIFT network, the CIPS system, facilitated the transfer of 123 trillion yuan ($17 trillion) in 2023.

Russia conducts nearly 100% of its exchanges in national currencies with China and Iran. This is the main goal of BRICS: to internationalize their own currencies to reduce their reserves in dollars and thereby weaken the American empire.

The dollar indeed offers immense privileges to the United States. Dollar reserves worldwide amount to about $7 trillion (58% for the dollar and 20% for the euro). These billions not being exchanged for national currencies artificially support the dollar’s exchange rate.

The great advantage for Americans is thus being able to import much more than they export without their currency collapsing. This is the “exorbitant privilege” that accompanies the ability to borrow at low rates.

Concrete Actions?

The BRICS’ priority is to strengthen the “Correspondent Banking System” to reduce the costs of settlements in national currencies. This means opening an account in a foreign bank to carry out operations in the local currency.

The main problem with this proposal is that the USA has made it clear to banks around the world that collaboration with Russia would cost them access to the dollar. This blackmail is keeping many countries from connecting to Russia’s SFPS financial messaging system.

Discussions are currently focused on establishing a clearinghouse named “BRICS Clear.” The New Development Bank (NDB) is actively participating in the development of this new financial infrastructure.

Dilma Rousseff, who chairs the BRICS bank based in Shanghai, promised last year that nearly a third (30%) of loans would be made in the national currencies of NDB member countries.

In an interview with the major Chinese media CGTN, Ms. Rousseff explained last year that it “is necessary to find ways to avoid exchange rate risk and other issues such as dependence on a single currency like the dollar.”

“The good news is that many countries are choosing to use their own currency for trade. China and Brazil, for instance, agree to exchange in reais as well as in yuan,” she added.

The issue of foreign reserves remains thorny. Russia, for example, has at one time ceased accepting the Indian rupee as payment. The reason being that India has not much to sell that interests the Russians. As a result, trade between Moscow and New Delhi takes place 70% in yuan, which does not please the Indians.

Bitcoin, the Reserve Currency of the 21st Century

The issues of trade balance imbalances among BRICS will remain acute. This is why gold holds an important place in the reserves of major exporting countries such as China, Saudi Arabia, and Russia.

These problems will grow as new countries join BRICS. Each reasonably hopes that its currency will be more accepted by others.

Thirty-six heads of state or representatives were present to attempt to join the club. Thirteen countries have become “partners” of BRICS:

The larger the club grows, the more geopolitical and economic objectives will diverge. There will be great disappointment if, ultimately, China inherits the exorbitant privilege by placing the yuan at the center of exchanges.

[Don’t miss our article: “The internationalization of the yuan is breathtaking”]

There are no miracles. The gifts will not last, and global problems will arise on the scale of BRICS as well. What will prevent China one day from doing like the West and seizing the yuan reserves of a country that goes against their interests?

The world needs a new reserve currency that does not benefit anyone in particular. This stateless currency should prevent anyone from blocking reserves and should embody the spirit of the Gold Standard by being a true store of value.

One currency checks all the boxes: Bitcoin. Its volatility frightens, but it is the temporary price to pay to create a truly fair international monetary system. There will never be more than 21 million bitcoins. This certainty is enough for the whole world to make it the pillar of their foreign reserves.

The United States will refuse to relinquish their exorbitant privilege to China, but may ultimately resign to play on equal terms…

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

A

A

Bitcoin, geopolitical, economic and energy journalist.

DISCLAIMER

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.