US Senators' offensive against crypto ETFs: Pressure on SEC to halt everything!

Democratic Senators Jack Reed and Laphonza Butler are pressing Gary Gensler, chair of the SEC, to stop approving new crypto ETFs. They highlight the risks of fraud and manipulation inherent in these still immature markets.

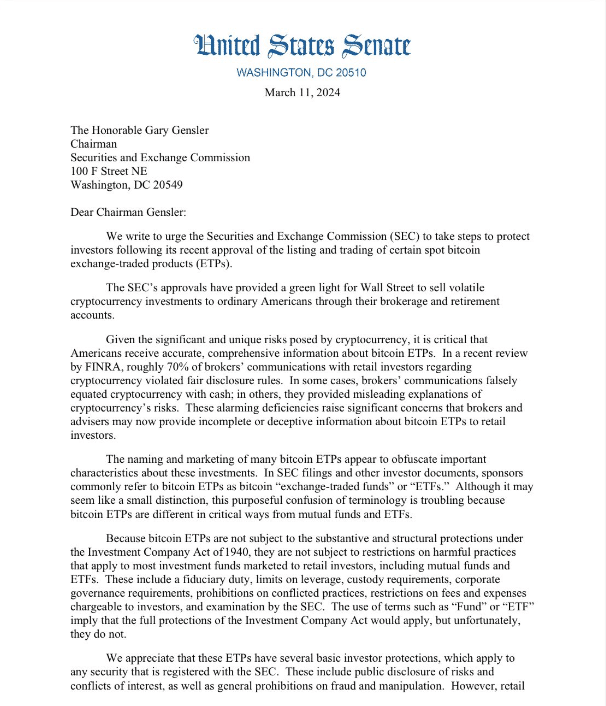

A letter that sounds the alarm on crypto ETFs

In a letter addressed to the Securities and Exchange Commission (SEC) on March 11, Democratic Senators Jack Reed and Laphonza Butler urge Gary Gensler not to give his approval to new crypto ETFs. They point out the “enormous risks” that small investors would be exposed to on these “lightly traded” markets, where fraud and manipulation are commonplace.

“Individual investors would face significant risks associated with ETPs backed by infrequently traded cryptocurrencies or those prices that are especially vulnerable to price manipulation or other fraudulent schemes“, it can be read in the letter.

Currently, no fewer than eight Ether-backed ETF proposals are awaiting approval by the American securities watchdog. Many hope that it is only a matter of time before other altcoins are given the same treatment. But for the senators, a stop must be put to this.

Senators Reed and Butler also call on the SEC not to make recent Bitcoin spot ETF approvals a precedent for other cryptos. While they acknowledge that the BTC market is more mature and better controlled, even though still “vulnerable to fraud and manipulation,” they argue that other cryptos are much more exposed to “reprehensible behavior.”

Beyond the demanded slowdown on future ETFs, the senators also want the SEC to tighten the screws on already launched Bitcoin ETFs. They specifically call for a “more thorough regulatory review” of brokers and advisors dealing with these products.

The Success of Bitcoin ETFs Disrupts

For Alexander Grieve, head of government relations at crypto venture capital firm Paradigm, this letter shows that the success of Bitcoin ETFs has “clearly ruffled a few feathers” on Capitol Hill. Many experts see it as a sign of mounting political pressure on the SEC chairman, seriously jeopardizing the chances of an Ether ETF being approved by May.

This is notably the view of Eric Balchunas, an analyst at Bloomberg. On March 11, he estimated at only 35% the probability of seeing an Ether ETF approved by May, compared to 70% in January. He points out in particular the SEC’s lack of communication towards potential issuers as a worrying signal.

This letter is not a first for Senators Reed and Butler, who have been multiplying anti-crypto initiatives in Congress. The former recently backed a bipartisan bill aimed at tightening KYC/AML rules and sanctions in decentralized finance. The latter co-sponsored in December the highly controversial Digital Asset Anti-Money Laundering Act introduced by Elizabeth Warren.

The crusade led by Senators Reed and Butler against crypto ETFs shows that despite recent advances, the integration of cryptocurrencies into the traditional financial system is far from unanimous. Their argument about the risks to investors is likely to weigh heavily when the SEC has to decide on the fate of Ether ETFs. This is a new test of truth for the crypto ecosystem.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Passionné par le Bitcoin, j'aime explorer les méandres de la blockchain et des cryptos et je partage mes découvertes avec la communauté. Mon rêve est de vivre dans un monde où la vie privée et la liberté financière sont garanties pour tous, et je crois fermement que Bitcoin est l'outil qui peut rendre cela possible.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.