Two Bitcoin ETFs emerge among the top 10 ETFs in January!

At the start of the year, ETFs are experiencing notable expansion, with particular attention being paid to Bitcoin ETFs, following their recent approval. According to data from Nate Geraci, two BTC ETFs stood out in January, ranking among the top 10 ETFs in terms of investment inflows. Let’s take a closer look at these financial products from BlackRock and Fidelity that are shaking up the rankings.

BlackRock and Fidelity Elevate Their Bitcoin ETFs to the Top

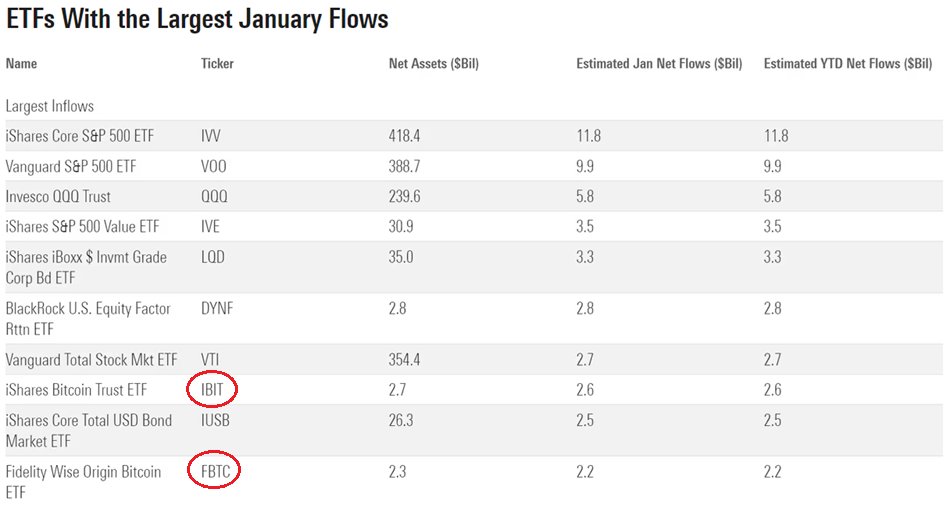

The numbers speak for themselves: among all ETFs, across all categories, that captured the most interest in January, BlackRock and Fidelity’s Bitcoin ETFs are prominently featured.

BlackRock’s iShares Bitcoin Trust ETF (IBIT) boasts an impressive net asset value of $2.6 billion. On the other hand, Fidelity’s Wise Origin Bitcoin ETF (FBTC) claims $2.2 billion in assets. They are thus positioned in eighth and tenth place in the rankings.

For comparison, market leaders, the iShares Core S&P 500 and the Vanguard S&P 500, generated $11.8 billion and $9.9 billion respectively.

However, despite the dominance of these traditional ETFs, BTC ETFs are carving out a prime spot for themselves, even rivaling the Vanguard Total Stock Mkt ETF and its $2.7 billion in incoming flows.

A Bright Horizon for BTC ETFs

The SEC’s approval of certain Bitcoin ETFs has marked a turning point, sparking growing enthusiasm for this asset class. This momentum comes despite a significant drop in the price of Bitcoin, falling from $49,000 to about $39,000 over the course of the month.

Additionally, the sector is also waiting on an SEC decision regarding a potential Ethereum ETF.

The exceptional performance of the two Bitcoin ETFs, in a universe of 3,109 active ETFs in the United States as of December 2023, signals a notable shift in investment trends.

The successful debut of Bitcoin ETFs heralds promising days for this asset class. It may indicate a gradual integration of cryptocurrencies into the traditional financial ecosystem, ushering in a new era for crypto investment.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Je suis passionnée par les cryptomonnaies, un monde que j'ai découvert il y a peine 3 ans. Mon seul but est de vous informer de cet univers incroyable à travers mes articles.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.