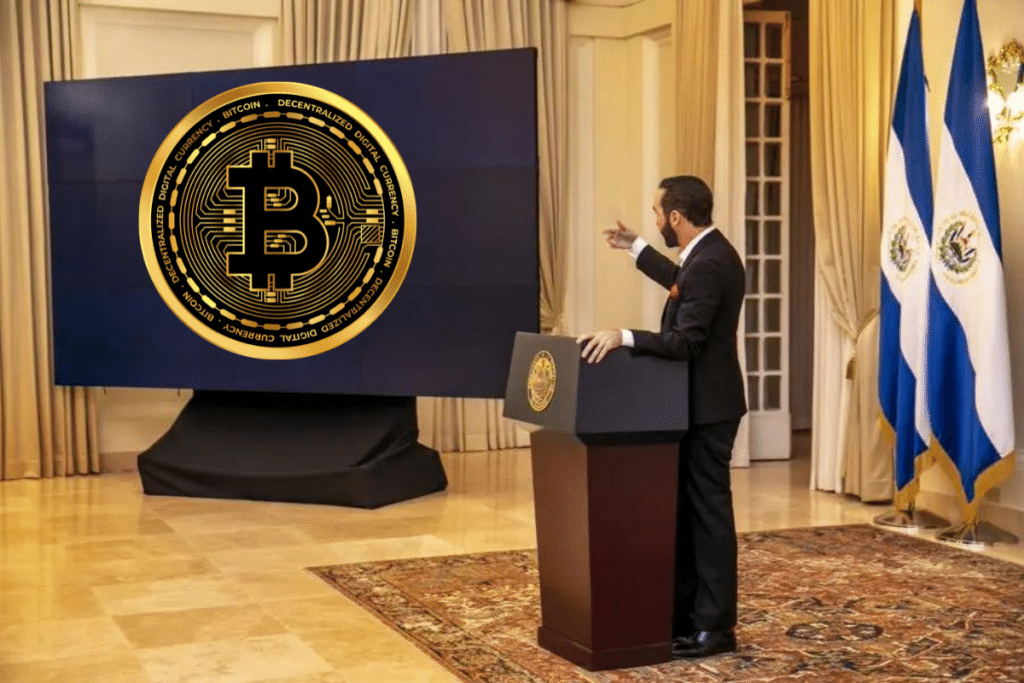

NEW – 🇸🇻 El Salvador President on embracing #Bitcoin: "I really, really want to say “I told you so” pic.twitter.com/GSz1uZRtVz

— Bitcoin Magazine (@BitcoinMagazine) August 15, 2023

A

A

Bitcoin triumphs in El Salvador: A bond rally conquers Wall Street

Thu 17 Aug 2023 ▪

4

min read ▪ by

Getting informed

▪

Event

El Salvador President Nayib Bukele’s introduction of Bitcoin two years ago raised concerns on Wall Street. Today, this bold move is boosting the attractiveness of El Salvador’s bond markets, propelling them to the top of emerging market dollar bonds this year.

El Salvador’s bond markets captivate investors

El Salvadorian President Nayib Bukele caused alarm on Wall Street when he adopted Bitcoin as his official currency. However, it is now clear that his bold decision has generated unexpected and fruitful spin-offs.

Despite initial reservations, the bond rally orchestrated under Bukele’s aegis was not only profitable, but irresistible in the eyes of prestigious financial players.

El Salvador’s dollar-denominated bonds created a surprise by generating an impressive 70% yield, far outstripping the performance of many other emerging market bonds.

This remarkable performance attracted the attention of financial heavyweights such as JPMorgan, Eaton Vance and PGIM Fixed Income. They adjusted their initial outlook to invest in the country’s debt.

El Salvador bonds take off

Salvadoran government bonds are attracting growing interest among investors, and the required premium over US Treasuries has fallen by more than 50% in the space of a year.

In addition, the country’s bonds, some of which will mature in 2035, are performing exceptionally well, well ahead of the 6.6% average yield observed on a benchmark index of developing nations.

In addition to JPMorgan, Eaton Vance and PGIM, data compiled by Bloomberg reveal that major players such as Lord Abbett & Co LLC, Neuberger Berman Group LLC and UBS Group AG have also included these bonds in their portfolios since April.

Mila Skulkina, fund manager at Lord Abbett, commented: “El Salvador has benefited from proactive and prudent management of its balance sheet, including a debt buyback during the second half of 2022 and material pension reform.”

Key players such as Lord Abbett & Co LLC, Neuberger Berman Group LLC and UBS Group AG also joined JPMorgan and PGIM in acquiring the bonds, testifying to growing confidence in the country’s financial stability.

“Although we missed a significant part of the rally, we still believe there is value on the El Salvador curve. Opportunities remain for this credit to continue to outperform.”

El Salvador’s story with Bitcoin will undoubtedly be an exciting case study in the years to come. As Bitcoin’s credit gains strength every day, its adoption is settling firmly into the landscape. Institutions continue to take an interest, and the rise of Bitcoin ETFs will only amplify this trend. Are we at the dawn of Hyperbitcoinization?

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

A

A

Passionné par le Bitcoin, j'aime explorer les méandres de la blockchain et des cryptos et je partage mes découvertes avec la communauté. Mon rêve est de vivre dans un monde où la vie privée et la liberté financière sont garanties pour tous, et je crois fermement que Bitcoin est l'outil qui peut rendre cela possible.

DISCLAIMER

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.