The United States Facing The Economic Turning Point Announced By Trump

Yesterday marked the beginning of an era that Donald Trump calls the “American golden renewal.” His protectionist speeches and promises of greatness raise as much concern as they impress. Economic giants, small partners, and even Elon Musk wonder if this shift hides traps. In this spirit, the first economic measures of the 47th president of the United States announce a reconfiguration that could shake far beyond America’s borders.

Trump, the dollar, and the end of the Green Deal: an explosive cocktail

Trump’s credo, invested yesterday in Washington, is simple: put “America first”, and tough luck for the rest. Under the guise of economic revival, he proclaims the end of the Green New Deal, once the climate showcase of the United States. In the same breath, he wants to “forge a manufacturing nation.” His weapons? Hydrocarbons and inflation under control, according to him.

“We are going to drill like crazy,” he claims, defying global climate consensus.

The president will also shake up the electric vehicle industry by eliminating tax credits.

Elon Musk, even though a member of his administration, remains silent. The promise of an “industrial America” seems to have a hidden cost: that of a weakened dollar against an euro that, despite its own crises, appears more virtuous environmentally.

Key points of this chapter:

- End of credits for electric vehicles;

- Suspension of the Green New Deal;

- Priority to hydrocarbons to reduce inflation;

- Risks of economic isolationism.

Limits of protectionist ambitions: the test of reality

Trump wields the tariffs as a deadly weapon. Heavily taxing imports, including those from Europe and Canada, becomes the cornerstone of his strategy. However, economists warn: these tariffs could hinder investments and worsen trade tensions.

The case of TikTok illustrates the ambiguity: suspended, then temporarily tolerated, the platform symbolizes the tense relations with China. However, its ban is far from reassuring, as experts denounce incoherent and difficult-to-implement policies.

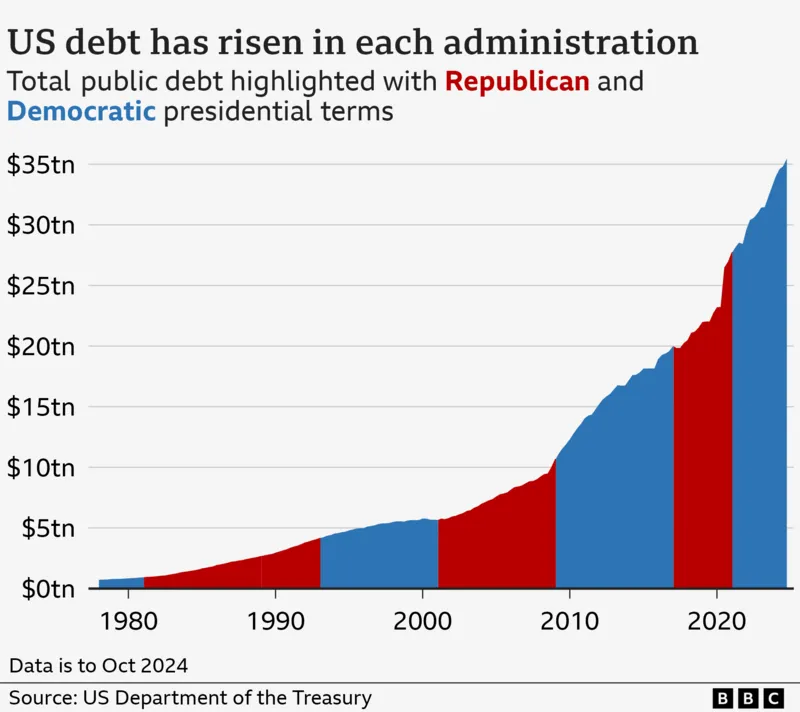

The United States also risks facing a global loss of trust. If tariffs seek to restore the manufacturing image, they isolate a country whose public debt keeps growing.

Indeed, the euro, less dependent on hydrocarbons, could gain attractiveness against a dollar weakened by these radical measures.

Donald Trump and the geopolitical revenge: a canal, battles

With Trump, symbols are never trivial. By calling for the reoccupation of the Panama Canal, he attacks Carter’s legacy and denounces a “gift” made to Panama, now exploited by China.

“We did not give that canal to China!,” he insists, riding a nationalist rhetoric.

Europe, although called out in the president’s speeches, prefers to advocate diplomacy. Ursula von der Leyen calls for stronger collaboration in the face of global challenges. But behind the scenes, European leaders worry: can one still trust a partner oscillating between isolationism and hegemony?

The announcement of a possible purchase (or annexation) of Greenland, although recently passed over in silence, crystallizes these questions. Trump’s America wants to be dominant, but at what cost? Between tensions with its North American neighbors and provocations toward Europe, doubt lingers: can this “American arrogance” revitalize a fragile global economy?

Faced with Trump, reactions diverge. François Bayrou calls for awaking Europe to this new American arrogance, while Canada seeks pragmatic solutions. Between division and hope for collaboration, the international scene observes, worried and fascinated, this president who leaves no one indifferent.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

La révolution blockchain et crypto est en marche ! Et le jour où les impacts se feront ressentir sur l’économie la plus vulnérable de ce Monde, contre toute espérance, je dirai que j’y étais pour quelque chose

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.