What is Bitcoin (BTC) fear and greed index?

Fear and greed index is a variable that shows to what extent investors are inclined to buy BTC and therefore shows where the crypto market is most likely to go.

The index has values from 0 to 100, where 0 is extreme fear and 100 is extreme greed. There is a “fear” zone in a bear market (this was observed in June and July this year) and a “greed” zone in a bull market. Thus, the closer the index is to 0, the more likely it is for the downtrend to reverse and become an uptrend. When the index is closer to 100, it means that the trend is likely to change from bullish to bearish very soon.

In simple terms, we can interpret the index as follows: if its value is low (the “fear zone”), it means that people are afraid to buy Bitcoin, so they stay in cash instead. This means that there are few buyers in the market and a lot of sellers. Prices fall, which provides an attractive buying opportunity. This situation cannot last forever, and eventually more investors lean towards buying, which reverses the trend upwards. With a “greedy” index the situation is the opposite: if there are more “greedy” investors in the market, there are fewer sellers, and sooner or later there will be no one left to sell.

There are four ranges on the index scale:

- 0-24 – “extreme fear” when there are virtually no buyers in the market and way too many sellers, which is a signal of a possible reversal into an uptrend;

- 25-49 – “fear” when the market’s mood is no longer in line with panic and strong selling, but a bullish rally is still far away;

- 50-74 – “greed” when the bulls are awake and clearly show that sell-offs aren’t going to happen in the near term;

- 75-100 – “extreme greed” when the bulls are leading the move, they have already managed to warm up the market a lot, and a correction is looming. It is too late to buy; you have to take profits or stay out of the market, waiting for a correction and then a resumption of growth.

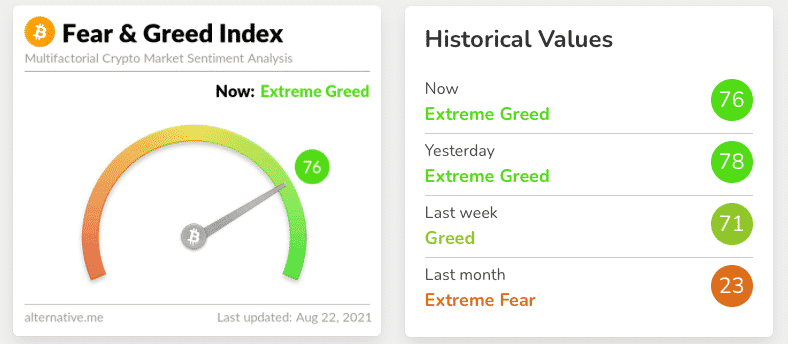

On 22nd August, the index was at 76, which indicates it is in an uptrend. It is not too late to buy, the bulls have yet to show their strength and push prices higher. We might expect a continuation of the rally over the next few weeks.

Where to see the index?

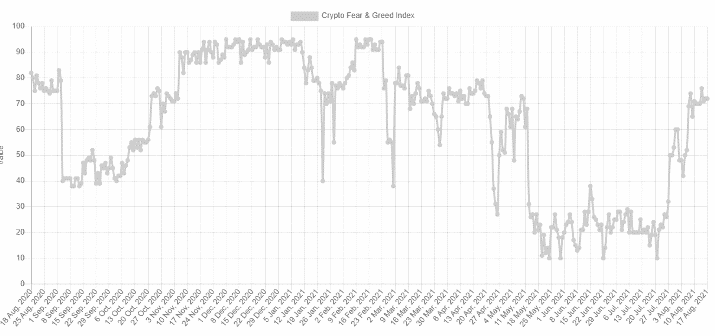

The index is calculated on alternate.me where you can look at a graph of the index and identify interesting patterns.

Between mid-May and end of July last year, the index was in the 10-30 range, and that was a bear market time. Then, last autumn, the index began climbing, hitting all-time highs until 20th April 2021. This was a strong bull run for Bitcoin and other crypto with many coins setting their all-time highs.

The site offers a widget, the code of which can be inserted on any other site, and the widget will display the value in real time.

How to calculate the index?

The index is calculated using five parameters, balanced by their weight:

- Volatility (25% weighting);

- Momentum/Trading volume (25%);

- Bitcoin mentions on social media (15%);

- Surveys (15%) – temporarily excluded from the calculation;

- Bitcoin dominance index (10%);

- Google Trends (10%).

Volatility. The price spikes and drawdowns are measured on the price chart. The obtained values are compared with the average of the last 30 and 90 days. If there is a spike in these values, then a conclusion is made about how “nervous” the market is and whether or not investors are undecided. In other words, the logic is as follows: if the price is going up and everything is going well, there should not be any sharp ups or downs — investors are likely to buy at a steady pace. If there are spikes up and down, then investors are antsy, hesitant. The concept of volatility in the markets is precisely the rate of change in price per time unit.

Momentum/Trading volume. This parameter measures market momentum and trading volume. Momentum is the difference between the closing price of the market in the current period and the closing price N periods ago. Momentum can also be viewed as the rated “power” of the market, i.e. the speed of price change in a certain direction. The current value is also compared with the value from 30 and 90 days ago.

Social media. More precisely, Twitter. Twitter hashtags related to Bitcoin are collected and counted. Then it is determined how quickly a hashtag receives feedback from other participants and how many people comment on a post with the hashtag within a certain time period. The high number of responses and the speed of interactions is in line with the growing interest in BTC and a “greedy” market.

Surveys. In cooperation with strawpoll.com, alternate.me conducts surveys with 2,000-3,000 respondents, based on which it draws conclusions about the market mood. The surveys are currently not included in the index calculation.

Bitcoin dominance. It measures the ratio of Bitcoin’s market capitalisation to the total capitalisation of all other cryptocurrencies. As BTC has been improving its reputation as a “safe haven” in the crypto world (and in finance in general) over time, a high dominance value is considered to be a sign of investors’ uncertainty about the market growth. Conversely, when dominance is at a low level, it indicates heightened public interest in altcoins, and thus investors’ confidence in the future price growth.

Google Trends. The frequency of search queries on Google Trends related to Bitcoin is analysed here. What is particularly important is not the frequency of queries per se, but the change in frequency (decrease or increase). On the basis of this data, a conclusion is also made as to whether the market is in a “fear” or “greed” state.

Conclusion

The fear and greed Index is a useful tool that can show the investor how the market is feeling at any point in time. It can be used to predict Bitcoin price behaviour reliably enough.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Hi everyone, thanks for reading my article! Join me on my journey to crypto enlightenment, we can always learn something new from each other – no one person has all the knowledge in the world.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.