Withdraw Your Money Securely From Coinbase

Coinbase is one of the leading crypto exchange platforms, known for its simplicity and security. It allows users to buy, sell, and store cryptocurrencies, as well as to withdraw their funds reliably. Although the withdrawal process is accessible, it is essential to understand the steps, fees, and options available to ensure a smooth experience. This detailed guide explains how to withdraw your funds with peace of mind from Coinbase.

How do withdrawals work on Coinbase?

Withdrawing money from Coinbase requires following several steps and choosing the most suitable transfer method. This can include a classic bank transfer, a card, or instant withdrawal solutions.

Coinbase offers solutions tailored to the diverse needs of users. You can withdraw funds in fiat currency such as euros or dollars, or transfer cryptocurrencies to an external wallet. Each method has its advantages, costs, and timelines, and it is important to understand them to optimize your transactions.

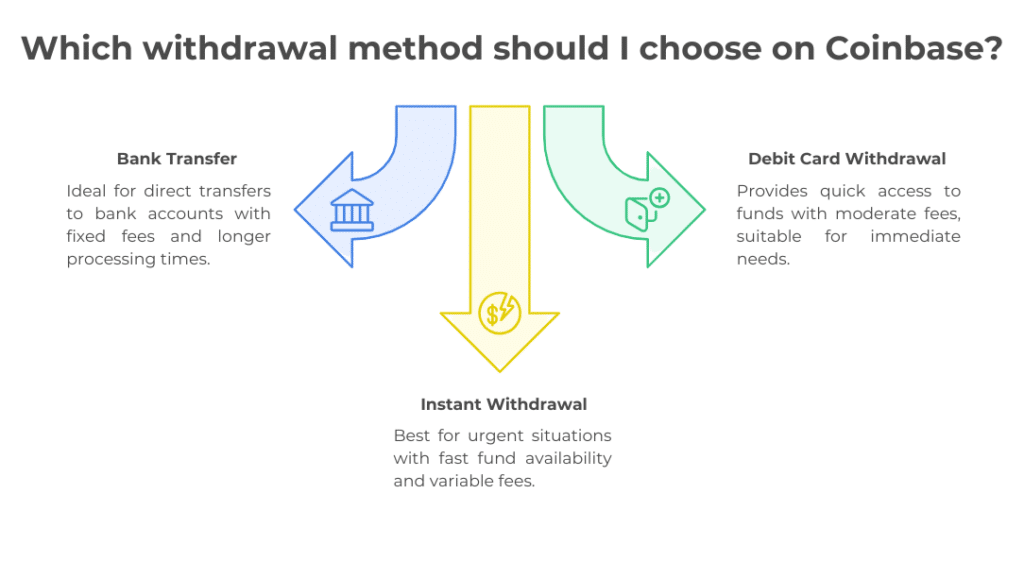

Withdrawal methods available on Coinbase

Coinbase offers several options to withdraw your funds depending on your geographical situation and preferences. Here are the main methods:

Withdrawals via bank transfer

The bank transfer is a widely used solution, especially in Europe thanks to the SEPA network. This method is ideal for transferring your funds directly to your bank account.

- You must first convert your cryptos into euros or dollars on Coinbase.

- Once the conversion is complete, you can select the “Withdraw” option and choose your bank account as the destination.

- This method incurs fixed fees, usually €0.15 for a SEPA transfer, and a processing time of 1 to 3 business days.

Withdrawals via bank card

Withdrawals by bank card allow for faster access to your funds. These cards must be compatible with Visa or Mastercard.

- You add your card to your Coinbase account.

- You select the card as the withdrawal method.

- Funds are generally available within minutes, although additional fees may apply, usually ranging from 1% to 2%.

Instant withdrawals

Instant withdrawals are available for users with Visa Fast Funds or Mastercard Send compatible cards. This method ensures a rapid receipt of funds, ideal for urgent situations.

- Funds are transferred in less than 30 minutes, although it may take up to 24 hours depending on the bank.

- This option may include variable fees depending on the card’s conditions.

These various methods offer a flexibility tailored to the specific needs of users, allowing you to choose between speed and reduced costs depending on the situation.

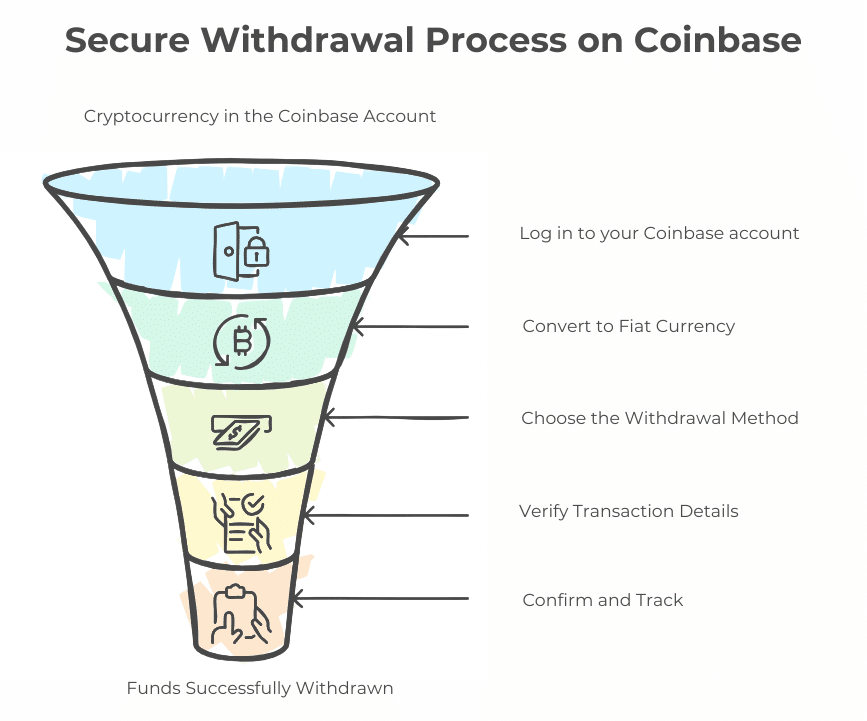

Detailed steps to withdraw your funds on Coinbase

The withdrawal process on Coinbase is simple, but requires following precise steps. This ensures that your funds arrive safely at their destination.

- Log in to your Coinbase account: access your account via the website or the Coinbase mobile app.

- Convert cryptocurrencies into fiat currency: select the crypto you want to convert, like bitcoin or ether, and sell it to obtain fiat currency.

- Choose the withdrawal method: decide between a bank transfer, card, or instant withdrawal based on your needs.

- Verify the transaction details: make sure all information is correct before confirming the transaction.

- Confirmation and tracking: confirm the transaction and track its status via the Coinbase app.

These steps help avoid mistakes and ensure a successful transaction.

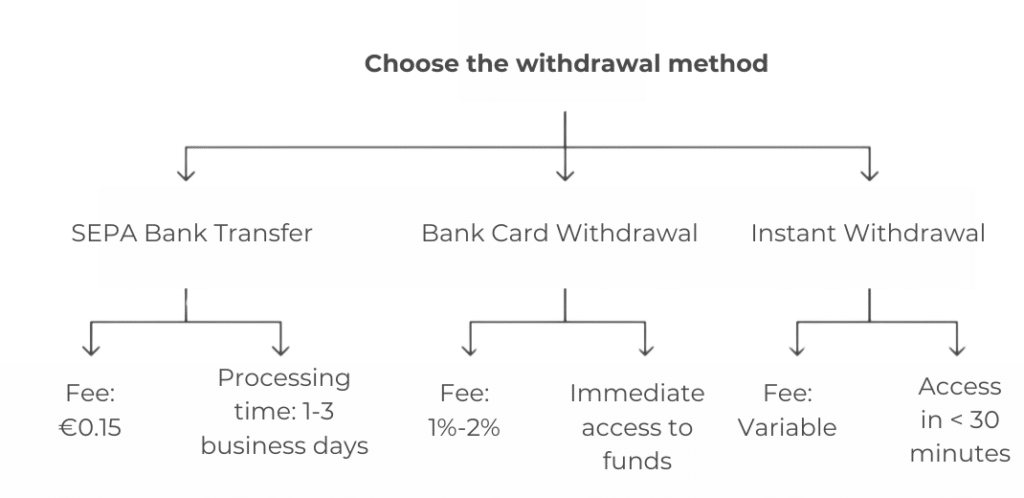

What are the fees associated with withdrawals on Coinbase?

Coinbase applies a transparent pricing structure for its withdrawal services. These fees vary depending on the chosen method, thus providing options tailored to the specific needs of users. Understanding these costs can help optimize your transactions.

Bank transfer fees

SEPA bank transfers remain one of the most economical options for withdrawing money from Coinbase, particularly in Europe. The fees are fixed at €0.15, regardless of the amount withdrawn. This attractive rate is ideal for users making regular transactions or withdrawing large amounts. On average, the processing time is 1 to 3 business days, a reasonable compromise for low fees.

Card fees

Withdrawals made with Visa or Mastercard compatible cards usually incur fees proportional to the amount withdrawn. These fees, ranging between 1% and 2%, are better suited for users looking for a fast method, even if it is slightly more expensive. This solution allows for almost immediate access to funds, although it is less economical for frequent or large transactions.

Fees for instant withdrawals

Instant withdrawals, via Visa Fast Funds or Mastercard Send compatible cards, offer a quick transfer of funds, often in less than 30 minutes. However, this increased speed incurs higher fees, typically set by the card issuer. These additional costs make it a preferred option for urgent needs, despite their impact on the profitability of small transactions.

Fees on Coinbase, while variable, remain transparent, allowing users to choose the method that best matches their priorities, between speed and cost efficiency.

Some tips for secure withdrawals

Security is a priority for any transaction on Coinbase. By following some best practices, you can ensure that your funds are protected and your withdrawals go smoothly.

Enable two-factor authentication (2FA)

The two-factor authentication is an essential security measure to secure your Coinbase account. By activating it, every login or withdrawal attempt requires confirmation via a unique code sent to your phone or a dedicated app. This significantly reduces the risks of unauthorized access, even if your credentials are compromised. Take the time to set up this feature from your user space to enhance the security of your funds.

Check payment information

Before proceeding with a withdrawal, carefully check the information related to your bank account or credit card. A simple mistake, such as an incorrect digit in an IBAN or an incorrectly entered bank address, can lead to major complications, including the irreversible loss of your funds. Take a few moments to validate each detail to ensure the proper receipt of your money.

Monitor withdrawal limits

Coinbase imposes limits on the amount you can withdraw daily or weekly. These ceilings depend on your account history and the security settings you have enabled. Familiarize yourself with these restrictions to plan your transactions effectively. If your needs exceed current limits, consider verifying your account or contacting support to increase your quotas.

By applying these tips, you can perform your withdrawals on Coinbase securely while avoiding common mistakes that could jeopardize your funds.

What are the processing times for withdrawals?

The time required to receive your funds depends on the chosen method. Here are the estimated times for each type of withdrawal:

- SEPA bank transfers: 1 to 3 business days.

- Bank cards: generally immediate or up to 24 hours.

- Instant withdrawals: less than 30 minutes, but it can take up to 24 hours.

These times are indicative and may vary depending on network congestion or bank policies.

The tax precautions to take into account

In France, gains made on cryptocurrencies, whether from sales or conversion to fiat currency, are subject to a flat tax of 30%, including income tax and social contributions. To comply with tax obligations, it is essential to keep a complete history of your transactions, including dates, amounts, and sale prices.

Use specialized tools or platforms to track your operations. Correctly declaring the gains made on Coinbase will help you avoid penalties or tax audits. If you incur losses, these can be used to offset your future gains, according to the rules in force.

Comparison with other platforms

Coinbase stands out for its ease of use, ideal for beginners, and its high security standards. However, in terms of fees, it is often considered more expensive than competitors like Binance or Kraken, which offer more competitive rates, especially for larger transactions.

Nonetheless, Coinbase compensates for this gap with increased transparency, an intuitive interface, and a variety of withdrawal options suited to different user profiles.

Coinbase provides a reliable solution to withdraw your funds securely. Whether you choose a bank transfer, a card, or an instant withdrawal, the platform ensures a smooth and secure process. Take the time to verify your transactions and understand the fees to maximize your experience. With these precautions, you can use Coinbase with confidence to manage your digital assets.

FAQ

Yes, Coinbase allows you to transfer cryptocurrencies to an external wallet. To do this, you must select the “Withdraw to an external wallet” option and enter your wallet address. This option is ideal if you want to keep your cryptocurrencies off the platform for security or personal management reasons.

No, withdrawal fees may vary depending on the country and the method chosen. For example, in Europe, the SEPA transfer withdrawal fee is fixed at €0.15, while instant withdrawal fees may be higher depending on bank card terms and local bank fees.

Once a withdrawal has been validated and processed on Coinbase, it cannot be reversed. Therefore, it is essential to carefully review all information, such as payment details and the amount, before confirming a withdrawal. If a mistake is made, it is advisable to contact Coinbase support immediately to explore possible options.

Yes, Coinbase offers withdrawal options in many other countries, but the available methods may vary depending on local regulations. For example, some users may have access to withdrawals via bank transfer, credit cards, or instant withdrawal services depending on their location.

Yes, Coinbase imposes daily and weekly withdrawal limits based on your verification and security level. These limits can be increased by further verifying your account or contacting Coinbase support if necessary. It’s important to check your withdrawal limits before planning large transactions.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The Cointribune editorial team unites its voices to address topics related to cryptocurrencies, investment, the metaverse, and NFTs, while striving to answer your questions as best as possible.

The contents and products mentioned on this page are in no way approved by Cointribune and should not be interpreted as falling under its responsibility.

Cointribune strives to communicate all useful information to readers, but cannot guarantee its accuracy and completeness. We invite readers to do their research before taking any action related to the company and to take full responsibility for their decisions. This article should not be considered as investment advice, an offer, or an invitation to purchase any products or services.

Investment in digital financial assets carries risks.

Read more