Trump's Crypto In Free Fall Before A Massive Unlocking

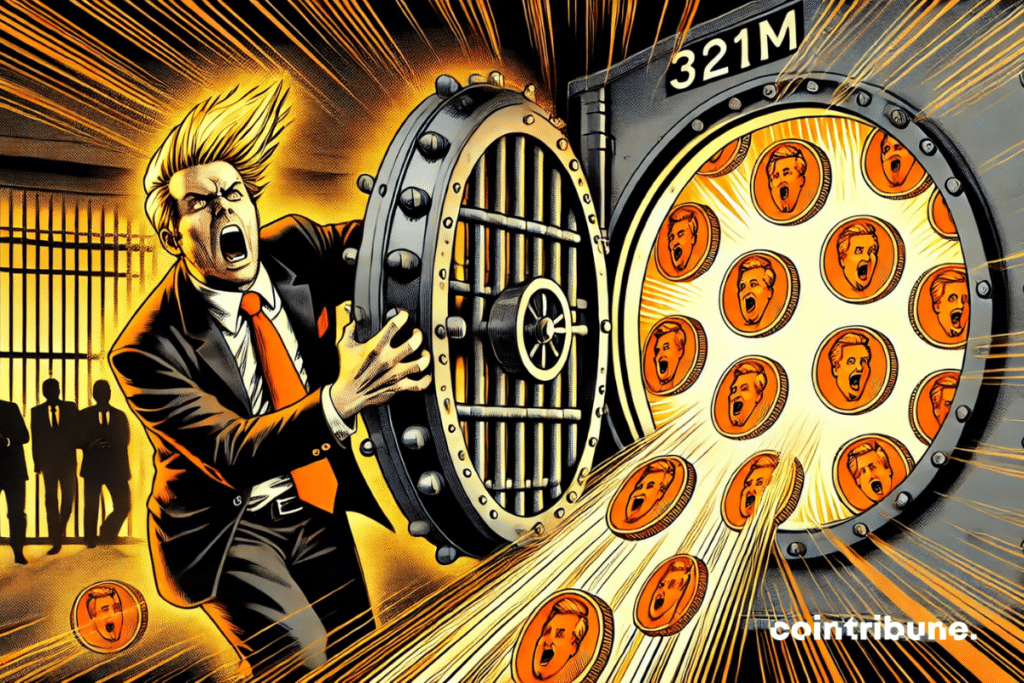

The twists and turns often defy logic in the crypto arena. The upcoming release of 321 million dollars in Trump tokens, scheduled for April 18, is proof of this. While the official memecoin of the American president has lost 89% of its value since January, this massive unlocking raises a crucial question: how can a free-falling asset still threaten the market?

The great unlocking: an underestimated avalanche

The acquisition mechanism, designed to stabilize crypto projects, sometimes turns into a trap. In the case of the Trump token, 40 million dormant units are about to flood the exchanges.

At $8 per unit, this wave of 321 million represents a tsunami for an already weakened asset. Tokenomist, an acquisition tracking platform, confirms that this event will dominate the week from April 14 to 20, absorbing 61% of the total planned unlocks.

Yet, this practice is nothing exceptional. Acquisition periods aim to discipline investors and teams, avoiding hasty sales.

But here, the timing works against the crypto project. While the Trump token struggles to maintain a semblance of credibility, the sudden influx of liquidity could further undermine its value.

Recent history offers worrying precedents. In March 2024, the Arbitrum crypto released $2.32 billion in ARB. The result? An 84% drop in a few weeks. A scenario that Trump holders dread, especially since market psychology tends to amplify these shocks.

From euphoria to disillusionment: the shipwreck of a political crypto

Everything had started well. On January 19, Trump’s crypto reached $73.43, riding the wave of political news and memecoin fever. But the novelty effect faded as quickly as it appeared. Now priced at $8, the asset embodies the excesses of a market where storytelling often prevails over fundamentals.

Behind the figures lie individual dramas. Chainalysis estimates that 813,000 wallets have suffered losses totaling 2 billion dollars.

Individual investors, lured by the aura of a political figure, find themselves trapped in extreme volatility. Meanwhile, the project creators are said to have made more than 350 million in profits – a gap that fuels criticism of memecoin ethics.

The irony lies in the very nature of the token. Aligned with the image of a man known for his deal-making skills, it now symbolizes the risks of an unregulated market. While Trump himself has oscillated between criticism and support for cryptos, his memecoin embodies a contradiction: a decentralized asset, yet reliant on a centralizing personality. Discover, furthermore, the true intentions of the SEC.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Fascinated by Bitcoin since 2017, Evariste has continuously researched the subject. While his initial interest was in trading, he now actively seeks to understand all advances centered on cryptocurrencies. As an editor, he strives to consistently deliver high-quality work that reflects the state of the sector as a whole.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.