Why Could Bitcoin Become An Essential Reserve Asset?

The Bitcoin Policy Institute recently published a report titled “The Case for Bitcoin as a Reserve Asset,” proposing that Bitcoin (BTC) be adopted by central banks as a global reserve asset. This proposal is based on several solid arguments that deserve particular attention.

Here’s why Bitcoin could be a global reserve asset!

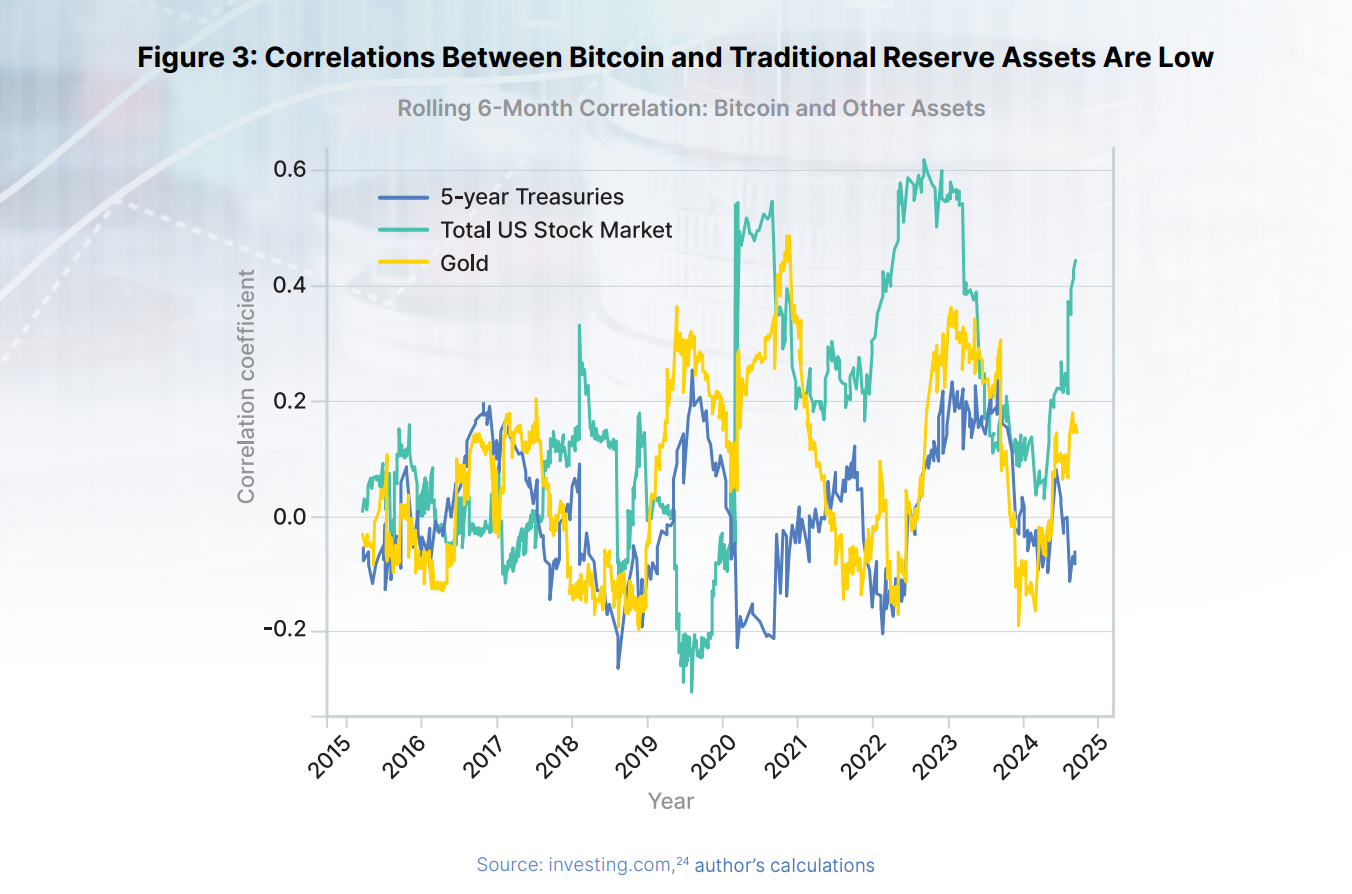

One of the main arguments put forward by the Bitcoin Policy Institute is that Bitcoin can serve as a hedge against inflation. Unlike fiat currencies, whose value can be eroded by inflation, BTC has a limited supply of 21 million units, making it inherently deflationary. Moreover, in a context of rising geopolitical tensions, Bitcoin offers an alternative to traditional assets like gold, which is often used as a safe haven.

Additionally, Bitcoin stands out due to its lack of counterparty risk. Unlike government bonds or bank deposits, BTC does not rely on any financial or governmental institution to guarantee its value. This characteristic makes it a valuable tool for central banks seeking to diversify their reserves and protect against the risks of sovereign default or bank failure.

Furthermore, this report emphasizes that Bitcoin can also help countries bypass international sanctions imposed by powers such as the United States. As a decentralized digital asset, BTC enables cross-border transactions without the intervention of intermediaries, thus providing some resilience against economic restrictions.

Growing Adoption

The growing adoption of Bitcoin by financial institutions and companies enhances its legitimacy as a reserve asset. Companies like Tesla and MicroStrategy have already invested heavily in BTC, and several central banks are actively exploring its potential. This trend could encourage other institutions to follow suit, further consolidating BTC’s position as an essential reserve asset.

In summary, Bitcoin presents several advantages that could make it a potential global reserve asset. In addition to dominating the crypto market, BTC’s ability to hedge against inflation, its absence of counterparty risk, and its resilience against international sanctions make it a serious candidate for central banks looking to diversify and secure their reserves.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The world is evolving and adaptation is the best weapon to survive in this undulating universe. Originally a crypto community manager, I am interested in anything that is directly or indirectly related to blockchain and its derivatives. To share my experience and promote a field that I am passionate about, nothing is better than writing informative and relaxed articles.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.