These Choices That Caused Ethereum To Fall

Ethereum is dead. For many venture capitalists, Ethereum has ceased to be a relevant investment asset. Layer-2 solutions, poorly managed inflation, loss of revenue… Ethereum seems caught in a spiral that calls into question its long-term financial viability. Decoding a major strategic shift.

Ethereum is dead as an investment…?

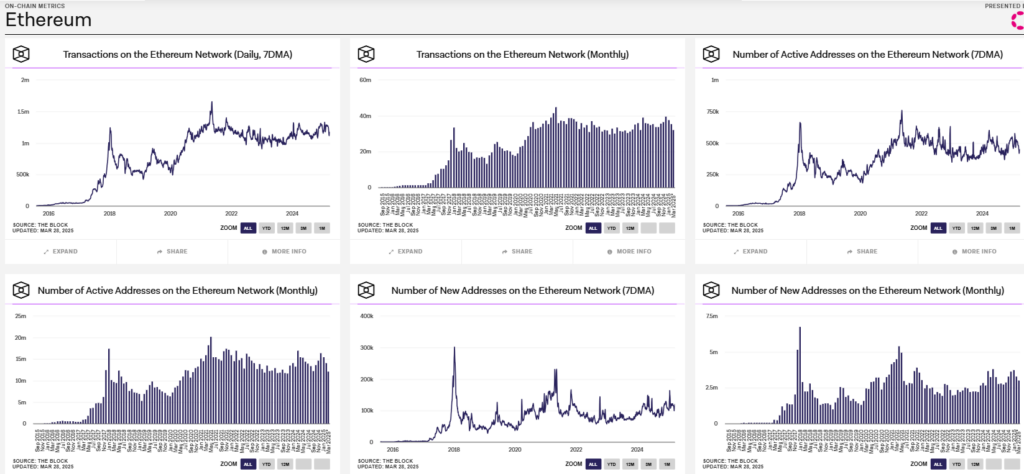

The criticism comes from within. Quinn Thompson, founder of Lekker Capital, does not mince words: “Ethereum is dead as an investment.” According to him, the lack of growth in crypto users, the decline in chain activity, the drop in revenues, and poorly calibrated tokenomics have caused ETH to fall from its status as a safe haven asset. And he’s not the only one who thinks so.

Since the explosion of Layer-2 solutions like Arbitrum or Optimism, a good part of Ethereum’s economic value has shifted. These secondary networks lighten the main layer, of course, but also absorb an increasing share of the generated value. Nic Carter from Castle Island Ventures summarizes the situation: “L2 siphons value from Layer-1[…] it has committed suicide.” As a result, basic Ethereum captures little of the transactional boom it initially triggered.

Additionally, there is another problem: token inflation. EIP-1559, which was supposed to make Ethereum deflationary, is no longer keeping its promises. The recent Dencun update has even restarted net issuance. Is the narrative of “ultrasound money” over? Perhaps so. In any case, this complicates the thesis of an ETH designed to preserve long-term value.

The Ethereum Foundation reacts!

In the face of this disaffection, the Ethereum Foundation is responding. Vitalik Buterin proposes a roadmap focused on securing and finalizing L2. The goal: to enhance the network’s interoperability, attract crypto developers again, and regain weight in the overall infrastructure.

But the question remains: is it enough to rekindle the interest of crypto investors? As long as the main network does not better capture value and the economic model remains unclear, ETH risks staying in the shadow of its own ecosystem.

Ethereum remains a driving force of Web3 innovation, and the $850 billion in stablecoin volume proves it. However, its positioning as an investment asset wavers. Between value dilution and poorly managed inflation, ETH needs to revisit its fundamentals if it wants to regain the trust of the crypto market. Without rapid evolution, it risks becoming a mere infrastructure tool.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The world is evolving and adaptation is the best weapon to survive in this undulating universe. Originally a crypto community manager, I am interested in anything that is directly or indirectly related to blockchain and its derivatives. To share my experience and promote a field that I am passionate about, nothing is better than writing informative and relaxed articles.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.