Weekly Recap: Bitcoin, Binance, Ethereum, Solana... the crypto news you shouldn't miss!

The year 2024 stands out for significant evolutions in the cryptocurrency sector. Between Bitcoin’s halving, Ripple’s expansion into crypto custodianship, and strategic partnerships such as Solana and Filecoin, the crypto landscape is experiencing unprecedented dynamics. These developments, coupled with Bitcoin’s ascension in the global assets ranking and increased commitment from Ethereum, as well as calls from U.S. banks for appropriate Bitcoin ETF regulation, reflect an increasing maturity and integration of cryptocurrencies into the global financial system. Here’s a recap of the most striking news from the past week.

Bitcoin Halving 2024: Exceptional Predictions According to Grayscale!

The Bitcoin halving in 2024 is anticipated with a lot of excitement, especially by Grayscale, which predicts an unprecedented event. Grayscale, a major player in digital asset management, emphasizes that, unlike previous halvings, the 2024 event is distinguished by several fundamental developments that could significantly strengthen the Bitcoin ecosystem. The rise of ordinals, the introduction of spot Bitcoin ETFs, and sustained on-chain activity are among the factors that make this halving particularly notable. The reduction in Bitcoin emission from 6.25 to 3.125 BTC per block represents a challenge for miners’ revenues, but they have prepared by raising funds and selling reserves to compensate.

On the other hand, the increase in transaction fees, fueled by the rise of ordinals and layer-2 solutions, offers new revenue sources for miners. With more than 59 million assets registered to date, ordinal registration fees have generated over $200 million in transaction fees. This dynamic, coupled with growing interest in Taproot-compatible wallets and the exploration of layer-2 rollups, indicates a collective movement towards enhancing the scalability and security of the Bitcoin network. Spot Bitcoin ETFs, absorbing part of the selling pressure typically exerted by miners after a halving, could also play a key role in transforming Bitcoin’s market structure.

Binance: The sentencing of CZ postponed until April 30!

Changpeng Zhao, the former CEO of Binance, found guilty of money laundering last year, sees his sentencing postponed to April 30, 2024. Originally scheduled for February 23, 2024, this decision extends the uncertainty surrounding the future of one of the world’s largest crypto exchanges. In November 2023, Zhao pled guilty as part of a deal with the U.S. government, which also saw Binance pay $4.3 billion in fines. Although prosecutors mentioned the possibility of a maximum sentence of 10 years, guidelines suggest a sentence of around 18 months, leaving Zhao’s legal future uncertain.

The case has significantly impacted Binance, which has seen its dominance over the crypto market erode. From daily volumes exceeding $10 billion in 2021, the exchange has seen its transactions drop to $2-3 billion, while its reputation took a severe blow. The outcome of Zhao’s sentencing is critical for the future of Binance; a lenient sentence could offer the exchange a chance to bounce back under its new CEO, Richard Teng. However, a severe penalty could strike a fatal blow to Binance’s reputation and cloud its future growth prospects.

Crypto: Solana and Filecoin now a duo!

Solana and Filecoin announce a strategic collaboration, promising to revolutionize the decentralized data storage. This alliance aims to combine the transaction speed and scalability of Solana with the robustness of Filecoin’s decentralized storage solution. The goal is to make block history more accessible and improve data redundancy, thereby offering increased security and better accessibility of data across the globe.

The announcement has aroused a mixture of enthusiasm and skepticism in the market. Filecoin has seen its value increase following the announcement, while Solana experienced a slight decline. However, beyond the immediate fluctuations, it’s the growing interest in decentralized storage that stands out. Solana and Filecoin, despite the challenges, seem determined to strengthen their resolution and contribute to the future of crypto.

Bitcoin becomes the 10th most important asset in the world!

In 2024, Bitcoin made history by joining the top 10 of the world’s largest assets by market capitalization, overtaking giants like Tesla and Visa with a valuation close to $1 trillion. This major milestone reflects the growing adoption of Bitcoin and cryptocurrencies in the traditional finance world, demonstrating their potential as a store of value in an uncertain macroeconomic context. With a price approaching $50,000 at the beginning of 2024, Bitcoin has not only solidified its position as a major asset but has also sparked bold predictions about its ability to surpass gold in market capitalization in the future.

This global recognition comes after only 15 years of Bitcoin’s existence and underlines its remarkable rise as a new asset class and its remarkable resilience. The ascent of Bitcoin also symbolizes the increasing democratization of cryptocurrencies among the general public and institutional investors, with more and more companies and investment funds incorporating Bitcoin into their portfolios.

Ethereum dries up its supply: 35% of ETH now locked

The Ethereum blockchain has reached a new milestone with over 35% of the total Ether (ETH) supply now locked in smart contracts. This record illustrates the growing utility of Ethereum, strengthened since the adoption of the proof-of-stake consensus mechanism with “The Merge”. The growth in the number of active validators and the increased commitment of ETH in activities such as staking, DeFi protocols, or DAOs reflect renewed confidence in Ethereum’s long-term potential.

The excitement around Ethereum is likely to intensify with the major technical update “Cancún” scheduled for March 2024, which promises to significantly reduce transaction fees. Moreover, the anticipation of a possible approval of a spot Ether ETF by the SEC fuels speculation about an imminent bullish movement for the price of ETH. With a significant portion of the ETH supply locked in smart contracts, the reduced availability in the markets accentuates Ethereum’s bullish potential.

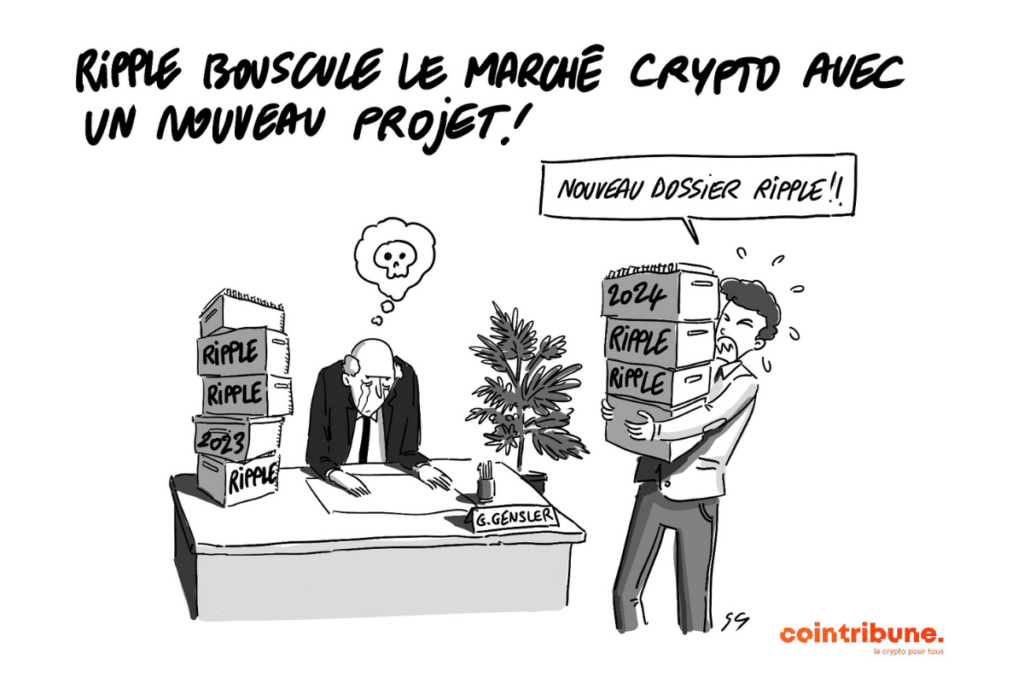

Ripple revolutionizes the crypto market with an audacious project!

Ripple, despite the regulatory and legal challenges it faces, including its ongoing battle against the Securities and Exchange Commission (SEC), is looking to expand its scope of action by venturing into the field of cryptocurrency custodianship. This initiative marks a significant strategic diversification for Ripple, which is mainly known for its payment solutions. Ripple’s CEO, Brad Garlinghouse, announced the company’s expansion project into crypto custody, highlighting a major shift toward providing services beyond traditional payments. Ripple aims to obtain regulatory approval to acquire Standard Custody and Trust Company, specializing in digital asset services, which represents a step forward in diversifying its offerings and improving its regulatory status.

The intended acquisition of Standard Custody by Ripple aims to strengthen its regulatory licenses, including a coveted New York fiduciary charter, essential for offering a complete range of crypto services, including the custody and settlement of digital assets. Monica Long, Ripple’s president, emphasized the importance of these licenses to provide comprehensive blockchain solutions to financial institutions, combining technology and compliance. The acquisition of Standard Custody, with its New York fiduciary license obtained in May 2021, could solidify Ripple’s regulatory framework, allowing it to bypass regulatory complexities and establish its presence on a global scale.

Towards a revision of Bitcoin ETF regulation?

A group of American banks has recently taken the initiative to invite SEC Chairman Gary Gensler to reconsider the current regulation regarding Bitcoin ETFs. These institutions, including the Bank Policy Institute, the American Bankers Association, and the Securities Industry and Financial Markets Association, have expressed their desire to actively engage in the Bitcoin ETF market. They point out that current capital and reserve requirements prevent them from providing custody services for Bitcoin ETFs, a role they already play for most other exchange-traded products (ETPs). The coalition highlights the risks to investors and the financial system if regulated banks cannot provide these custody services, pushing investors toward less secure providers.

The banks have also proposed reforms, including revising the definition of cryptos in Staff Accounting Bulletin 121 (SAB 121) to exclude traditional financial assets registered or transferred on blockchain networks. This distinction could alleviate some accounting constraints for banks while maintaining disclosure obligations, favoring transparent and regulated participation in the digital assets ecosystem. These proposals aim to balance the need for investor transparency with the meaningful integration of banks into the crypto market.

That’s the essential news to remember for this week. But if you want a more detailed recap and in-depth analyses directly in your inbox, don’t hesitate to subscribe to our weekly newsletter.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Diplômé de Sciences Po Toulouse et titulaire d'une certification consultant blockchain délivrée par Alyra, j'ai rejoint l'aventure Cointribune en 2019. Convaincu du potentiel de la blockchain pour transformer de nombreux secteurs de l'économie, j'ai pris l'engagement de sensibiliser et d'informer le grand public sur cet écosystème en constante évolution. Mon objectif est de permettre à chacun de mieux comprendre la blockchain et de saisir les opportunités qu'elle offre. Je m'efforce chaque jour de fournir une analyse objective de l'actualité, de décrypter les tendances du marché, de relayer les dernières innovations technologiques et de mettre en perspective les enjeux économiques et sociétaux de cette révolution en marche.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.