What Is the Hurst Cycle in Technical Analysis?

In the complex world of trading, understanding and analyzing market trends are essential for success. Among the various technical indicators, the Hurst cycle stands out for its ability to predict market movements based on historical trends. This article explores the Hurst cycle in detail, starting with its fundamental principle, its advantages, and its practical application in trading.

The Hurst cycle: what is it?

The Hurst cycle, named after its creator Harold Edwin Hurst, is a fundamental concept in technical analysis. This principle is based on the idea that financial markets follow cycles or periods of trends that can be predicted and analyzed. The Hurst method, often discussed in trading forums, helps identify persistence or memory effects in price movements.

The principle of the Hurst cycle

The Hurst cycle plays a fundamental role in trading and economics. This principle, developed by Harold Edwin Hurst, is essential for understanding movements in financial markets. It relies on identifying cycles and trends in asset prices, thus offering a unique perspective on market dynamics.

Understanding trend persistence

The Hurst cycle focuses on the persistence or memory of market trends. This approach analyzes how the past movements of an asset influence its future behavior. In practice, this means that if an asset has shown an upward trend, there is a probability that it will continue on this trajectory. The Hurst method uses statistical calculations to evaluate this persistence, providing traders with an estimate of the likelihood that a current trend will continue or reverse. This analysis is crucial for forecasting market movements and planning effective trading strategies.

Measuring volatility and cycles

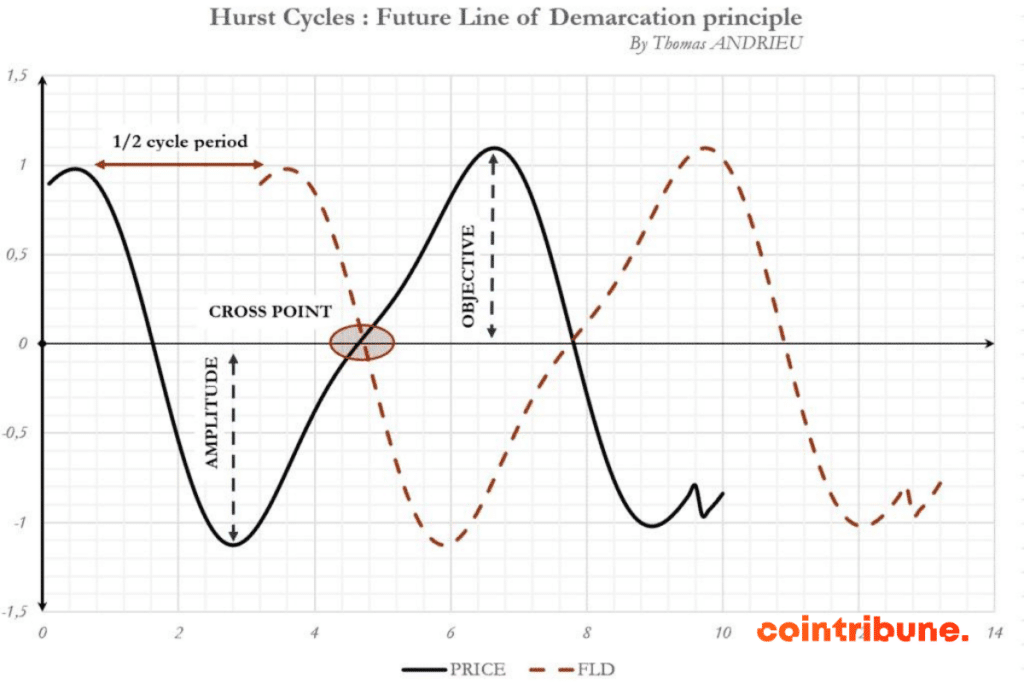

Another key aspect of the Hurst cycle is measuring volatility and identifying market cycles. By using moving averages and other technical indicators, traders can detect periods of high volatility or relative stability. This information is vital for understanding economic cycles and periods of market consolidation or expansion. The Hurst method helps determine when a market is likely to change direction, which is particularly helpful for traders looking to optimize their entry and exit points.

How traders use the Hurst cycle to make decisions?

In the trading world, effective use of technical analysis tools is crucial for making informed decisions. The Hurst cycle, in particular, helps traders understand and anticipate market movements. This method, based on the analysis of cycles and trends, allows traders to develop more sophisticated and tailored trading strategies.

Identifying long-term trends

One of the main advantages of the Hurst cycle is its ability to help traders identify long-term trends. By analyzing historical data and calculating the Hurst coefficient, traders can determine if an asset is likely to continue its current trend or reverse. This information is vital for long-term strategies, as it allows traders to position their investments to capitalize on these extended trends. By understanding the general direction of the market, traders can adjust their portfolios to maximize potential gains or minimize risks.

Optimizing entry and exit points

The Hurst cycle is also used to optimize entry and exit points in trading. By identifying periods when a market is likely to experience a trend reversal, traders can plan their trades to enter or exit the market at the most opportune moment. This approach is particularly useful in a volatile market, where trend changes can occur rapidly. By using the Hurst cycle, traders can better anticipate these movements and adjust their strategies to avoid significant losses or to seize profit opportunities.

Risk management and portfolio diversification

Finally, the Hurst cycle plays an essential role in risk management and portfolio diversification. By understanding cycles and market trends, traders can identify sectors or assets that present a higher risk and adjust their portfolio accordingly. This method allows for more strategic diversification, focusing on assets that are in line with current market trends or that offer long-term growth potential. Moreover, by using the Hurst cycle to anticipate trend changes, traders can take proactive measures to protect their investments from unforeseen market fluctuations.

Advantages of the Hurst cycle in trading

The Hurst cycle offers traders a multitude of significant advantages. This method, which analyzes market trends and cycles, has become an essential element in modern trading strategies. It allows for a better understanding of market movements, thus facilitating informed decision-making.

Precision in trend prediction

The first major advantage of the Hurst cycle is its ability to provide accurate predictions about market trends. Based on analysis of historical data, the Hurst cycle helps traders identify whether a current trend is likely to continue or reverse. This method uses statistical calculations to assess the persistence of trends, thereby allowing traders to forecast future price movements with greater accuracy. This precision is crucial for developing effective trading strategies, particularly in volatile markets where trend understanding can significantly influence trading outcomes.

Optimizing trading strategies

Another notable advantage of the Hurst cycle is its role in optimizing trading strategies. By providing in-depth analysis of market cycles and trends, the Hurst cycle allows traders to adjust their strategies according to current market conditions. This adaptability is essential for maximizing gains and minimizing risks. Traders can use the Hurst cycle to determine the best moments to enter or exit a market, based on trend forecasts. This ability to adapt strategies in real-time is a major asset for traders looking to remain competitive in a constantly evolving market environment.

Improvement of risk management

Finally, the Hurst cycle plays a crucial role in improving risk management. By identifying trends and market cycles, traders can better understand the risks associated with different assets or sectors. This understanding allows for a more strategic allocation of resources and a more effective diversification of the portfolio. By anticipating potential trend changes, traders can also take proactive measures to protect their investments from sudden market fluctuations. Thus, the Hurst cycle is not limited to trend analysis, but also contributes to more robust risk management.

Limitations of using the Hurst cycle

Despite its usefulness in technical analysis, the Hurst cycle has notable limitations in trading. Its complexity requires an advanced understanding of mathematics and statistics, which can be an obstacle for less experienced traders. Furthermore, it can produce ambiguous or delayed signals, particularly in volatile markets, leading to potentially inaccurate trading decisions. Its strong dependence on historical data also limits its effectiveness in atypical market conditions or during major economic changes. These constraints highlight the importance of using the Hurst cycle in conjunction with other analysis methods for a more robust and diversified trading strategy.

Software and technical analysis tools integrating the Hurst cycle

In the trading field, the efficiency and precision of decisions largely depend on the tools and software used for technical analysis. The Hurst cycle, being a key concept in technical analysis, is integrated into various software and tools, providing traders with advanced means to analyze and predict market movements. These tools are designed to facilitate the application of the Hurst method, making the analysis of market trends and cycles more accessible and accurate.

Specialized software integrating the Hurst cycle

Some specialized software in technical analysis offers advanced features for integrating the Hurst cycle. These software are designed for traders looking to apply complex analyses, including the calculation of the Hurst coefficient, to forecast market trends. They provide intuitive user interfaces and graphical tools that help visualize cycles and trends, thus facilitating data interpretation. These software can also include additional features such as customizable indicators, backtesting options, and integrations with trading platforms. By using this software, traders can not only apply the Hurst cycle but also combine this method with other indicators for a more comprehensive analysis.

Online tools and plugins for Hurst cycle analysis

In addition to specialized software, there are online tools and plugins that integrate the Hurst cycle. These solutions are often more accessible and easy to use, addressing a wide range of traders, from beginners to professionals. These online tools can be extensions for existing trading platforms or standalone web applications. They offer quick analyses and visualizations of the Hurst cycle, allowing traders to make informed decisions without needing to install complex software. These tools are particularly useful for those looking to quickly integrate the Hurst cycle into their daily trading routine.

Conclusion

Used in technical analysis, the Hurst cycle provides traders with a unique perspective on market trends and cycles. Although its use requires a certain level of expertise, the advantages in terms of trend forecasting and trading strategy optimization are undeniable. Software and tools that integrate the Hurst cycle simplify its application, making this method accessible to a broader range of traders. Ultimately, mastering the Hurst cycle can significantly improve trading decision-making, leading to more effective and potentially more profitable strategies.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Diplômé de Sciences Po Toulouse et titulaire d'une certification consultant blockchain délivrée par Alyra, j'ai rejoint l'aventure Cointribune en 2019. Convaincu du potentiel de la blockchain pour transformer de nombreux secteurs de l'économie, j'ai pris l'engagement de sensibiliser et d'informer le grand public sur cet écosystème en constante évolution. Mon objectif est de permettre à chacun de mieux comprendre la blockchain et de saisir les opportunités qu'elle offre. Je m'efforce chaque jour de fournir une analyse objective de l'actualité, de décrypter les tendances du marché, de relayer les dernières innovations technologiques et de mettre en perspective les enjeux économiques et sociétaux de cette révolution en marche.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.