Trump Dismisses BRICS' Dedollarization Push

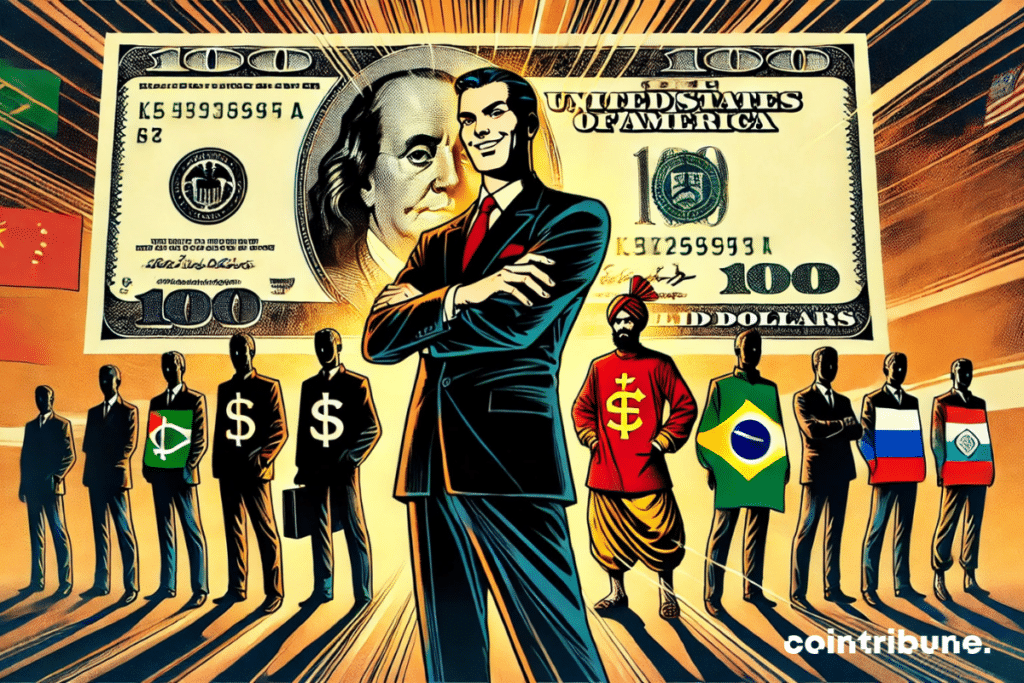

The status of the US dollar in the global economy once again causes tensions. While the BRICS seek to free themselves from its hegemony, Donald Trump swept aside any possibility of dedollarization with a wave of his hand. “There is no chance that the BRICS will replace the US dollar in international trade or elsewhere,” he asserted. This statement comes at a time when China, Russia, and their allies are intensifying their efforts to limit their dependence on the greenback, particularly through local currency exchanges and the establishment of alternative financial infrastructures. Behind this statement from the American president, a question arises: is the dollar truly untouchable, or are we witnessing the beginnings of a new monetary order?

The Unshakeable Dominance of the Dollar According to Donald Trump

The statements of Donald Trump fit into a climate of increasing economic tensions between the United States and emerging countries, where the battle for monetary hegemony is intensifying. Indeed, the American president, known for his strong positions on financial policy, firmly reaffirmed the supremacy of the dollar in the face of BRICS initiatives. “There is no chance that the BRICS will replace the dollar as the global medium of exchange,” he insisted, and he categorically rejects the idea of a weakening of the greenback on the international stage.

For Trump, several structural factors render any alternative unrealistic. The dollar remains the dominant reserve currency, accounting for nearly 58 % of international transactions, according to the IMF. It also serves as an essential reference for the pricing of strategic commodities, including oil and gold. The economic and military power of the United States plays a key role in this hegemony, reinforcing investor confidence and consolidating the stability of the global financial system. According to him, no currency from the BRICS has sufficient liquidity, a developed banking network, or an equivalent level of trust to claim to rival the greenback. The ambitions of the BRICS, although asserted, would therefore only represent an unfinished project in the face of the solidity of the American monetary pillar.

The BRICS and the Dedollarization Strategy : An Unequal Fight?

Despite the significant dominance of the dollar, the BRICS are actively pursuing their efforts to build a financial system that is less dependent on the United States. For several years, these nations have been multiplying initiatives to reduce their exposure to the greenback. Among the strategies implemented, the increasing use of local currencies in trade exchanges is a priority. At the same time, the creation of payment platforms alternative to the SWIFT network, heavily controlled by Washington, is accelerating.

China and Russia, in particular, are at the forefront of this approach. Beijing is encouraging the adoption of the yuan in international transactions, while Moscow favors payments in rubles to limit the effects of American sanctions. This approach aims to strengthen the monetary sovereignty of the countries in the bloc and to reduce their vulnerability to financial restrictions imposed by the West. However, despite these advances, the dedollarization process faces several major obstacles.

The absence of a single reference currency complicates the adoption of a credible alternative to the dollar. Each BRICS currency has its own level of volatility, making large-scale acceptance difficult. Furthermore, the lack of common financial infrastructures hinders the establishment of an ecosystem capable of competing with dominant institutions such as the IMF or the World Bank. Investor distrust is another significant hurdle: markets remain cautious about emerging economies, often perceived as less stable and less transparent.

If the BRICS wish to impose a new monetary order, they will need to overcome these limits by consolidating robust financial institutions and ensuring sustainable economic stability through the reinforcement of international trust. At this stage, the ambition to dethrone the dollar rests more on political intentions than on tangible economic reality.

Donald Trump’s statements revive a fundamental strategic debate: can the BRICS really challenge the supremacy of the dollar? While their economic and diplomatic influence is strengthening, the greenback remains supported by a network of strong alliances and powerful financial institutions, which guarantee its central role in international exchanges. However, the rising geopolitical uncertainties, the gradual weakening of trust in American institutions, and the rise of new monetary technologies, including central bank digital currencies, could ultimately reshuffle the cards. Between ambitions of dedollarization and the resistance of the current financial system, the monetary battle between Washington and the BRICS is just beginning.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Diplômé de Sciences Po Toulouse et titulaire d'une certification consultant blockchain délivrée par Alyra, j'ai rejoint l'aventure Cointribune en 2019. Convaincu du potentiel de la blockchain pour transformer de nombreux secteurs de l'économie, j'ai pris l'engagement de sensibiliser et d'informer le grand public sur cet écosystème en constante évolution. Mon objectif est de permettre à chacun de mieux comprendre la blockchain et de saisir les opportunités qu'elle offre. Je m'efforce chaque jour de fournir une analyse objective de l'actualité, de décrypter les tendances du marché, de relayer les dernières innovations technologiques et de mettre en perspective les enjeux économiques et sociétaux de cette révolution en marche.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.