Trump Shakes The Markets: Crypto Industry Loses $130 Billion In Days

On April 2, the “Liberation Day” announced by Donald Trump does not rhyme with economic liberation. On the contrary. Between the bleak global markets and a bloodless crypto market, it’s a global shockwave that shakes investors. Promised recovery during the campaign, crypto is now facing the storm of American tariff rates. Far from a bull market, it’s the bear that growls.

More than 130 billion lost: the haemorrhage hits the crypto market hard

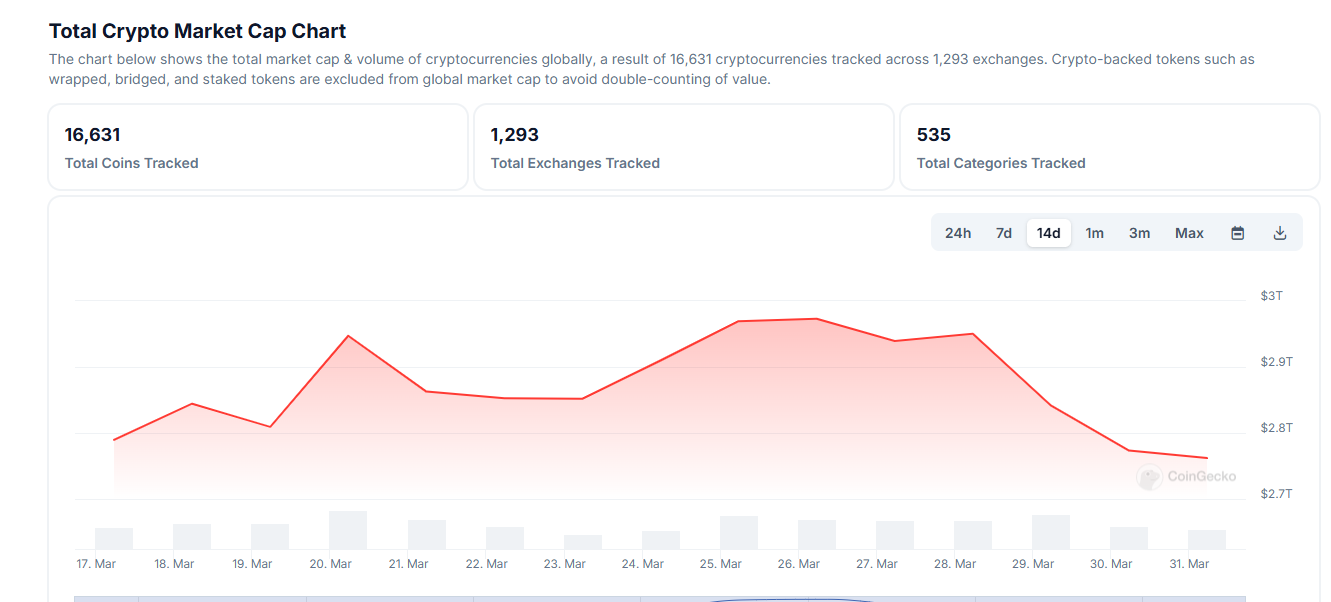

In recent days, crypto has been bleeding white. In just one week, the market saw its capitalization shrink by 131 billion dollars. A brutal drop that brings the total capitalization down to 2,360 billion dollars, its lowest level since early March.

Bitcoin (BTC) is not spared: it has even seen its worst quarterly close since 2018. It slips below 82,000 dollars, marking a 6% drop in 7 days. The same trend for Ethereum (ETH), which is down 14%.

Altcoins, more vulnerable, are being crushed. Solana (SOL) falls 11.6%, while Ripple (XRP) drops 16.8%. The entire market is in the red, further crushing hopes for a restart.

This plummet into hell also recalls another dark period. On March 1, the analyst @DeFiTracer wrote:

The crypto market lost 650 billion dollars in just a few days… SOL under 10 dollars, BTC -30%.

A premature warning that some ignored.

This new wave of bear market establishes an unprecedented climate of tension. The slightest presidential tweet or suspicion of tariff provokes a panic wave.

Will the crypto market be able to stop the haemorrhage in time?

A clear cause: Trump’s tariffs and generalized uncertainty

At the origin of this earthquake: the announcement of a massive increase in tariff rates by the United States. According to The Kobeissi Letter, Trump’s team is considering “a general tariff increase of up to 20%”. And warns:

April 2nd is NOT the end of tariff uncertainty.

On the contrary.

The threat is concrete. It affects more than 400 billion dollars in imports from targeted countries. A trade war is brewing, and investors are retreating. Risky assets, like cryptocurrencies, become the first victims of this instability.

Flows into crypto ETFs have seen a brutal pause. Fidelity, for instance, registered a net outflow of 93 million dollars. Whales are reducing their exposure. The result: tension on prices and diminished confidence.

Moreover, the reaction is not limited to crypto. Tech stocks are plummeting, gold is rising, and the dollar is weakening. The domino effect leaves no market untouched.

How can confidence be restored if tariff policy becomes a lever for global economic instability?

Saylor believes in the future of Bitcoin, despite the tariff turmoil

In this ambient malaise, one voice persists in believing in the future of crypto. That of Michael Saylor, executive chairman of Strategy. He does not see a crisis, but an opportunity. His conviction? Bitcoin will one day reach a capitalization of 500 trillion dollars.

According to him, BTC will capture 5 to 7% of global capital. It will replace gold, real estate, and other safe havens. He even predicts a Bitcoin price reaching 13 million dollars by 2045. A bold scenario, but not without foundation: BTC’s annual return over the past 13 years exceeds 44%.

He also reminds us that periods of crisis reinforce Bitcoin’s scarcity. “Less than 21 million units will ever be issued“, he repeats. For him, tariffs, sanctions, and chaotic economic policies only confirm the interest in crypto as a sovereign asset.

- BTC drops to $66,000 (-6%).

- ETH loses 7.3%, XRP 6.3%.

- SOL collapses by 13.7%.

- 131 billion dollars lost in a week.

- 93 million dollars withdrawn from crypto ETFs (Fidelity).

Can the crypto market still aspire to this grand destiny or will it sink into prolonged uncertainty?

Beyond the drop in assets, it is the trading volume that is collapsing. Since the post-electoral peaks, it has decreased by 70 %. This decline raises questions. What remains of a crypto market without liquidity, without dynamics, without conviction? Disinterest, even more than devaluation, is the real threat for the months to come.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

La révolution blockchain et crypto est en marche ! Et le jour où les impacts se feront ressentir sur l’économie la plus vulnérable de ce Monde, contre toute espérance, je dirai que j’y étais pour quelque chose

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.