Why is the Price of Bitcoin Exploding on Some Platforms and not on Others?

As digital markets continue to mature, a complex dynamic is emerging that disrupts traditional trading models: the fragmentation of liquidity. This phenomenon, far from being anecdotal, could well redefine the rules of the game on major crypto exchanges, accentuating price disparities and increasing volatility.

The fragmentation of liquidity accentuates price disparities

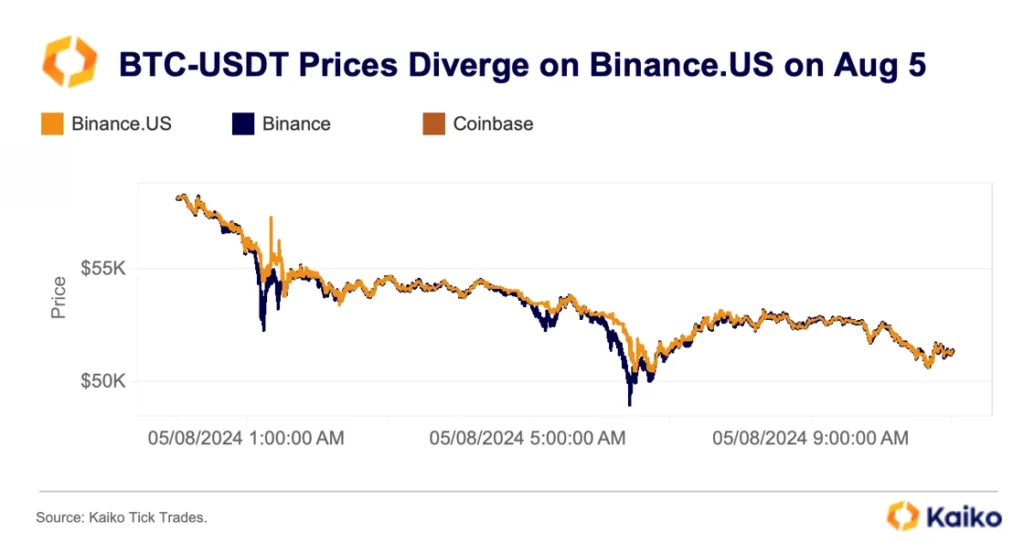

The fragmentation of liquidity in crypto markets has become an important factor to monitor, particularly during episodes of intense volatility. This dispersion of liquidity among different crypto exchange platforms leads to significant price divergences and disrupts traders’ strategies by creating sometimes costly arbitrage opportunities, according to Kaiko’s latest report. The case of Binance.US, where trading volumes drastically dropped following SEC regulatory actions in 2023, perfectly illustrates this phenomenon. On August 5th, Bitcoin prices on this platform noticeably deviated from other more liquid markets, revealing the direct impact of fragmentation on price formation.

The effects of this fragmentation are not limited to major assets like Bitcoin. In fact, other cryptos, particularly those with low liquidity, have shown even more marked price disparities. A more robust infrastructure and stricter liquidity management are therefore essential to minimize risks and stabilize markets, especially during periods of high tension.

The current challenges and trends in crypto liquidity

The impact of liquidity fragmentation is not only limited to a price disparity among different crypto exchange platforms but also manifests through liquidity variations within trading pairs on the same platform. Take the example of Coinbase: the BTC-EUR pair is significantly less liquid than the BTC-USD pair, creating much more volatile market conditions during stress episodes. This phenomenon was illustrated last March when the BTC-EUR pair experienced marked price divergences compared to the global market, exacerbated by a plummeting market depth.

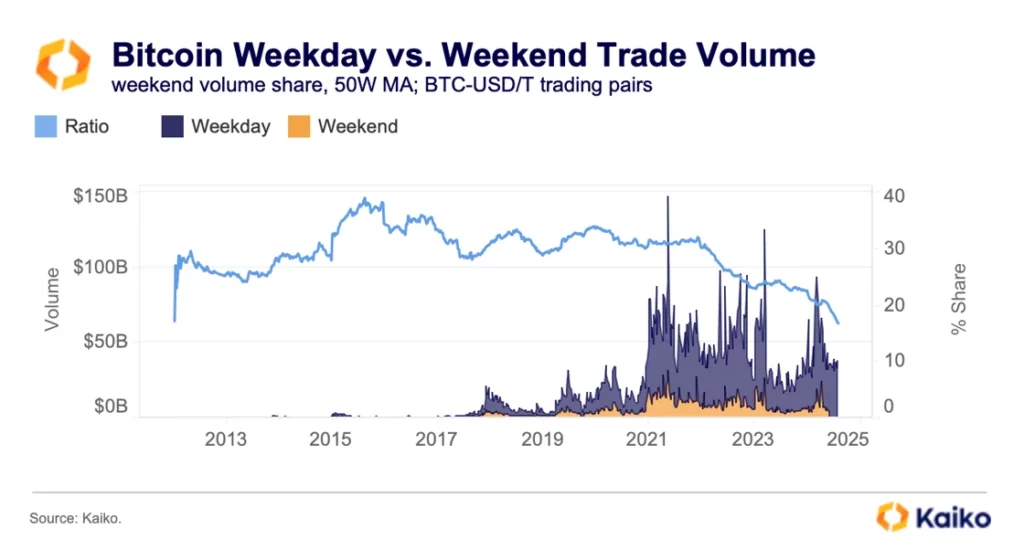

This trend is further amplified by the concentration of liquidity on business days, a phenomenon intensified with the advent of spot crypto ETFs in the U.S. Unlike traditional financial markets, crypto markets operate nonstop, 24/7, making periods of weakness, such as weekends, particularly vulnerable to abrupt price movements. Sell-offs that begin on a Friday tend to intensify over the weekend, when liquidity is lower, amplifying the impacts on prices. This reality was particularly observed during the last sell-off, where Bitcoin recorded a 14% movement between the opening of U.S. markets on Monday and their closing on Friday, a recurrent pattern during major corrections since 2020.

In the future, the ability of platforms to strengthen their resilience to these challenges will largely determine the stability of crypto markets. Investors, on the other hand, must remain vigilant, aware that liquidity, or its absence, could be a decisive factor in upcoming price movements.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Diplômé de Sciences Po Toulouse et titulaire d'une certification consultant blockchain délivrée par Alyra, j'ai rejoint l'aventure Cointribune en 2019. Convaincu du potentiel de la blockchain pour transformer de nombreux secteurs de l'économie, j'ai pris l'engagement de sensibiliser et d'informer le grand public sur cet écosystème en constante évolution. Mon objectif est de permettre à chacun de mieux comprendre la blockchain et de saisir les opportunités qu'elle offre. Je m'efforce chaque jour de fournir une analyse objective de l'actualité, de décrypter les tendances du marché, de relayer les dernières innovations technologiques et de mettre en perspective les enjeux économiques et sociétaux de cette révolution en marche.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.