USA: These New Pro-crypto Elected Officials Who Could Change Everything!

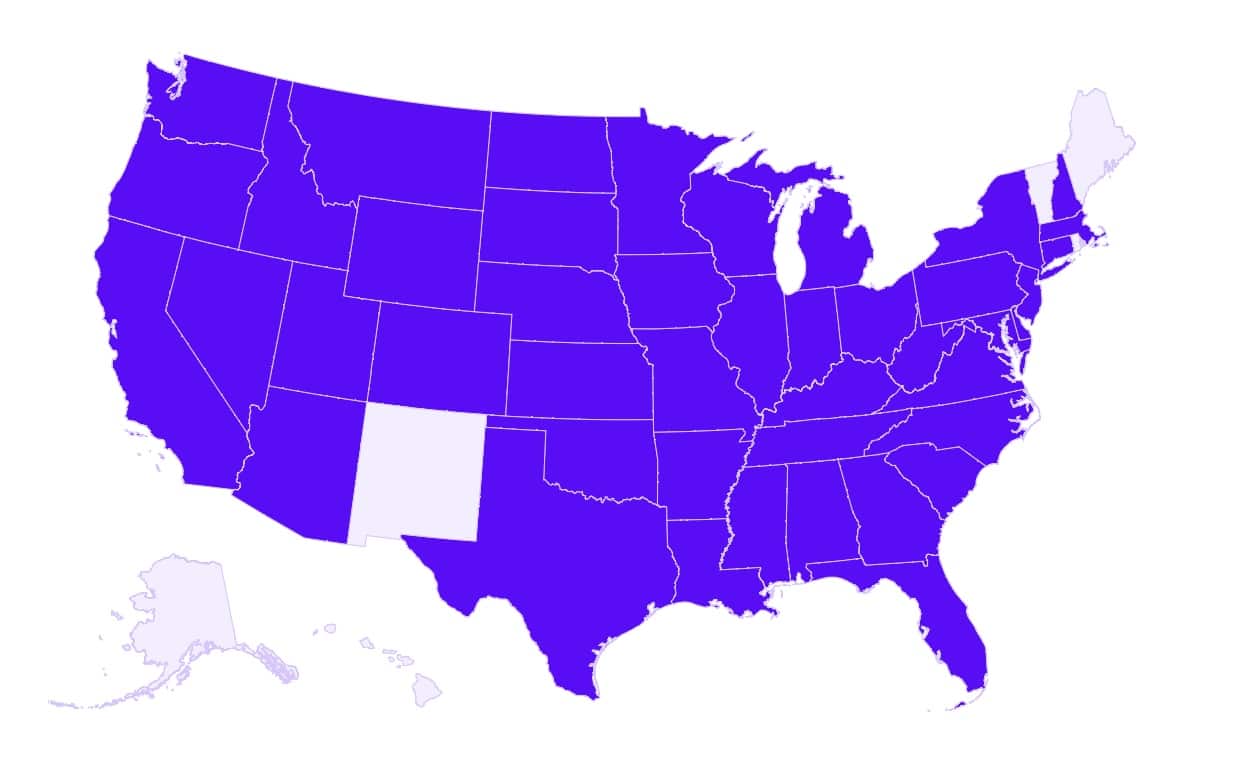

The recent American elections marked a significant victory for the pro-crypto movement. With 261 candidates elected to the House of Representatives and 17 to the Senate, this wave of support could transform crypto regulation and influence the technological future of the United States. However, this is not without risks.

Pro-crypto candidates take power in the United States!

As Donald Trump prepares to return to the White House, the American elections saw a wave of pro-crypto candidates winning important seats. According to SWC data, 261 pro-crypto candidates were elected to the House of Representatives, compared to 116 anti-cryptocurrency officials. In the Senate, 17 pro-crypto candidates were elected, while 12 anti-cryptocurrency candidates secured seats.

This significant victory marks a potential turning point in American politics. These candidates who support the adoption and favorable regulation of cryptocurrencies could substantially influence future legislation. Their increased presence in Congress could facilitate the drafting of laws more favorable to technological innovation and crypto adoption.

The election of these candidates occurs in a context where crypto is gaining popularity and acceptance. Many voters see in cryptocurrencies an opportunity to modernize the financial system and promote greater economic inclusion.

A victory with heavy consequences?

However, this rise of pro-crypto candidates is not without controversy. Opponents fear that widespread adoption of cryptocurrencies may lead to financial risks and security issues. Anti-cryptocurrency officials, though fewer in number, continue to advocate for strict regulations to prevent abuses and protect consumers.

Regardless, initial decisions on cryptocurrencies, particularly Bitcoin, are already being made by Senator Cynthia Lummis. She proposed the creation of a strategic Bitcoin reserve to strengthen the American economy and reduce the national debt, echoing Trump’s crypto promises.

In the medium to long term, Trump’s election could benefit BTC, but his policy direction may also increase inflation in the U.S., with interest rates potentially staying above 3.5% over the medium to long term. With the Republican sweep in Congress, there may be favorable developments in the regulatory framework for the crypto market, which would be a long-term positive for the industry.

Ryan Lee, Chief Analyst at Bitget Research

In summary, the election of these candidates at the head of the United States represents a major victory for the pro-crypto movement. Their growing influence could shape the future of cryptocurrencies in the USA, paving the way for broader adoption and more favorable regulation.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The world is evolving and adaptation is the best weapon to survive in this undulating universe. Originally a crypto community manager, I am interested in anything that is directly or indirectly related to blockchain and its derivatives. To share my experience and promote a field that I am passionate about, nothing is better than writing informative and relaxed articles.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.