The Services And Features Of The Coinbase Card

The Coinbase Card has become an essential solution for those who wish to use their cryptos on a daily basis. It allows for payments in digital or fiat currencies, directly at merchants accepting Visa. With a user-friendly interface and advanced features, this card aims to democratize the use of cryptocurrencies in everyday life. However, to make the most of it, it is necessary to understand its characteristics, advantages, and limits.

General Presentation of the Coinbase Card

The Coinbase Card is designed to democratize the use of cryptos in daily transactions. By directly linking digital assets to a debit card, it allows users to easily pay at merchants accepting the Visa network.

This card is available in a virtual version for immediate use and in a physical version for in-store payments or cash withdrawals. With a base of over 110 million users, Coinbase has established itself as a reference platform for integrating cryptocurrencies into traditional financial uses. Its popularity relies on an intuitive interface, enhanced security, and global accessibility.

How the Coinbase Crypto Card Works and Its Use

The Coinbase Card simplifies transactions by directly connecting the card to the crypto wallet of the user. When a payment is made, the platform automatically converts the chosen cryptos into fiat currency, thus avoiding manual conversion steps. This feature is particularly useful for quick and smooth payments, whether online or at a physical store.

The card also adapts to the specific needs of the user, allowing them to choose between different digital assets to fund their transactions. This system optimizes the user experience while ensuring simplified management of digital assets.

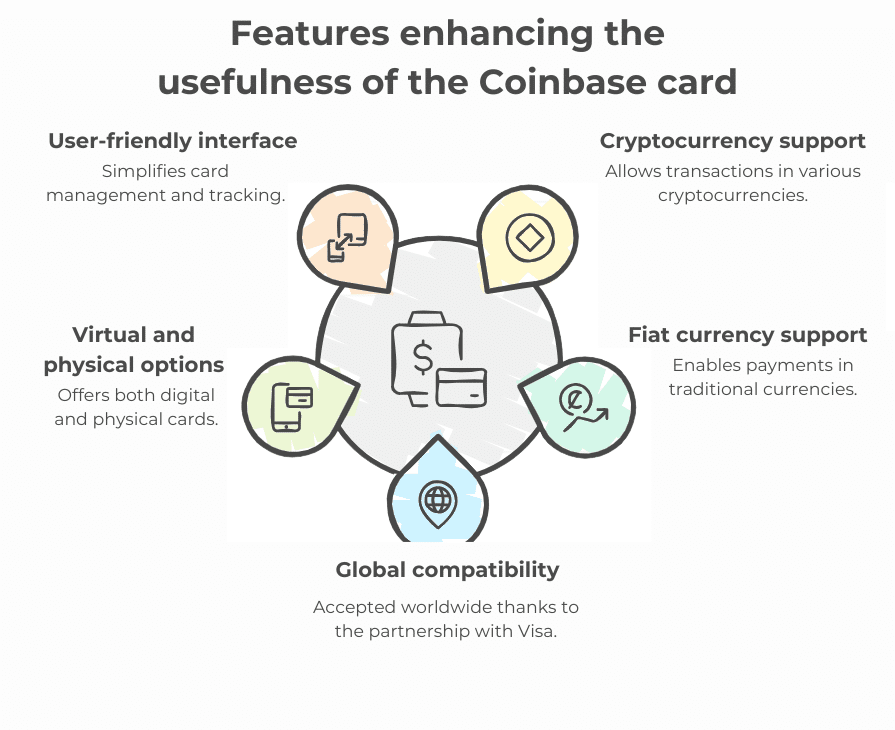

The Main Features of the Coinbase Card

The Coinbase Card stands out for its advanced features, designed to facilitate the integration of cryptocurrencies into everyday spending. By combining innovation and simplicity, it meets the varied needs of users while ensuring a secure and smooth experience.

Spending in Cryptos and Fiat Currencies

The Coinbase Card allows for purchases in cryptocurrencies such as Bitcoin, Ethereum, or stablecoins like USDC. It also supports fiat currencies, such as the euro or the dollar. This flexibility offers a practical solution for juggling between digital assets and traditional currency.

Users can thus adapt to crypto fluctuations and choose the most advantageous option according to the economic context. This dual usage expands the range of transactions accessible with the card.

Global Compatibility

Thanks to its partnership with Visa, the Coinbase Card is accepted at over 40 million merchants worldwide. It allows for in-store payments, online purchases, and even cash withdrawals at ATMs. This global compatibility makes it a valuable tool for travelers and users looking for a card that can be used without geographic restrictions. The reliability of Visa ensures near-universal recognition of the card, regardless of the country.

A Virtual and Physical Card

The Coinbase Virtual Card is available immediately upon approval of the request. It can be used through applications like Apple Pay or Google Pay for online or contactless payments.

The physical version, delivered within two to three weeks, offers additional features, such as ATM withdrawals. This combination of both versions ensures fast use and maximum flexibility for all types of transactions. Users can thus choose the option that best suits their needs.

The Intuitive User Interface

The Coinbase mobile application simplifies card management with a clear and intuitive interface. Users can track their spending in real time, change the digital asset used to fund their payments, or lock the card in case of security issues. These features provide peace of mind and increased control over transactions. They also enhance the transparency and efficiency of using the Coinbase card.

What are the Fees Associated with the Coinbase Card?

Fees related to the use of the Coinbase Card vary depending on the transactions and services used. They play a crucial role for users looking to optimize their spending.

Standard Fees

The card is issued without management fees or subscription fees. However, certain operations incur charges:

- Crypto-Fiat Conversion: a fee of 2.49% applies for payments requiring a conversion;

- ATM Withdrawals: cash withdrawals are charged at 1.5%, plus any additional fees from the ATM;

- Exchange Fees: when making payments in a foreign currency, additional fees may apply.

How to Reduce Costs?

To minimize the transaction fees imposed by Coinbase, users can prioritize payments in USDC, which do not generate conversion fees. SEPA transfers to recharge the Coinbase account are also a free option to limit costs.

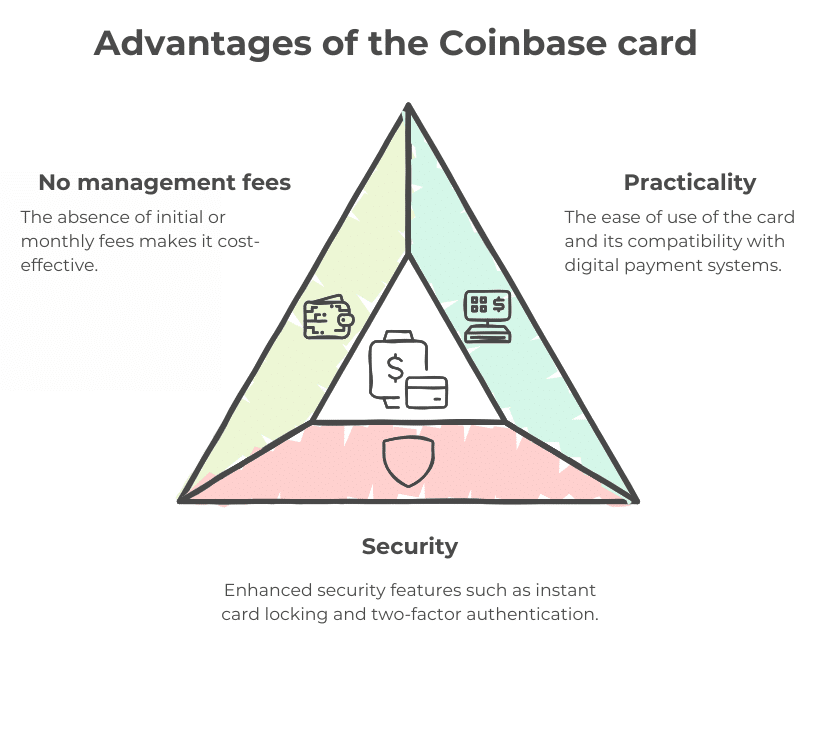

The Benefits of the Coinbase Card

The Coinbase Card stands out for its simplicity and flexibility, meeting the expectations of modern users. Between practicality, security, and affordable cost, it constitutes an attractive solution for integrating cryptocurrencies into daily financial management.

A Practical and Modern Solution

The Coinbase card is aimed at all profiles, whether novice or expert in cryptocurrencies. Its compatibility with Apple Pay and Google Pay facilitates contactless payments in millions of merchants.

Users can conduct online transactions or at physical terminals in seconds, providing a smooth and modern experience. This ability to function with popular digital tools makes it an essential option for those who prioritize speed and simplicity.

Enhanced Security

Security is a priority for Coinbase. Users can lock their card instantly from the mobile app in case of loss or theft. This feature limits the risks of fraudulent transactions. Additionally, two-factor authentication protects account access and enhances the reliability of payments. This high level of protection reassures users and strengthens trust in the card.

No Management Fees

The Coinbase Card is issued without initial fees or monthly subscription. Unlike other crypto cards that impose recurring fees, it remains economical for regular or occasional users. This absence of additional costs makes the card accessible to a broader audience, while offering a competitive alternative compared to other solutions on the market.

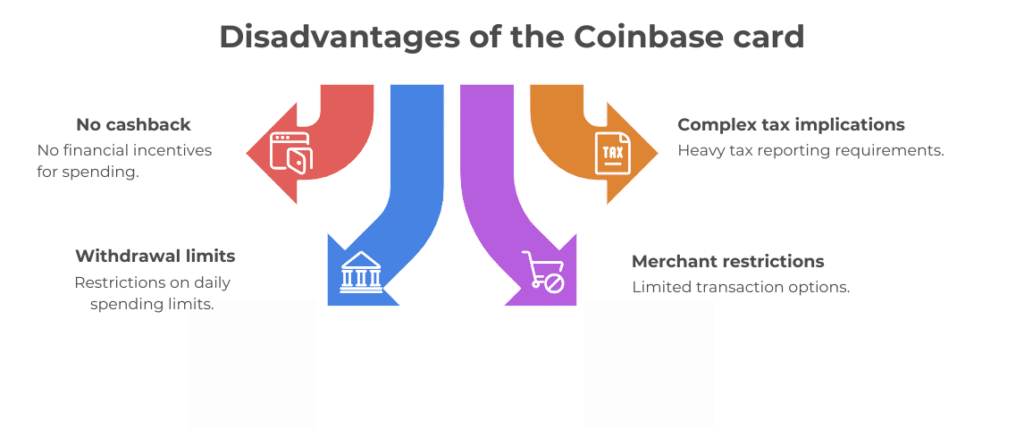

Disadvantages of the Coinbase Card

Although the Coinbase Card offers significant advantages, it also has certain limitations that may influence its attractiveness for some users. It is important to understand these disadvantages before adopting it.

The absence of a cashback program

The Coinbase Card stands out from other crypto cards such as those from Binance or Crypto.com by offering no cashback program (for European users). This absence deprives users of a direct financial advantage on their spending in cryptocurrencies or fiat.

For individuals used to receiving rewards in the form of tokens or discounts, this lack of benefits can be seen as a hindrance. This shortcoming limits the card’s appeal for those looking for added value beyond the simplicity of payments.

Complex tax implications

Using the Coinbase Card to pay in cryptos triggers a tax event with each transaction. Each crypto-fiat conversion must be declared to tax authorities, involving the calculation of any associated gains or losses. This obligation can quickly become complex for active users, especially if the transactions are numerous.

Investors must keep accurate records and ensure that their tax returns comply with current regulations, which can discourage some from using the card for daily payments.

Usage limits

The Coinbase card imposes a daily withdrawal limit of $1,000, which may limit its use for higher amounts. This restriction can be a disadvantage for users with greater financial needs.

In addition, the card offers no travel insurance, purchase protection, or extended warranty, common services found with traditional bank cards. These limitations make it less attractive for users seeking comprehensive coverage beyond standard payments.

Restrictions on accepted merchant types

The Coinbase Card limits the types of possible transactions. It cannot be used at securities brokers, escort services, massage parlors, or for gambling, including in physical and online casinos. Businesses related to cryptocurrency, arms manufacturing, or marijuana are also excluded. These restrictions limit options for some users.

Inaccessibility in certain countries

The Coinbase Card is not usable in certain countries, notably those under sanctions or international restrictions such as Iran, Syria, Russia, or Venezuela. This list includes countries affected by conflicts or strict regulations. These geographical limitations reduce the card’s attractiveness for frequent travelers and users residing in these areas.

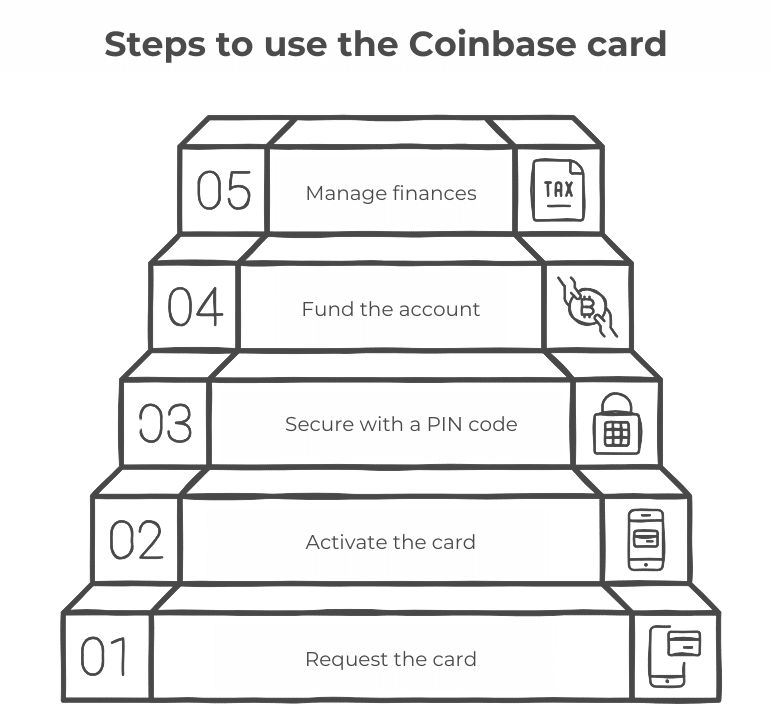

How to obtain and set up the Coinbase card?

The procedure to request, activate, and manage the Coinbase Card is designed to be simple and quick. It is aimed at any user looking to integrate cryptocurrencies into their daily life. Here are the detailed steps to make the most of this card.

The application process

The Coinbase card can be requested through the mobile app or the Coinbase website. Registration requires identity verification, in accordance with KYC (Know Your Customer) regulations.

Once this step is validated, the virtual card becomes immediately available for online payments and transactions via Apple Pay or Google Pay. This instant availability allows users to start spending their cryptocurrencies without waiting for the physical card to arrive.

Activation and configuration

After receiving the physical card, users must activate it via the Coinbase app. This activation includes entering the card number and CVV code. Once activated, users can set a PIN code to secure their transactions, whether for payments or withdrawals at ATMs. This step ensures an additional layer of protection, essential for preventing any fraudulent use in case of loss or theft of the card.

Funding and management

The account associated with the card can be funded in various ways, such as SEPA bank transfers, transfers from PayPal, or deposits in cryptocurrencies from external wallets like Ledger or Metamask.

The Coinbase app offers an intuitive interface to track expenses in real time, view transaction history, and adjust card settings, such as the funding source. This flexibility allows users to maintain total control over their finances.

Comparison with other crypto cards

The Coinbase Card stands out for its immediate access through the virtual version and its global compatibility via the Visa network. However, it is surpassed in some aspects by competitors like Crypto.com or Binance, which offer attractive cashback programs and benefits related to premium subscriptions or services.

These alternatives appeal to users looking to maximize their crypto spending. On the other hand, the Coinbase Card remains a solid option for users prioritizing simplicity and smooth management of cryptocurrencies in their daily lives.

The Coinbase card is a practical solution for integrating cryptocurrencies into your daily transactions. Its ease of use, enhanced security, and lack of management fees make it a relevant choice for both beginner users and seasoned investors. However, the absence of cashback and complex tax implications may limit its appeal for some. Before adopting it, it is advisable to assess your specific needs and compare with other available options on the market.

FAQ

Yes, the Coinbase Card can be used at over 40 million merchants worldwide, thanks to its partnership with Visa. However, foreign exchange fees may apply for payments made in foreign currencies, so it’s important to check these fees before making international transactions.

Currently, the Coinbase Card is compatible with Apple Pay and Google Pay for contactless payments. There is no mention of compatibility with other popular mobile payment platforms like Samsung Pay. If you use another service, it is recommended to check compatibility through the Coinbase app.

The Coinbase Card imposes daily withdrawal limits of $1,000, but there is no specific mention of a monthly spending limit. Users should monitor their balance and withdrawals based on this daily limit and ensure they adhere to their account restrictions to avoid any surprises.

Yes, you can use your Coinbase Card to withdraw money abroad at Visa-enabled ATMs. However, additional fees may apply, including a 1.5% withdrawal fee and possible ATM operator fees.

The 2.49% conversion fee is only applied to payments made with the Coinbase Card, when a cryptocurrency-to-fiat conversion is required. This fee does not apply to cryptocurrency withdrawals or transfers without conversion. Therefore, it’s recommended to use stablecoins like USDC to avoid this fee when making payments.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The Cointribune editorial team unites its voices to address topics related to cryptocurrencies, investment, the metaverse, and NFTs, while striving to answer your questions as best as possible.

The contents and products mentioned on this page are in no way approved by Cointribune and should not be interpreted as falling under its responsibility.

Cointribune strives to communicate all useful information to readers, but cannot guarantee its accuracy and completeness. We invite readers to do their research before taking any action related to the company and to take full responsibility for their decisions. This article should not be considered as investment advice, an offer, or an invitation to purchase any products or services.

Investment in digital financial assets carries risks.

Read more