VanEck Files For An Avalanche ETF

Bitcoin, then Ethereum, and now Avalanche, Solana, and XRP: which digital asset does not yet have its ETF? Since Gary Gensler left the SEC, the market has taken off. VanEck recently filed for an ETF for Avalanche, offering direct exposure to investors. Could this financial product propel AVAX to new heights?

ETF Avalanche: a new Eldorado for digital asset investors?

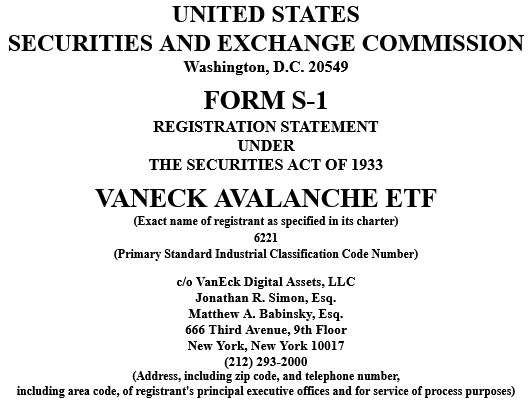

VanEck has officially submitted a request to the Securities and Exchange Commission to launch an ETF for Avalanche. This financial instrument aims to replicate the performance of the AVAX token, without the constraints of direct ownership. This news comes at a crucial time as the enthusiasm for crypto ETFs explodes in the United States.

Some key figures:

- $7.7 billion: market capitalization of AVAX.

- 16th place: ranking of Avalanche among the most valued cryptos.

- $110 billion: total trading volume of Bitcoin ETFs in March 2024.

According to Bloomberg, this filing formalizes a fundamental trend: the growing interest of institutions in altcoins. But will this new Avalanche ETF be the next growth engine for the crypto market?

As Eleanor Terrett points out:

A variety of crypto ETFs are flooding in, and Avalanche is the latest example.

A winning bet for investors or a flash in the pan?

The crypto ETF boom: simple trend or lasting phenomenon?

The rise of crypto ETFs is not limited to Avalanche. After Bitcoin, many issuers have filed for ETFs for Solana, XRP, or even Dogecoin. The crypto market is in full swing, and investor appetite seems insatiable.

But will these new products deliver on their promises?

According to a report from JPMorgan, altcoin ETFs could attract billions of dollars in assets under management. The institution estimates that:

- SOL could see influxes of $3 to $6 billion.

- XRP could generate between $4 and $8 billion.

- Institutional interest is growing day by day.

However, not everything is so simple. Some experts point out that crypto ETFs do not systematically trigger a price increase. Xeusthegreat, a DeFi analyst, noted:

The BTC ETF was supposed to bring Bitcoin to $100,000. What happened? An initial drop followed by a late rebound.

Will Avalanche suffer the same fate?

The role of the crypto regulator: between caution and openness

The SEC, under a more crypto-friendly administration, is examining these new crypto ETF requests closely. If regulation loosens, opportunities multiply. But uncertainties remain: the volatility of cryptos, market manipulation risks, and the evolution of legal frameworks continue to be major concerns.

Could the crypto regulator hinder this momentum? The SEC has already postponed some decisions, opting for a more in-depth review. However, Bloomberg believes that the chances of approval for altcoin ETFs remain high for 2024.

The stakes are high: investors want greater diversification, but authorities seek to avoid excesses. Between caution and innovation, the crypto market is at a crucial turning point.

Crypto ETFs offer a range of possibilities, paving the way for new capital and investors. Yet, enthusiasm sometimes hides a more nuanced reality. Katalin Tischhauser, an analyst at Sygnum, warns: behind the promises also lie uncertainties. Will the Avalanche ETF and other altcoins be a revolution or a mere illusion?

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

La révolution blockchain et crypto est en marche ! Et le jour où les impacts se feront ressentir sur l’économie la plus vulnérable de ce Monde, contre toute espérance, je dirai que j’y étais pour quelque chose

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.