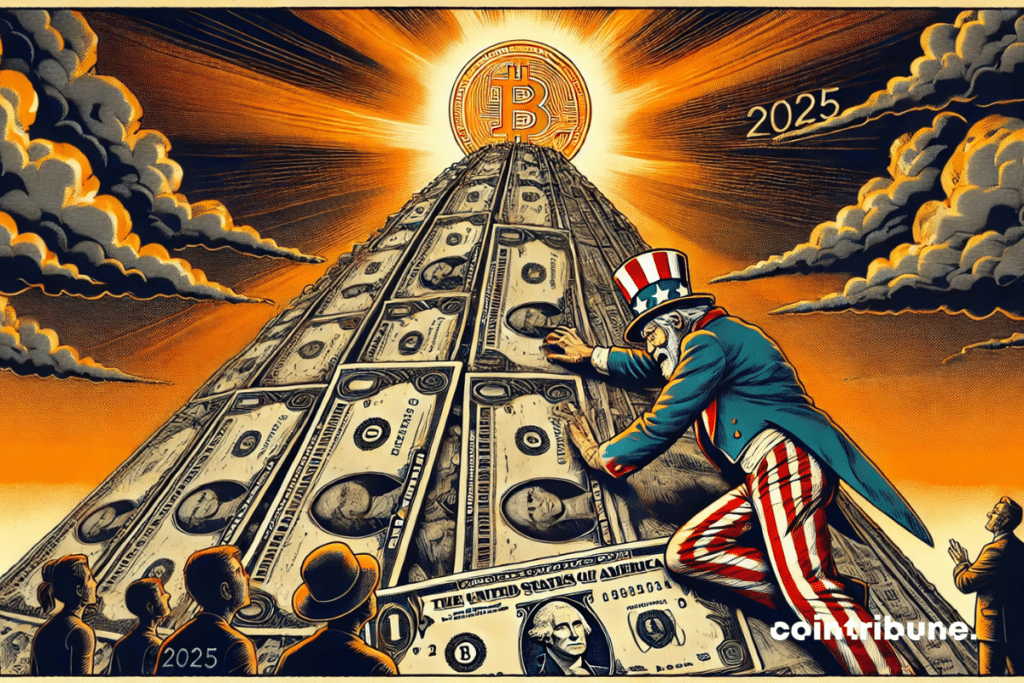

U.S. Treasury On Alert: Is The Crypto Rush Imminent?

The United States is preparing to issue more than $31 trillion in debt in 2025. This inevitably creates tensions in the markets. According to cryptography experts, this situation could benefit crypto-assets. The shock promises to be violent!

In brief

- The record issuance of Treasury bonds in 2025 could destabilize the markets

- Crypto assets could appeal amid prolonged inflation risks

A colossal debt weighing on the markets and benefiting crypto

The US Treasury plans to flood the financial market with a historic issuance of bonds exceeding $31 trillion. This represents 109% of the projected GDP for 2025 and 144% of the money supply (M2). Such an overload could push yields upward. But that’s not all! It would also harm risk assets, including cryptocurrencies.

Paradoxically, this pressure could nevertheless boost the appeal of certain crypto assets. This notably refers to BTC, often seen as a store of value independent of central banks.

If rates explode, the FED will indeed have to adjust its monetary policy. It will choose:

- either a sudden pivot;

- or a liquidity injection.

In either case, the crypto market could come out ahead.

Debt monetization: a scenario that could propel crypto

Faced with the scale of financing needs, some crypto analysts fear massive recourse to debt monetization. The concept is simple: turn on the printing press to avoid a budget crisis. This scenario would fuel fears of prolonged inflation. Which would further weaken the dollar.

In such a context, crypto-assets appear as a credible alternative for investors wishing to hedge against monetary depreciation. The bitcoin, in particular, could be seen as a protection against the loss of purchasing power of fiat currencies.

The scale of bond issuances will indeed force the FED to choose between stability and inflation. In this sense, crypto could once again benefit from the macroeconomic disorder.

2025 thus promises to be a decisive year for American debt… and for crypto. Between inflation, monetary uncertainty, and huge financing needs, crypto-assets could become a rational choice to diversify one’s portfolio.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

My name is Ariela, and I am 31 years old. I have been working in the field of web writing for 7 years now. I only discovered trading and cryptocurrency a few years ago, but it is a universe that greatly interests me. The topics covered on the platform allow me to learn more. A singer in my spare time, I also cultivate a great passion for music and reading (and animals!)

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.