USA vs. China: Bitcoin ETFs Plunge as Over $1 Billion Vanishes

The Sino-American tensions, far from sparing the classic stock markets, are also hitting the cryptocurrency market hard. The relationship between geopolitics and the volatility of crypto-assets is evident, and recent movements on Bitcoin ETFs are just another illustration. Indeed, the combination of geopolitical and economic uncertainties has caused a wave of panic among investors, leading to massive withdrawals of BTC via these funds.

Historic record for Bitcoin ETF outflows

US-based Bitcoin ETFs, held at +50% by BlackRock, recently saw an unprecedented capital exodus: 1.14 billion dollars left these financial instruments in just two weeks. These are the largest outflows since their launch in January 2024.

These alarming figures demonstrate the direct impact of the trade tensions between the United States and China, exacerbated by fears related to new economic policies. The evolution of customs tariffs, coupled with vague expectations regarding future monetary decisions, has largely influenced investors’ perception.

- 1.14 billion dollars withdrawn in 2 weeks;

- Largest outflow of Bitcoin ETF since January 2024;

- Increased pressure from USA-China tensions.

“The fear of the unknown becomes contagious,” summarized Marcin Kazmierczak, a market analyst. A statement that resonates particularly as crypto market players take their distances due to economic uncertainties.

In summary, while these outflows are impressive in the short term, the question remains: are Bitcoin and its ETFs merely victims of the storm, or do they carry within them a promise of long-term recovery?

USA-China: a long-standing conflict that redefines the global balance

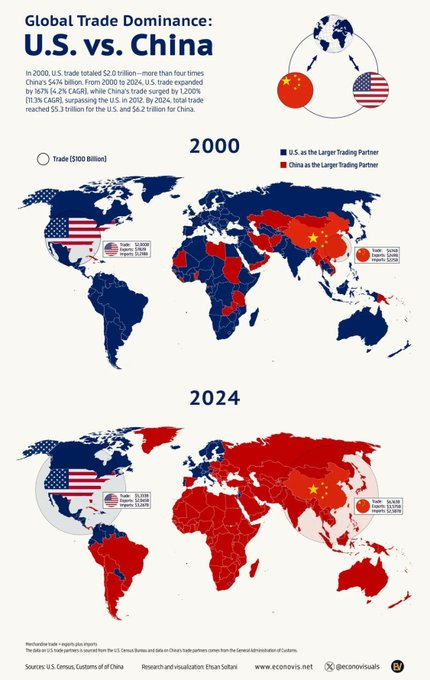

The standoff between the United States and China, much more than a trade war, embodies a confrontation of radically opposed geopolitical visions. While Washington bets on ideological exportation and military intimidation, Beijing plays a very different card: that of reciprocal trade and equal cooperation.

A strategy that combines patience and perseverance. This confrontation has erupted into the spotlight, yet the roots are deep and stretch back decades of rivalry and mistrust.

The United States, which has long seen itself as the center of the world, has sought to dominate by force, imposing its system on less powerful nations. But China, after centuries of submission, has taken a different path: that of fair economic exchange, often referred to as “soft power”.

According to observers like ShanghaiPanda, this approach has allowed China to gain a considerable lead over its rival, even though history shows that when China was at its weakest, it has already defeated the United States — an episode that some refer to as “psychological superiority”.

Today, the issue has become clear: the United States must recognize that to break this deadlock, the path to victory involves a revision of their relationship with China. Could a cooperation based on reciprocity and equity actually ease tensions? It is a significant challenge, but also a necessity for the future.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

La révolution blockchain et crypto est en marche ! Et le jour où les impacts se feront ressentir sur l’économie la plus vulnérable de ce Monde, contre toute espérance, je dirai que j’y étais pour quelque chose

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.