Weekly Recap: Bitcoin, Binance, Ethereum, Solana... the crypto news you shouldn't miss!

Between revolutionary announcements, technological advancements, and regulatory turbulence, the crypto ecosystem continues to prove that it is simultaneously a realm of boundless innovation and a battleground of regulatory and economic strife. Here’s a summary of the most significant news from the past week involving Bitcoin, Ethereum, Binance, and Solana, among others.

Historic Drop in Bitcoin Reserves on Exchanges

The Bitcoin reserves held by centralized exchanges have reached their lowest level since the start of the year 2021. More than 90,700 bitcoins were withdrawn from major crypto exchanges over the last month, leading to a significant reduction in available reserves. This situation occurs in the context of a general market rise, making the phenomenon even more noticeable.

The reasons behind this massive reduction in reserves remain varied and speculative. Analysts suggest a growing awareness of the risks associated with holding cryptos on centralized platforms, particularly due to a recent surge in hacks and bankruptcies in the industry. This trend could indicate a move towards more autonomous asset management, with an increasing interest in non-custodial wallets and decentralized finance (DeFi) solutions.

Binance Establishes Its First Board of Directors

Crypto exchange Binance has taken a significant step by announcing the formation of its first board of directors. This new governance structure consists of seven members, including four internal company members and three independent members. The initiative aims to strengthen Binance’s compliance in the face of international regulatory challenges.

The board is chaired by Gabriel Abed, former ambassador of Barbados to the United Arab Emirates, who brings his expertise in diplomacy and international affairs. The composition of the board reflects a desire to balance internal and external perspectives, with the goal of fostering more transparent governance and improving strategic decision-making. However, reactions within the crypto community have been mixed, with some applauding the move towards greater openness, while others express concerns about the real independence of the board and its effectiveness in overseeing the exchange’s operations.

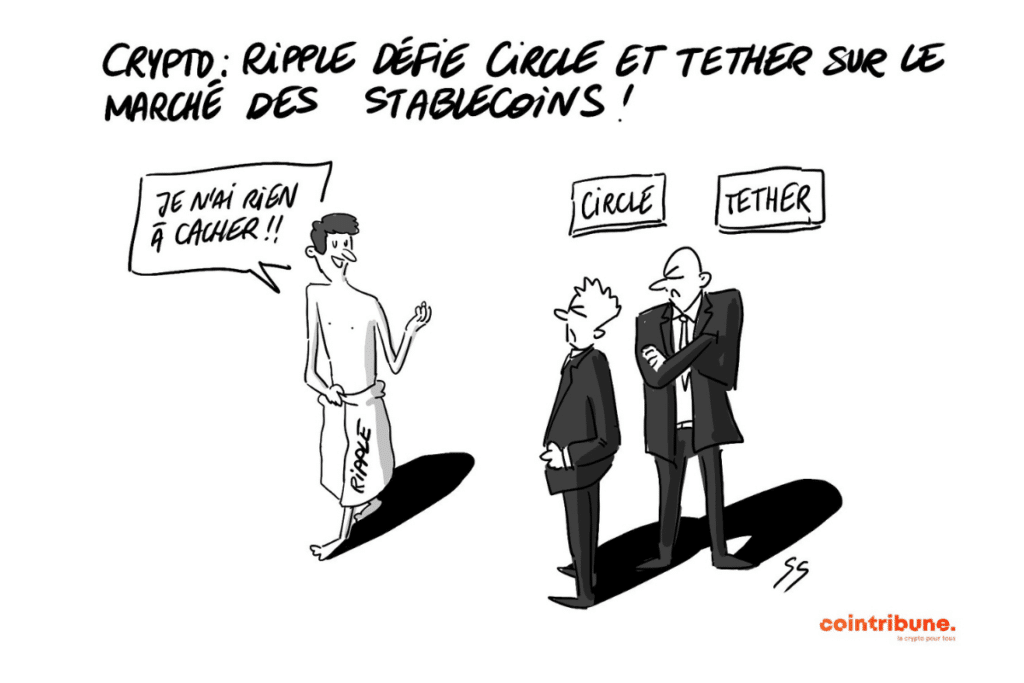

Ripple Enters the Battle of Stablecoins

Ripple is expanding its horizon by announcing its intention to enter the stablecoin market, currently dominated by Circle and Tether. The firm plans to launch a stablecoin backed by the US dollar, which will initially be integrated on the XRP Ledger as well as the Ethereum blockchain. This bold move comes after a period of controversy for Ripple, marked by legal disputes with the US SEC.

Ripple aims to distinguish itself in this new segment by focusing on compliance and transparency, two critical aspects that have been lacking in some of its competitors in the past. The name of this new stablecoin has not yet been revealed, but the company, under the technical direction of David Schwartz, intends to emphasize the importance of security, value stability, and trust. Taking a cue from Circle’s USDC model, Ripple plans to back its stablecoin with tangible assets such as dollar deposits and Treasury bills, while ensuring full transparency through monthly attestations by external auditors.

Tether Makes a Massive Investment in Bitcoin

Tether, the company behind the stablecoin USDT, has made a big move by acquiring 8,889 bitcoins, representing an investment of nearly 627 million dollars. This strategic operation significantly strengthens Tether’s reserves, bringing the total of its Bitcoin holdings to over 75,000 BTC, with a valuation exceeding 5.3 billion dollars. This bold investment reflects Tether’s confidence in Bitcoin as a leading investment asset and attests to its long-term vision for the crypto ecosystem.

Beyond this investment in Bitcoin, Tether continues to diversify by engaging in key sectors such as Bitcoin mining and artificial intelligence (AI) technology. These initiatives showcase Tether’s ambition to establish itself as a major and multidimensional player in the cryptocurrency industry.

Solana Takes on Problematic Memecoins

Solana, known for its high-performance blockchain, is facing controversy related to the presence of offensive memecoins on its platform. In a proactive move, the Solana team has decided to take concrete steps to curb this phenomenon. The main initiative is to introduce filters to eliminate inappropriate content associated with memecoins.

This strategy was announced during a roundtable at the BUIDL Asia Summit in Seoul. Solana wants to collaborate with crypto wallet developers to implement these filters. These will allow blocking access to specific tokens based on blacklists, offering users the ability to filter out content they wish to avoid. Austin Federa, head of strategy for the Solana Foundation, emphasizes the importance of this measure in preserving the permissionless nature of the network while protecting users from problematic content.

Ethereum Realizes Record Profits in Q1 2024

Ethereum experienced an exceptional first quarter of 2024, tripling its profits to reach 369 million dollars, generating 1.2 billion dollars in revenue primarily from transaction fees. This impressive performance is the result of a considerable increase in transaction fees on the network and highlights the growing demand and sustained activity on Ethereum despite high user costs. Ethereum’s financial success during this quarter reflects the robustness and increasing attractiveness of its ecosystem, particularly in the decentralized finance (DeFi) and decentralized applications (dApps) sectors.

Despite average transaction fees reaching highs (79 dollars on average in early March, with spikes up to 400 dollars in late February for some operations), the use of the Ethereum network continued to increase. The total transaction volume climbed by 8.4% over the previous quarter, and the total value locked (TVL) in DeFi on Ethereum exploded, jumping by 86% to reach 55.9 billion dollars. This remarkable growth not only demonstrates the users’ trust in the Ethereum network despite the costly barriers but also highlights the constant evolution of the Ethereum ecosystem towards broader adoption and ongoing innovation.

PayPal Transforms Cross-Border Transfers with PYUSD

PayPal revolutionizes cross-border transfers by enabling the use of its stablecoin, the PayPal USD (PYUSD), to conduct international transfers without fees via its Xoom service. This initiative, available to US users except those residing in Hawaii, represents a major advancement in the efficiency and economy of international money transfers. By eliminating transaction fees for transfers funded by PYUSD, PayPal offers its users a more economical solution for sending funds abroad, directly challenging one of the major drawbacks of traditional money transfer services: high costs.

This innovation is part of a broader trend of integrating cryptos into traditional financial services and demonstrates PayPal’s willingness to leverage blockchain technology to enhance its services. The introduction of fee-free international transfers through PYUSD underlines the company’s commitment to providing more accessible and less expensive payment options, aiming to reinforce its leadership position in the field of digital payments.

There you have it, the essentials to keep in mind for this week. But if you want a more detailed recap and in-depth analyses directly in your inbox, do not hesitate to subscribe to our weekly newsletter.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Diplômé de Sciences Po Toulouse et titulaire d'une certification consultant blockchain délivrée par Alyra, j'ai rejoint l'aventure Cointribune en 2019. Convaincu du potentiel de la blockchain pour transformer de nombreux secteurs de l'économie, j'ai pris l'engagement de sensibiliser et d'informer le grand public sur cet écosystème en constante évolution. Mon objectif est de permettre à chacun de mieux comprendre la blockchain et de saisir les opportunités qu'elle offre. Je m'efforce chaque jour de fournir une analyse objective de l'actualité, de décrypter les tendances du marché, de relayer les dernières innovations technologiques et de mettre en perspective les enjeux économiques et sociétaux de cette révolution en marche.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.