TUSD stablecoin shipwreck: Crypto holders in disarray!

The stablecoin TUSD, linked to Justin Sun, collapsed below its US dollar peg on January 15th, hitting a low of $0.984 amid a massive wave of selling on the crypto exchange Binance that exceeded $330 million.

Massive Selling and Crypto Holders Exodus

On January 15th at around 11 AM UTC, the TUSD stablecoin began to significantly drop below its peg to the US dollar, reaching a bottom of $0.984 at 11:15 AM. As of the time of writing this article, TUSD is trading around $0.988, which is 1.3% below its theoretical parity of $1.

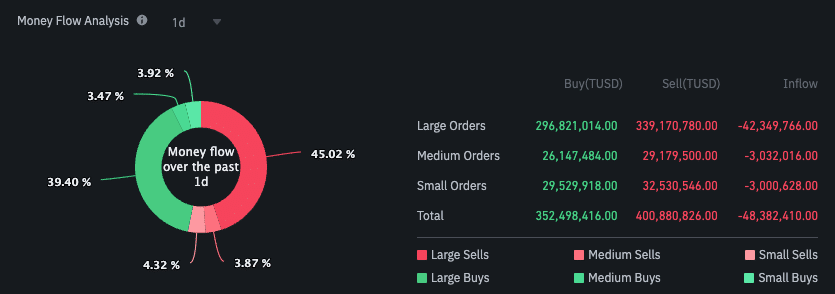

This crash follows significant selling volumes on the Binance exchange during the last 24 hours, exceeding $339.2 million against only $296.8 million in purchases. This represents a net capital outflow of $42.3 million, fueling downward pressure on TUSD.

Possible Causes

Several theories are circulating to explain the sudden collapse of the stablecoin. Firstly, early in January, reports indicated difficulties for TUSD in providing real-time certifications of its reserves, suggesting a possible lack of dollar collateralization.

Moreover, some have mentioned that TUSD was not included among the cryptocurrencies awarded during a recent Binance campaign. This could have triggered a massive selling movement by TUSD holders.

Finally, a possible under-collateralization, which caused panic among holders, leading to this massive exodus. Especially since problems had already been reported for weeks on certain exchanges, including the inability of users to withdraw TUSD from the Poloniex platform.

While the exact causes remain to be determined, this massive collapse raises serious questions about the long-term viability of TUSD and investor confidence in this controversial stablecoin project linked to Justin Sun. If the downward trend continues, other stablecoins like USDT could benefit from a transfer of capital leaving the TUSD ship.

What Are the Consequences for the Future of the Stablecoin?

With this growing distrust from investors and the ongoing collapse of its value, the future of TUSD now seems compromised.

To regain trust, TrueUSD must urgently restore transparency about its reserves and ensure they are fully backed by the dollar. Otherwise, doubt will persist and holders will probably continue to liquidate their positions, further driving down the price.

A swift intervention by the TUSD teams is essential to stop the bleeding and prevent a ruthless dissection of the stablecoin by panic-stricken investors. However, the damage seems to have already been done and the reputation is permanently tarnished. The vertiginous fall of the past 24 hours could just be the beginning.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Passionné par le Bitcoin, j'aime explorer les méandres de la blockchain et des cryptos et je partage mes découvertes avec la communauté. Mon rêve est de vivre dans un monde où la vie privée et la liberté financière sont garanties pour tous, et je crois fermement que Bitcoin est l'outil qui peut rendre cela possible.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.