Countries whose largest trading partner is China or the USA (2000 vs. 2020) pic.twitter.com/OUelV5XZVN

— Daily Loud (@DailyLoud) November 10, 2022

A

A

Dollar - Trump Threatens The BRICS

Mon 09 Sep 2024 ▪

6

min read ▪ by

Getting informed

▪

Investissement

The Republican candidate for U.S. President threatens the BRICS with heavy economic sanctions if they turn away from the dollar. Bitcoin as an alternative solution…

Money or life

Donald Trump wields the carrot and the stick. The carrot came on Friday with the promise to lift sanctions:

“I myself used sanctions, but I lifted them as quickly as possible to avoid killing the dollar. […] We have lost Iran, Russia, and China is trying to make its currency the dominant one. The dollar is losing its dominance.”

Indeed, the transaction volume of China’s cross-border payment system, CIPS was 123 trillion yuan in 2023 ($17 trillion). This figure is on track to double this year to about $34 trillion. Compare that to the $150 trillion exchanged via the Swift network.

Even the IMF recently noted that the use of the yuan in cross-border payments rose from 0% in 2014 to 20% in 2021 (from a sample of 125 countries). A quarter of these countries predominantly use the yuan to trade with China.

The stick didn’t take long. Donald Trump declared the next day that “the dollar is besieged”.

“We must ensure that the dollar remains the global reserve currency. Here is what I will say to recalcitrant countries: if you abandon the dollar, you will no longer trade with the United States. We will impose 100% tariffs on your goods,” he stated at a rally in the state of Wisconsin.

This is a threat directed at China and the BRICS in general. That is, the countries that have made dedollarization a priority since the freezing of Russia’s foreign exchange reserves (~€300 billion).

The dollar no longer has a place in a multipolar world

As Russian Foreign Minister Sergei Lavrov declared when taking the rotating presidency of the UN Security Council in July:

“The restoration of regional and international power balance must be accompanied by the elimination of the injustices at the heart of the global economy. There cannot be a monetary monopoly in a multipolar world.”

The dollar’s monopoly as the global pivot currency is what is known as the “exorbitant privilege.” It is also referred to as the “petrodollar system” because all Gulf petro-states sell their oil exclusively in dollars.

Iraq, Libya, Syria, and Iran have all refused the dollar with the known consequences… Washington does not hesitate to destroy entire countries to protect its monetary hegemony. Indeed, the more the dollar circulates internationally, the more the United States can afford to print it to import more and more.

Today, the world holds more than $7 trillion in reserves. That’s as much money that is not exchanged for other currencies and artificially supports the dollar’s value despite a massive trade deficit.

But all good things come to an end. The nations currently turning away from the dollar are major military powers that are no longer intimidated by American threats. The inability to weaken Vladimir Putin via the war in Ukraine is proof of this.

Hence Donald Trump’s threat of economic war. But again, do the United States really have the upper hand?

The BRICS Behemoth

The BRICS represent nearly half of the world’s population (46%), compared to just under 10% for the G7 (United States, Canada, Japan, United Kingdom, Germany, France, and Italy).

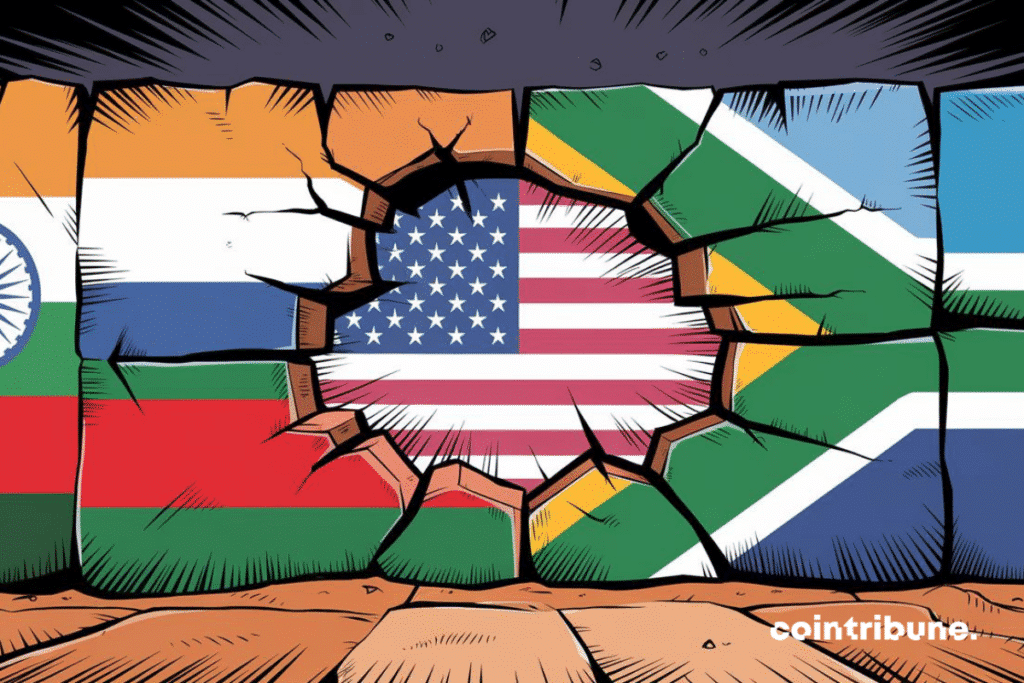

The BRICS’s global GDP share is now 35% (ppp), compared to 30% for the G7. According to McKinsey, Asia accounts for 50% of global merchandise trade. China is the largest trading partner for more than 120 countries:

In short, it is not certain that the United States is still in a position of strength. With their back to the wall, at least 120 countries will likely prefer to maintain their trade relations with China rather than the United States.

Furthermore, let’s not forget that raising tariffs means more inflation for Americans. The Peterson Institute for Economics calculated that imposing a global tariff of 20% combined with a 60% tariff on China would cost an average American household more than $2,600 per year.

That is why Donald Trump does not want the Fed to raise interest rates. He knows that his foreign policy could be extremely inflationary. This bodes well for bitcoin, whose fixed, stateless, and non-censorable money supply makes it a potential international reserve currency.

That is why Mr. Trump is considering creating a strategic bitcoin reserve before anyone else. Giant asset management firm Alliance Bernstein estimates that a Donald Trump victory in November will drive bitcoin to $90,000 before the end of the year.

Let’s conclude by recalling that Republican Senator Cynthia Lummis has drafted a bill ordering the US Treasury to purchase one million bitcoins.

Do not miss our article: “BRICS – 120 countries ready to dedollarize.”

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

A

A

Bitcoin, geopolitical, economic and energy journalist.

DISCLAIMER

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.