What Is Decentralized Finance (DeFi)?

You have heard about decentralized finance and are wondering what all the hype is about? You have come to the right place. In this article, we will answer all your questions:

- What is decentralized finance?

- How is decentralized finance different from traditional finance?

- How to evaluate DeFi tokens?

- How to get started with DeFi?

- And finally, what are examples of DeFi applications?

After explaining what “Yield Farming” is and glimpsing the potential of new passive income generation mechanisms offered by the crypto industry, it’s now time to dive into the heart of the matter. We continue to apprehend this new crypto continent with a learning of the fundamentals in this new chapter of the Decentralized Finance Tribune.

This content is brought to you in partnership with CryptoTesters.com, a platform specializing in DeFi service comparisons and analyses, where you will learn a bit more at the end of the article.

What is decentralized finance (DeFi)?

Decentralized finance is one of the fields in cryptography that is currently receiving a lot of attention. In its grand ambition, DeFi aims to recreate the financial system we use today in a way that removes all trusted intermediaries like banks.

Bitcoin, the first decentralized network, laid the foundations of this movement by facilitating trustless peer-to-peer payments. This means you can send bitcoins to anyone in the world without knowing or trusting that person AND without using a third-party service like a bank. In addition to these features, Bitcoin has other attributes hard-coded into its protocol. The most important is probably the supply cap, which stipulates that there will never be more than 21 million bitcoins in total. This scarcity explains why Bitcoin is often referred to as “digital gold”.

As soon as people recognized the power of the Bitcoin network, they immediately began to think about how it could enable more use cases beyond simply storing the state of bitcoin ownership.

Determined to find a solution to this problem, a young Bitcoin enthusiast named Vitalik Buterin set out to create Ethereum in 2013. Technically, Ethereum is a kind of “world computer” that can store both code and data. Like a normal computer, Ethereum can execute code and it uses the Ethereum blockchain as a hard drive. Every time code is executed and data is changed, the state of the blockchain is updated. However, unlike a traditional computer, Ethereum’s state changes are governed by the rules of consensus, and the state is distributed globally, meaning the data is collectively owned by thousands of nodes.

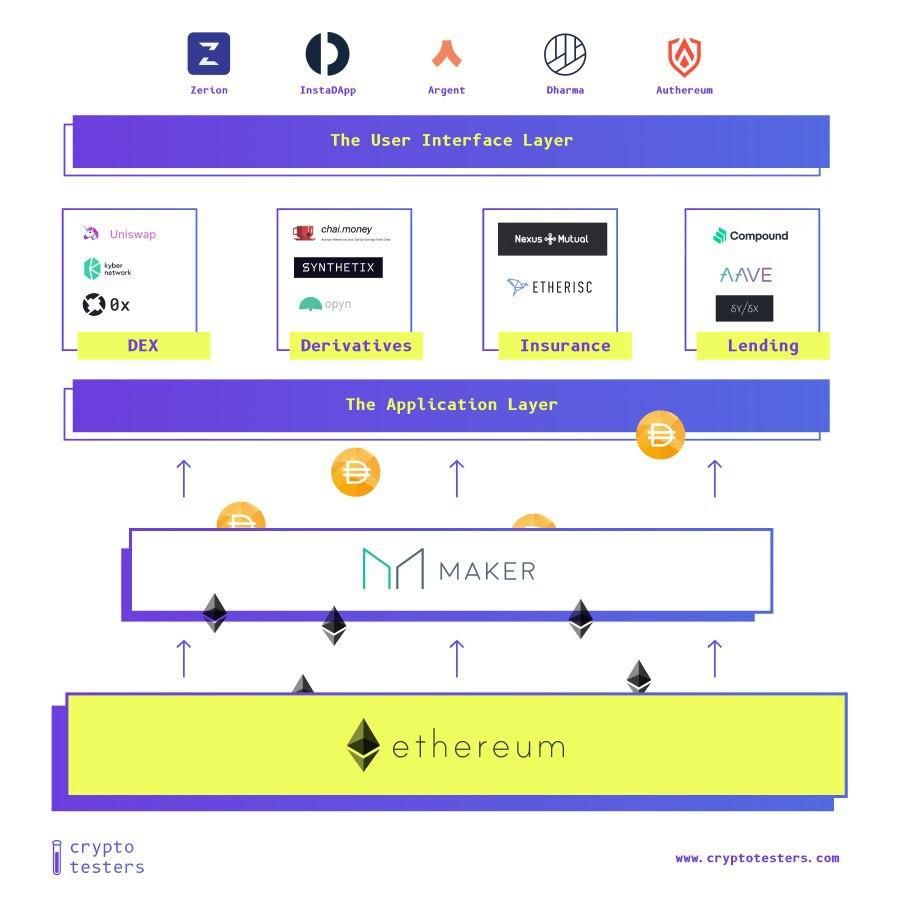

These building blocks make Ethereum the ideal candidate to host new types of applications. Applications that are:

- Decentralized – Applications that can operate without a single central entity controlling them and are governed by their users.

- Censorship-resistant – Applications that cannot be hindered by any government or other actor.

- Permissionless – Applications that can be built and used by anyone in the world without any geographic limitation.

While in theory, Ethereum can host any type of application, decentralized finance is the sector currently being explored the most. Decentralized finance encompasses a wide range of applications that aim to replace banks and other financial institutions, i.e., applications revolving around trading, lending, borrowing, and investing.

What are the differences between traditional finance and decentralized finance?

In traditional finance, when you visit your bank’s website or mobile app, all the logistics of the application are hosted on a server controlled by your bank. Your bank account balance and personal information are also stored in a database controlled by your bank. Decentralized finance upends this logic. We will examine some of the differences between using a bank account and a DeFi application.

Deposit and Storage

In decentralized finance, your assets are stored in a blockchain account rather than a database. While your bank can freeze your assets at any time, no one can prevent you from accessing your assets on the blockchain. There is no single server that can be shut down. To deprive you of your assets, someone would have to stop the entire blockchain, which is almost impossible since it is run by thousands of computers spread around the world.

Your account is not represented by a name and bank account number but by a pair of public and private keys. The public key is… public and identifies you on the network (for example, when you want to receive funds from a friend), and the private key is what you need when you want to send funds to another Ethereum account. Miners verify all transactions and only validate those with authentic digital signatures.

Opening an account on the blockchain is totally free. If you are tech-savvy, you can run a node and generate as many addresses and accounts as you want. However, most users use an Ethereum wallet to create an account. Wallets are interfaces that make it very easy to interact and communicate with the Blockchain. When you download a wallet and set it up, the wallet automatically generates a public and private key. When you send assets to another address, your wallet produces the necessary signatures and submits the transaction to the blockchain, where it is then processed and validated. In short, the wallet is your entry ticket into the financial system existing on the Ethereum blockchain.

Unlike a bank account where you need to identify yourself, no one will deny you an Ethereum wallet. They are all free and open-source.

Frictionless

Another difference between an Ethereum account and a bank account is that the former gives you total freedom over the interface you wish to use.

You can download an Ethereum wallet, copy the private key, then import it into another wallet application and you will see your balance immediately appear in the interface. Imagine being able to import your bank account into the banking app of your choice and switch from Société Générale to Boursorama in seconds. This is a reality in the crypto world because a wallet is just an interface that reads the blockchain. This blockchain is public and accessible to everyone.

The transition from one DeFi application to another is just as seamless. The concept of “signing up for a website” and being indissolubly linked to a provider does not exist. If you want to use a DeFi application, you need to go to the website where the app is hosted. As soon as you connect your wallet, you can use the application. You are “identified.” The only difference is that no personal data is stored. You can switch from one application to another in seconds.

Permissionless

What’s more, on Ethereum, developers can start building whatever they have in mind. They don’t have to ask for permission, and there is no paperwork. In traditional finance, it is extremely difficult to build a product. Especially if you are trying to build something new. This has stifled innovation in finance over the past few decades.

On Ethereum, literally anyone can create an app. Developers who have an idea on how to build an exchange, a synthetic dollar, or an options market more efficient than existing markets can simply do it. For the first time in history, developers from around the world are joining forces and building on the same platform. While the traditional financial system is extremely fragmented, Ethereum provides a global settlement platform that transcends borders and nationalities. A sandbox for innovation.

Interoperable

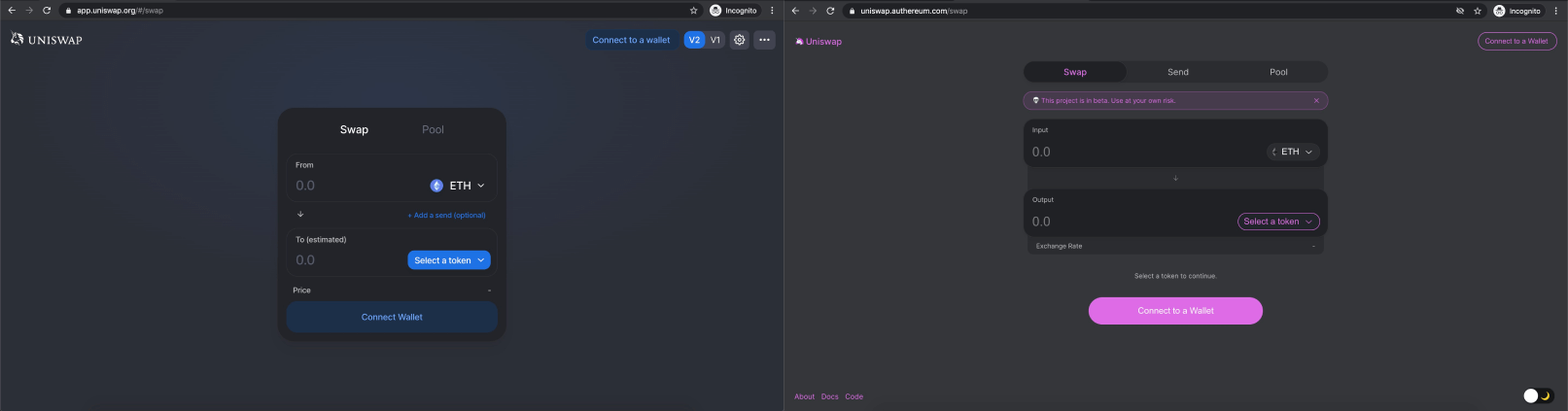

Another key feature of decentralized finance is that all smart contracts are public, readable and available on the chain. Open source by default. Anyone who knows how to code can trigger the functions of these smart contracts. Consequently, anyone can also build an interface with these smart contracts.

For example, the team behind Uniswap, a decentralized exchange that allows users to swap tokens, developed an interface that users can visit at uniswap.exchange, but there are many other interfaces hosted by other teams and individuals. This means that not only can the backend of these applications – i.e., the smart contracts – not be dismantled, but even the frontends/interfaces are resistant to censorship and are decentralized. The teams behind the smart contracts even encourage this by making the frontend code public as well.

But there is another interesting feature of these smart contracts. Because they are public and exist on the same computing platform, they can interact with each other. This is called interoperability. Essentially, this means that if I build a new application, I can integrate all existing smart contracts into my application.

Let’s say I create a lending protocol. The lending protocol has two main functions. Users can deposit money into a common pool and earn interest. And borrowers can borrow assets from this same pool. However, to guarantee the loan, they will need to deposit assets as collateral for the loan. This procedure is similar to traditional finance loans, which are secured by a mortgage or other collateral.

But what happens when the value of the crypto assets held as collateral by the protocol drops to 0, and the borrower defaults on the loan? To ensure that this cannot happen, the protocol would need a liquidation mechanism by which it would sell the borrower’s risky collateral on the market and repay the lenders. Instead of having to build an exchange from scratch, as well as a lending market, I can simply integrate Uniswap into my protocol. Whenever collateral is at risk, the protocol seizes it and sells it on Uniswap. The proceeds of the sale go directly to the protocol pool and ensure its solvency.

Interoperability is a powerful notion because it means that each new application being built can benefit from those that already exist. With each application being built, Ethereum as a whole becomes more useful and more powerful. That’s why Ethereum is so dominant. No developer wants to build on a Blockchain without applications. Even if it promises millions of transactions per second.

Governance

In the traditional world, companies (like your bank) are run by executives, usually overseen by a board of directors and ultimately owned by shareholders.

The vast majority of companies are private, meaning their shares are not listed on the stock exchange and the average citizen cannot buy a share of ownership. Those that are public are relatively expensive when listed on the stock exchange. By the time a company like Facebook goes public, venture capital funds have already made their profits. They invest in companies when they are very cheap and sell their shares to the public years later at prices reaching billions of dollars.

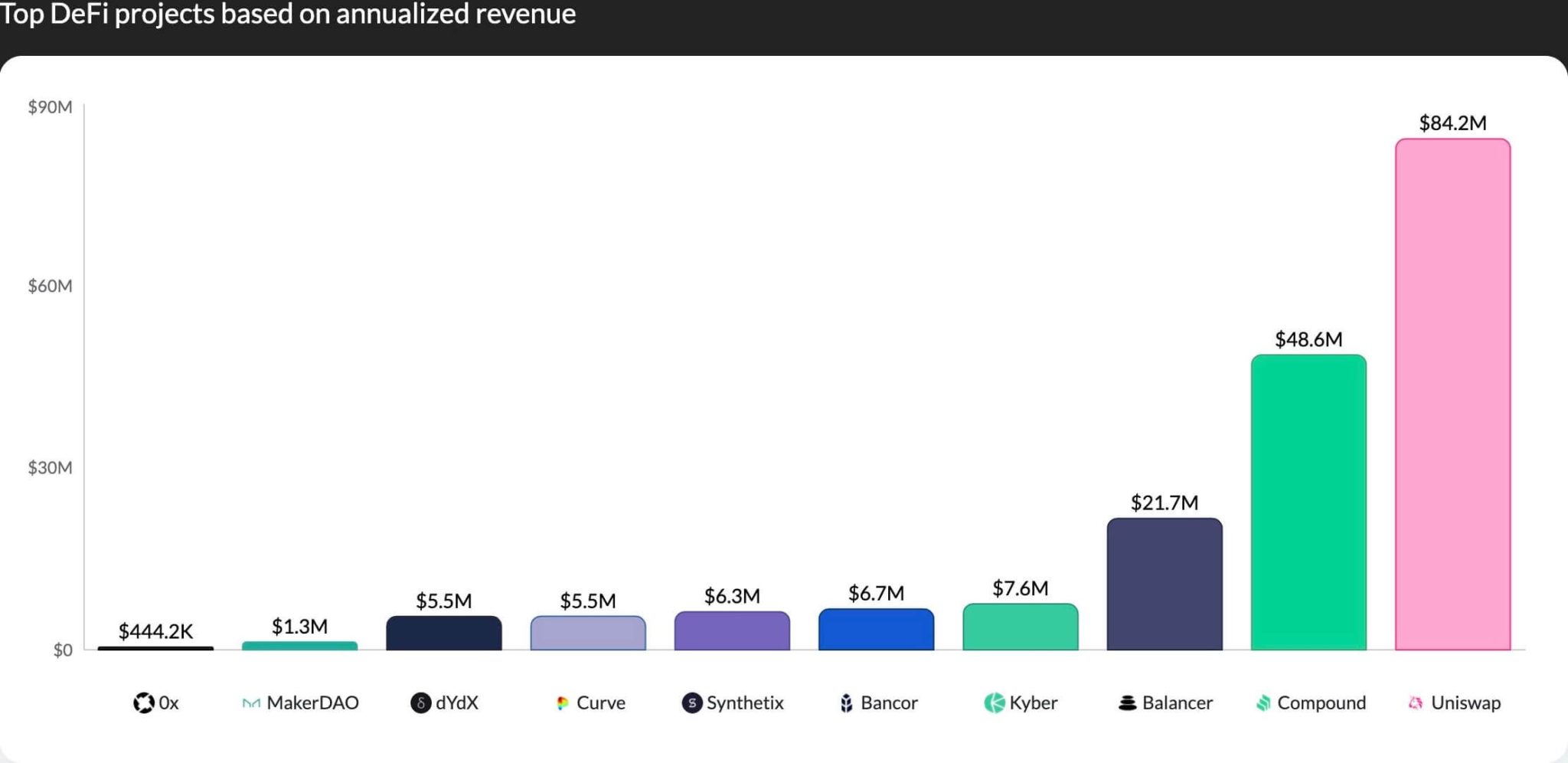

In contrast, most protocols are owned and governed by their community. Anyone can submit proposals or code changes to a protocol, which are then accepted and implemented or rejected by the community. To participate in decision-making, users must buy the governance token. Token holders also typically receive a portion of the fees the protocol collects for its services.

In this sense, they constitute a new asset class. Similar to stocks but different in that they give holders ownership of a protocol, not a legal entity. As the cash flows generated by these protocols are public, anyone can make informed decisions without having to wait for a company to report its earnings quarterly (and without being sure that the reported earnings are accurate).

Thanks to a transparent mechanism for calculating a protocol’s earnings (“Protocol Earning -PE“), we can apply one of the old asset valuation parameters in traditional finance: the price-to-earnings ratio. Simply put, the price-to-earnings ratio is a way of understanding how the market values an asset relative to the amount of revenue it generates. For example, Compound’s protocol token ($COMP) has a PE ratio of 40. This means that investors are willing to pay $40 for every dollar earned by the protocol today. If you want to know the PE ratio of the most popular DeFi applications, the site Token Terminal does a great job of providing accessible data.

How to Get Started with Decentralized Finance – DeFi?

To get started with decentralized finance, you will need some Ether and a wallet.

To buy Ether, you need to visit a centralized crypto exchange (like Coinbase or Kraken). Exchanges allow you to convert your fiat currencies into cryptocurrencies. Once you’ve acquired ether, you need to transfer it to an Ethereum wallet.

1. Buy Ether (ETH)

To buy ETH, we recommend Coinbase, Blockchain.com or Kraken. If these exchanges do not operate in your country, please refer to our page on major platforms for a more comprehensive overview.

2. Get an Ethereum Wallet

For a good Ethereum wallet suited to DeFi, we recommend Argent, Metamask or Authereum.

Metamask is the most popular wallet. It works as a browser extension and pops up when you need to connect your wallet to an application or sign a transaction. You can download it here.

Argent is a sleek and incredibly user-friendly mobile wallet. It natively integrates many DeFi functions in its mobile app, but you will be slightly more limited in terms of choice compared to Metamask. Ultimately, it is a matter of personal preference as Metamask is preferably used on desktop/web while Argent is used on mobile (iOS/Android).

3. Withdraw your ETH from the Exchange

As long as your ETH is on your exchange account, you do not really own it. To start moving in DeFi, you need to transfer it to your Ethereum wallets.

4. Start Using DeFi

A good starting point for your journey into DeFi is to visit uniswap.exchange and swap some of your ETH for tokens. For instance, you can trade Ether for USDC, a dollar stablecoin. Once you have USDC, you can go to Aave and deposit it on the platform to earn interest.

Examples of DeFi Applications

The DeFi ecosystem is constantly growing with new protocols and applications emerging almost daily. To give you an idea of the types of financial applications that are already being built on Ethereum today, we will cover some of the most interesting projects that exist today.

What is MakerDao?

Naturally, for these applications to be useful, they need to work with dollars and not just a crypto currency. The dollar is the most stable currency in the world. Many people want exposure to it but cannot do so because they live outside the geographic borders of the United States. This is why “stablecoins” or “crypto-dollars” appeared early in crypto history.

Stablecoins like Tether or USDC are tokens that exist on the Blockchain and are pegged to the value of the US dollar at a 1:1 ratio. They are issued by private companies (often crypto exchanges) that guarantee they hold the equivalent amount of dollars in bank accounts. However, to exchange these tokens for real dollars, holders must go through a KYC process. Issuers need to comply with current regulations to combat money laundering. The market capitalization of stable tokens on Ethereum recently exceeded 12 billion dollars and continues to rise.

However, these coins are not decentralized. Although they can be freely exchanged within the Ethereum ecosystem, to actually redeem them for fiat dollars, individuals must identify themselves to stablecoin issuers. Furthermore, the smart contracts powering these stablecoins have special features built-in, allowing issuers to blacklist certain addresses or freeze assets.

The goal of the MakerDAO protocol is to create stablecoin tokens without any of these limitations. A coin that is not issued by a company. A truly decentralized currency governed by a protocol and kept stable against the dollar by collateralizing with ETH.

The main function of the MakerDAO protocol is to issue DAI, a stable token that aims to always be worth one dollar.

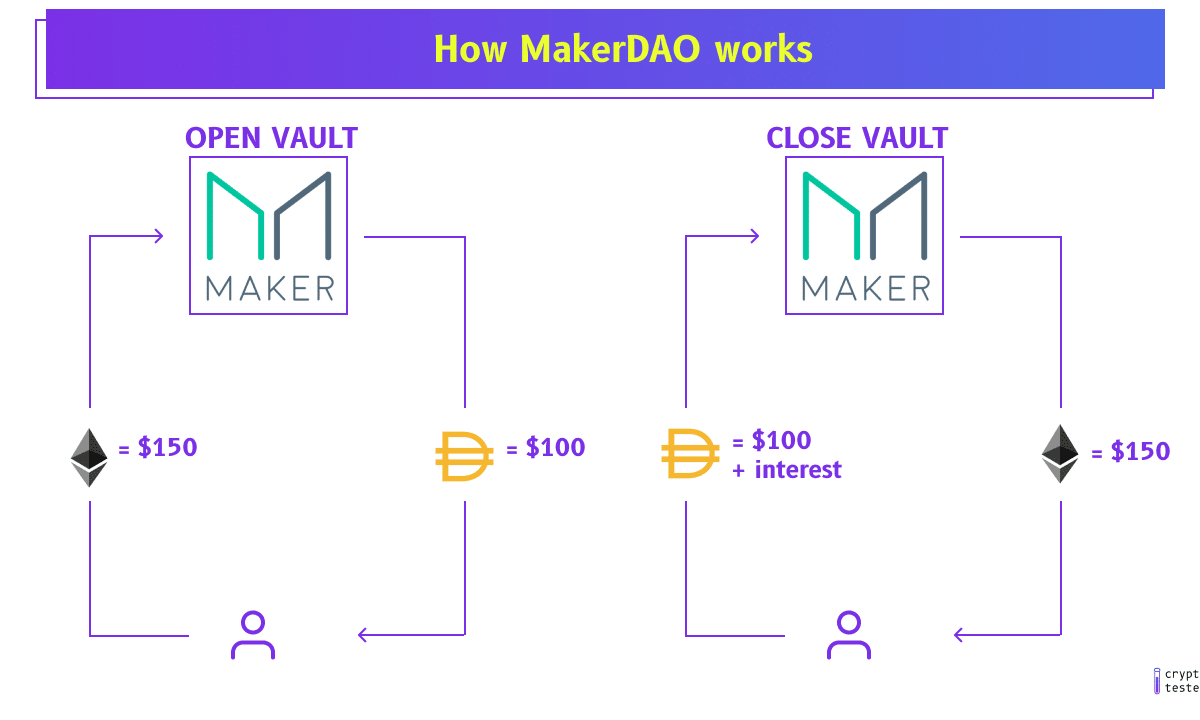

However, DAI is not backed by real dollars in a bank account, which is why the value of DAI (expressed in dollars) can sometimes slightly fluctuate. Instead, DAI is backed by ether and generated through a process in which anyone can send ether to a smart contract (called a “Vault”) where it is temporarily locked. In return, the user receives DAI. For instance, if a user sends $150 worth of Ether, they will receive 100 DAI, which is ⅔ of the Ether locked in the smart contract as collateral.

How MakerDAO Works

Next, the user can send their DAI to anyone globally or sell and buy something with it. Essentially, the user borrowed DAI from the Maker Vault, but since the smart contract holds the user’s Ether as collateral, there is no default risk. When the user wants to retrieve the Ether, they must repay the loan principal plus accrued interest.

Of course, not everyone needs to go through this process to obtain DAI. Only users with financing needs or who want to take a long position actually generate (or “mint”) DAI. Most users simply buy DAI on exchanges. In most cases, they will pay exactly one dollar. Like any currency traded in free markets, DAI derives its value from supply and demand.

If too many people sell DAI to buy other cryptos, for example, DAI’s value may drop below $1. In this case, two forces pull the market price back to $1.

- 1) Arbitrage – On one hand, people who took out a loan will take advantage of the discount to repay their debt, buy low-cost DAI on the market (for instance $0.95), and close their debt position. The 100 DAI initially borrowed would now only be worth $95, producing an arbitrage opportunity. This increases market demand for DAI, while the supply of DAI is regulated as it is repaid to smart contracts and burned (destroyed).

- 2) Interest Rates – If market forces are not enough to bring the price back to one dollar, the Maker organization, driven by thousands of individuals who collectively vote on policies, can also increase the interest rate. By making borrowing more expensive (or less expensive), users will close (or open) Vaults, reducing (or increasing) supply.

In other words, these smart contracts work as a decentralized “central bank” that mints money, adjusts incentives, and ensures DAI tokens are always backed by a sufficient reserve of ether to keep their value stable.

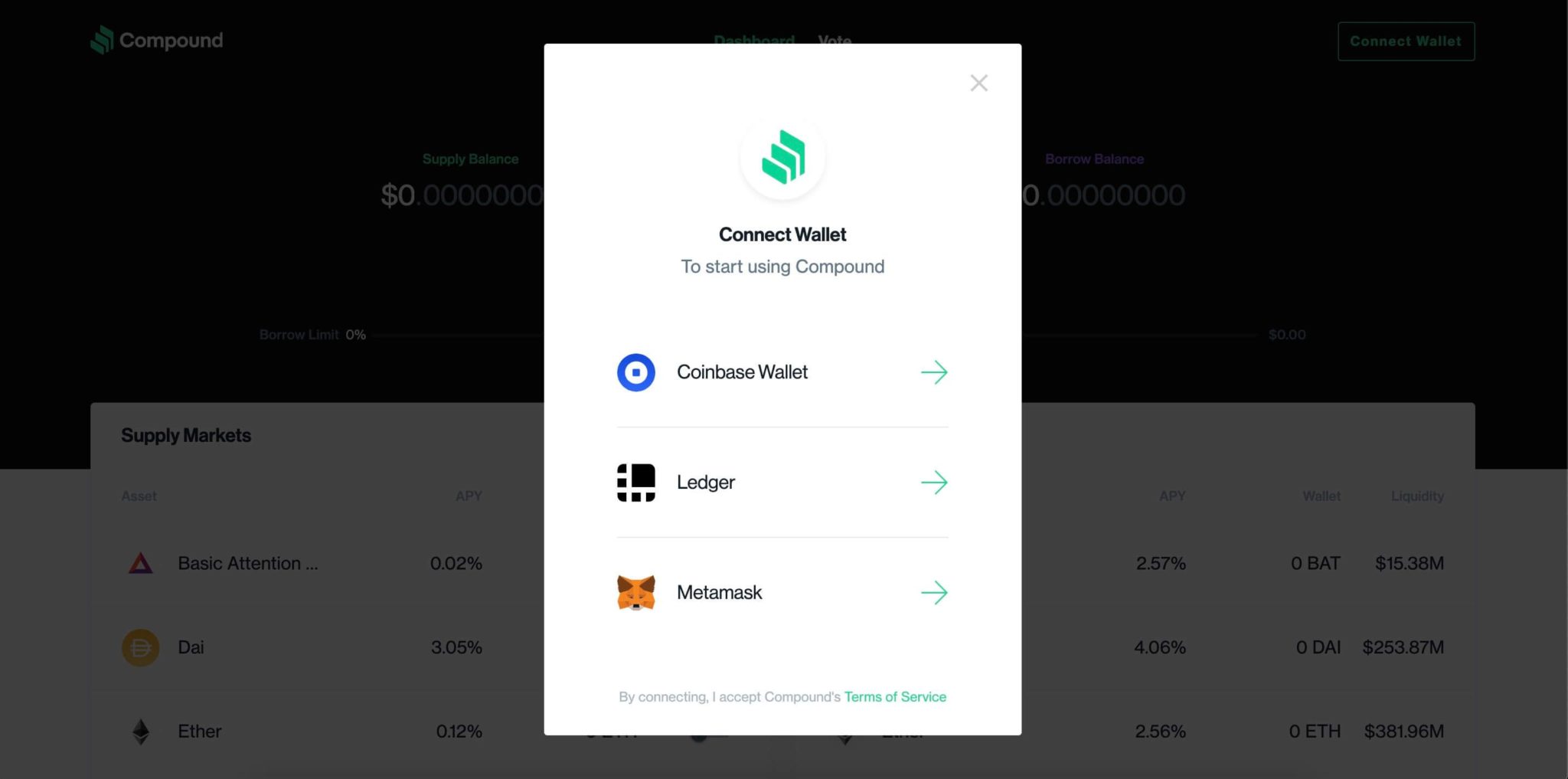

What is Compound?

“Compound” is a decentralized lending protocol that enables people to borrow and lend assets by providing a Liquidity Pool (LP) that anyone can borrow from or lend to. Users who want to lend money can send their assets to the liquidity pool and start earning interest immediately. The interest generated by the entire pool is distributed among all providers, so even when funds are not in use, providers receive their share of interest.

Users who want to borrow money from the liquidity pool must provide collateral, similar to the MakerDAO system, ensuring loan security at all times. Interest rates are algorithmically set based on supply and demand, which means they fluctuate. If a large amount of DAI is supplied to the pool and there is not enough demand to match it, the DAI interest rate will be lowered. Conversely, low supply and high borrowing demand will drive interest rates up.

Compound works not only with DAI but also with many other tokens existing on the Ethereum network. Each token has its own liquidity pool and interest rate. At the time of writing, Compound supports lending and borrowing of Ether, WBTC, BAT, USDC, DAI, and several other assets.

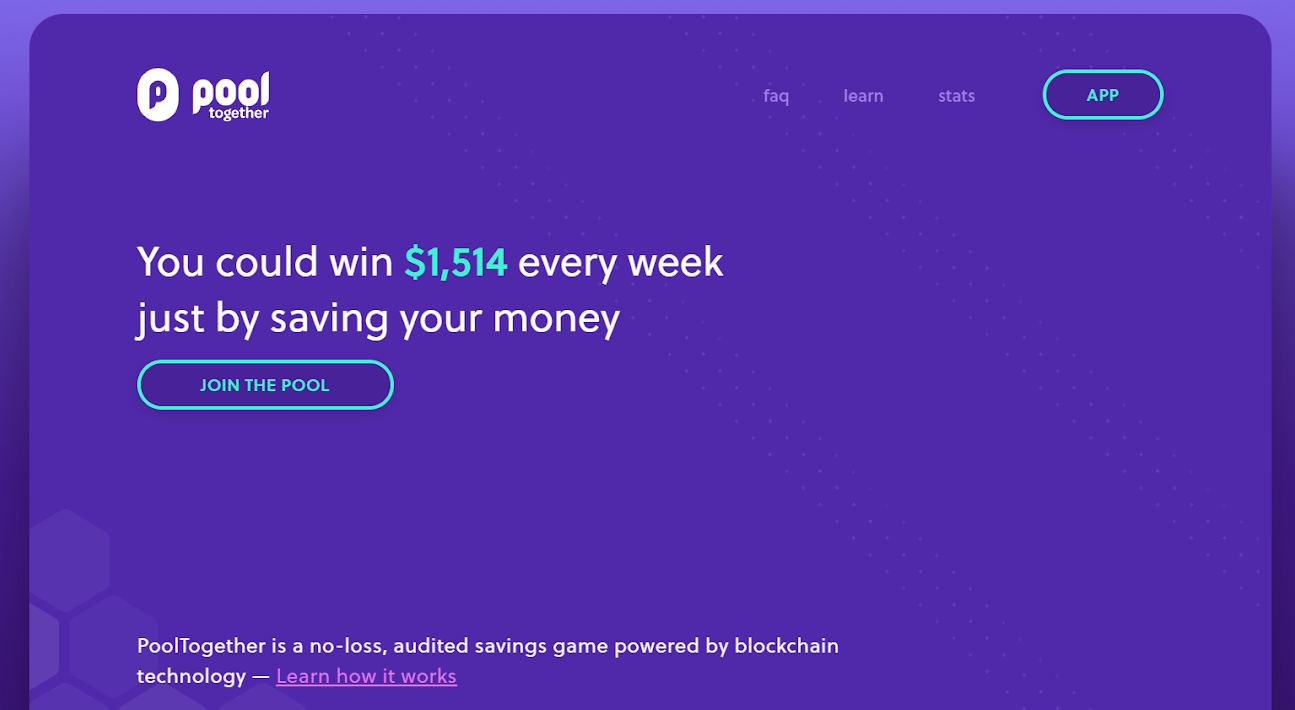

What is Pool Together?

To show how modular these different DeFi systems are, we’ll end by explaining PoolTogether, a no-loss lottery that uses both DAI and Compound in its product. It allows users to pool their funds and collectively invest in Compound’s DAI pool. When money is placed in the Compound pool, it generates interest, which is given away as a weekly prize to a random wallet address. For each user’s DAI contributed to the pool, they receive a lottery ticket in the form of a token.

In essence, users have a chance to win the weekly prize without risking losing money. They are free to withdraw the amount they invested at any time. Two additional benefits of PoolTogether over traditional lotteries:

- 1) the code is fully open-source and verifiable, ensuring users the prize distribution is not rigged

- 2) PoolTogether has contributed over $300,000 of its own money to the prize pool, which generates the most money but is not eligible to win.

Summary

These are just a few examples of decentralized financial applications. More and more applications are joining the list every week, developed by young developers from around the world. The magic of decentralized finance is that it is global by definition and can be used by anyone in the world with a smartphone – even by the 1.7 billion people without a bank account. DeFi apps are powered by open-source code that can be verified by everyone. Compare this to the highly centralized, opaque, and profit-seeking financial system we live in, and you will understand why this vision fascinates the crypto community.

This article is taken from the excellent blog Cryptotesters. The Berlin-based team describes the purpose of their approach as follows:

“The crypto space is a place of permissionless innovation, a dream for builders and hackers who launch new products on the market every week. […] This abundance of choice unfortunately makes the space extremely complex to navigate for people who have never ventured into it. At cryptotesters, we want to help people who are new to the field of cryptography by recommending the best products. We also believe that exchanges are not the place to start your Blockchain journey. […] Our vision doesn’t stop there. We anticipate that the crypto space will continue to evolve. We are only at the very beginning of it. Eventually, there will be an infinite number of crypto products to choose from in different sectors (think insurance, lending, etc.), and our goal is to help users choose the best of each.”

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Adepte de nouvelles technologies et d'innovation, j'ai pour objectif de mettre à profit les connaissances acquises lors de ma formation afin de me spécialiser dans les secteurs d'avenir que sont la cryptomonnaie et le metaverse. J'aspire à tirer parti de mes connaissances concernant la blockchain dans le but de proposer un contenu de qualité accessible à tous !

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.