Did you know there are over $1 billion dollars of tokenized gold?

— Chainlink (@chainlink) July 22, 2023

Here’s how #Chainlink is powering the adoption of tokenized assets 🪙👇https://t.co/iYcnRxsFyz

A

A

Chainlink's (LINK) gold tokenization strategy

Tue 25 Jul 2023 ▪

5

min read ▪ by

Getting informed

▪

The tokenization of the economy is the future. Stocks, bonds, real estate, wine, works of art… everything can integrate this new classification of digital units programmable from a smart contract. To take full advantage of these opportunities, leading players such as Chainlink are deploying major resources to permanently protect investors’ assets. Gold tokenization is one of its spearheads.

Tokenized gold, $1 billion market capitalization

Tokenization aims to democratize access to digital property. And, as a corollary, to increase liquidity on the various markets through the participation of new investors.

Thanks to this new alternative for trading traditional assets, the average investor can acquire a fraction of a property with the little money he or she has.

Ripple Labs is currently one of the leading companies in the field of real estate tokenization.

According to CoinDesk, tokenized gold assets were valued at over $1 billion last April. At that time, the crypto media highlighted two gold stablecoin heavyweights: Tether, issuer of Tether Gold (XAUT) and Paxos Trust Company, originator of Pax Gold (PAXG).

It’s also worth noting that at the end of March, gold was trading at $2,021 an ounce, while bitcoin, the “digital gold”, made a spectacular leap. It was valued at $29,000, up from $20,000.

What is tokenized gold?

Large quantities of gold are currently languishing in the carefully guarded vaults of central banks. It will take the intelligence of Arsène Lupin to get his hands on it.

But to avoid getting too absurd, let’s take a look at what Chainlink has in store for us. In a blog post published on July 22, the data provider highlighted its tokenized gold, easily accessible by any investor.

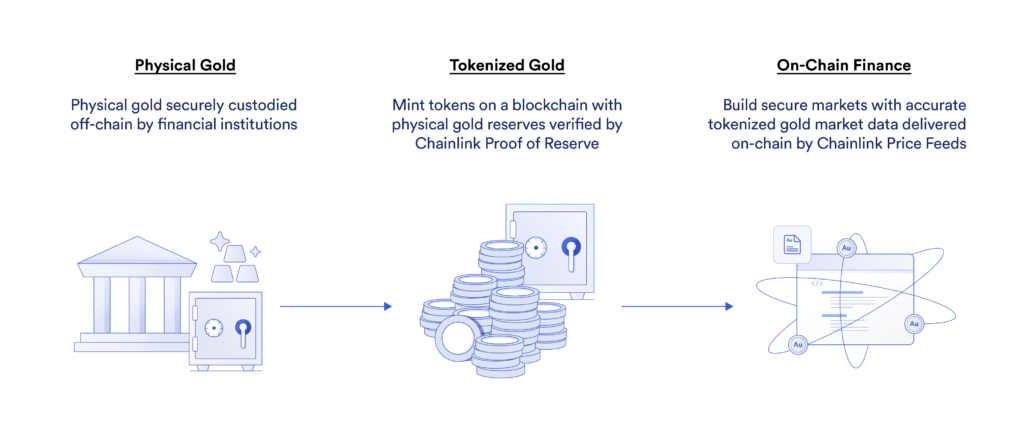

Chainlink defines tokenized gold as a “next-generation solution for gold ownership”. This solution emanates from a process of minting digital tokens on a blockchain. These assets, once minted, authorize ownership rights to physical gold, or even gold bullion, held by a third party in some vault.

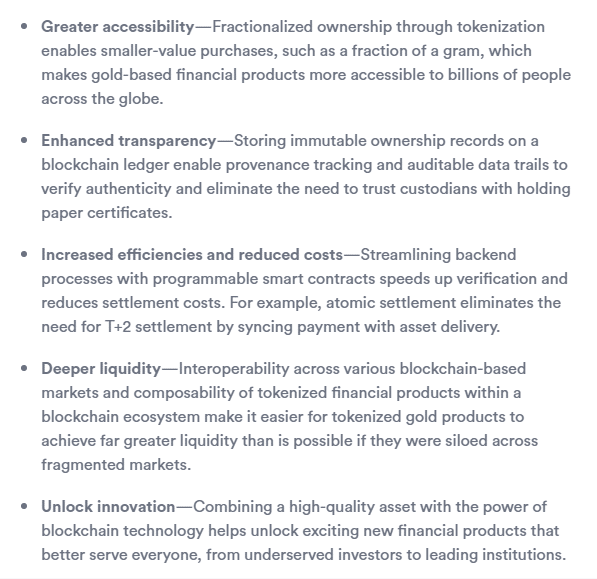

In short, the benefits of tokenized gold are manifold: “greater accessibility”, “increased transparency”, “greater efficiency and lower costs”, “deeper liquidity” and “unlocking innovation”.

How is Chainlink helping to democratize these assets?

Chainlink’s role is to implement Web3 services to “build secure, efficient, reliable, liquid and transparent Web3 platforms”.

“As the industry-leading oracle network, Chainlink securely delivers data and computation on-chain, enables seamless and secure cross-chain communications and token transfers, and provides a secure gateway on-chain—critical for individual DeFi developers and major enterprises alike.” says the Chainlink team.

Proof-of-Reserve

The word Proof-of-Reserve came into vogue towards the end of 2022, more precisely, just after the FTX collapse. OKX, Binance, Tether and many other crypto companies had to issue PoR reports to reassure its users plagued by worries of widespread industry bankruptcy. And yet, the Proof of Reserve is worrying some analysts.

Aware of its stakes, Brian Hankey, co-founder of CACHE Gold, praised Chainlink’s. “Chainlink Proof of Reserve has enabled us to bring greater transparency to our platform,” he said.

Price flow

Reliable, accurate and decentralized, Chainlink’s price feeds are ideal for creating secure markets on a blockchain to which tokenized assets such as gold are backed. A number of projects are currently successfully incorporating PAXG into lending or borrowing platforms, or DEX, thanks to this device.

The Functions platform

This Web3 serverless development platform enables data to be retrieved from an API. It also enables customized calculations to be performed securely on the Chainlink network.

Cross Chain Interoperability Protocol

Announced with great fanfare last week, Chainlink’s CCIP facilitates the creation of secure services and applications. These will serve as a solid foundation for the transfer of tokens, the sending of messages and so on. Golteum, a fractional NTF platform backed by physical gold, intends to use it for its interchain communications.

Finally, we’d like to take up our colleague’s point that tokenization is revolutionizing alternative investments. Even BlackRock CEO Larry Fink agrees.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

A

A

La révolution blockchain et crypto est en marche ! Et le jour où les impacts se feront ressentir sur l’économie la plus vulnérable de ce Monde, contre toute espérance, je dirai que j’y étais pour quelque chose

DISCLAIMER

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.