The RSI Indicator in Trading: Everything You Need to Know

In the dynamic world of trading, technical indicators play a crucial role in traders’ decision-making. Among these tools, the Relative Strength Index (RSI) stands out for its versatility and effectiveness. This indicator helps assess the strength of market trends and identify potential reversal points. However, despite its popularity, the RSI presents challenges and limitations that traders must understand to use it effectively. This article explores the RSI in detail, from its functioning to its practical application, while highlighting the precautions to take to optimize its use in trading strategies.

What is the RSI indicator?

The RSI or Relative Strength Index is an essential technical analysis tool in the trading world. Developed by J. Welles Wilder in 1978, the RSI is a momentum oscillator that measures the speed and change of price movements. It varies between 0 and 100 and is typically used to identify overbought and oversold conditions in the market. The RSI calculation is based on a predefined period, usually 14 days, to assess the relative strength of price movements.

How to interpret the RSI?

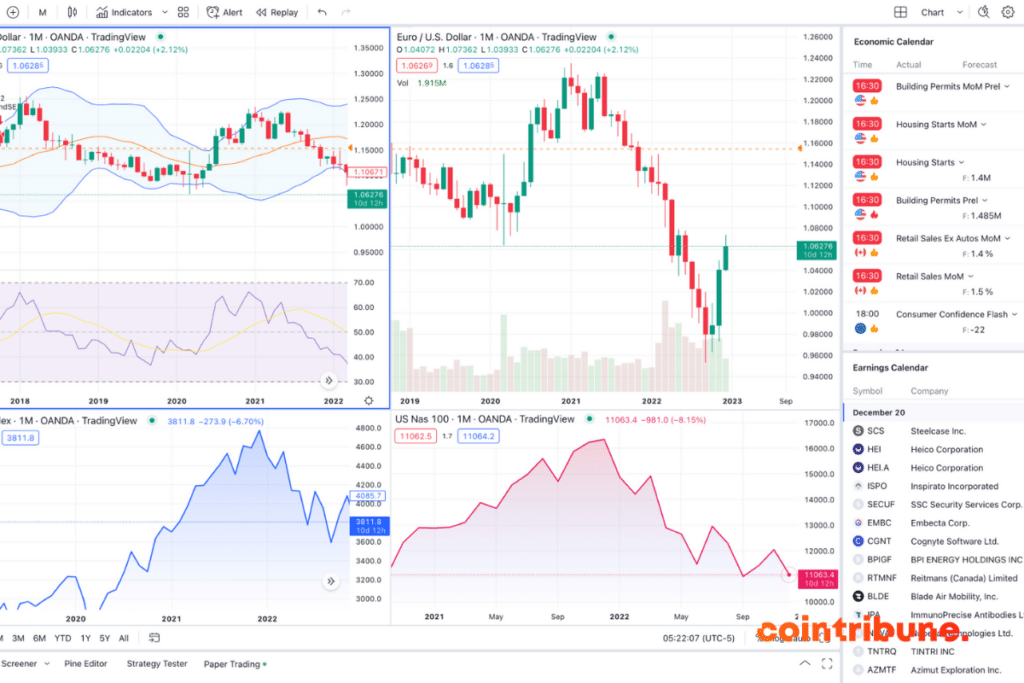

The interpretation of the Relative Strength Index (RSI) is crucial for traders looking to analyze market trends. This indicator oscillates between 0 and 100, helping to identify overbought (above 70) and oversold (below 30) zones. A high RSI suggests that prices might soon decline, while a low RSI indicates a potential rise in prices. Traders must also monitor divergences between the RSI and price movements, as they can signal an imminent trend reversal. A precise understanding of the RSI allows for optimization of trading strategies by anticipating market changes.

Practical use of the RSI in trading strategies

The Relative Strength Index (RSI) is a leading technical indicator used by many traders to improve their trading strategies. By providing valuable information on overbought and oversold conditions, as well as the strength of current trends, the RSI can help make more informed trading decisions. Here’s how to integrate this indicator into trading strategies.

Identification of entry and exit points

One of the most common uses of the RSI is to identify optimal entry and exit points in trading. When the RSI falls below the 30 threshold, it often indicates an oversold zone, suggesting that the asset price may soon increase. Conversely, an RSI above 70 can signal an overbought zone, indicating that the price might decrease. Traders can use this information to buy assets when the RSI indicates oversold conditions and sell when it indicates overbought conditions. However, it’s important to note that these signals should not be used in isolation, as the RSI can remain in extreme zones for prolonged periods, especially in strongly trending markets.

Combining the RSI with other indicators

To improve the accuracy of trading signals, the RSI is often combined with other technical indicators. For example, the joint use of the RSI and moving averages can help confirm trends and filter out false signals. A trader may wait for the RSI to indicate oversold or overbought conditions and use a moving average to confirm the trend direction before taking a position. This multi-indicator approach allows for a more comprehensive analysis of the market, thereby increasing the chances of success in trading.

Adjusting the RSI parameters for different markets

The RSI is a flexible tool that can be tailored to different trading styles and markets. The standard period for calculating the RSI is 14 days, but traders may adjust this period to meet their specific needs. In volatile markets or for short-term trading, a shorter period can be used to make the RSI more responsive. For long-term trading or in less volatile markets, a longer period can help smooth out RSI fluctuations and provide more stable signals. Adjusting the RSI parameters according to market conditions and trading style can greatly enhance its effectiveness and relevance.

Why the RSI is one of the traders’ favorite indicators?

The Relative Strength Index is a widely acclaimed technical analysis tool in the trading world. Its popularity is due to its versatility, ease of interpretation, and effectiveness in various market conditions. Here’s an overview of the advantages of the RSI that make it one of the most used technical indicators.

Simplicity of use and understanding

The RSI is known for its simplicity of use, making it accessible even to beginner traders. Unlike other technical indicators that may be complex and difficult to interpret, the RSI is relatively easy to understand. It is presented as an oscillator that varies between 0 and 100, providing clear indications of overbought and oversold conditions. This simplicity allows traders of all levels to quickly integrate it into their analyses and make informed trading decisions without getting lost in complicated calculations.

Ability to provide clear signals

Another major advantage of the RSI is its ability to provide clear and actionable signals. By identifying overbought zones (RSI above 70) and oversold zones (RSI below 30), traders can anticipate potential trend reversals. Additionally, divergence between the RSI and market prices can signal weakening of the current trend, thus offering strategic trading opportunities. These clear signals help traders make quick and well-founded decisions, a valuable asset in volatile financial markets.

Adaptability to different trading styles

The RSI also stands out for its adaptability to different trading styles and markets. Whether for short-term trading, swing trading, or long-term trading, the RSI can be adjusted to meet the specific needs of each trader. By modifying the RSI calculation period, traders can make it more sensitive to short-term price movements or more stable for long-term analysis. This flexibility allows the RSI to fit into various trading strategies, making it useful for a wide range of traders operating in different markets, such as stocks, Forex, or cryptocurrencies.

Limits and precautions to take when using the RSI

The Relative Strength Index (RSI) is a widely used technical analysis tool in trading, but like any indicator, it has its limits. A thorough understanding of these limitations and taking appropriate precautions are essential for using the RSI effectively.

Risk of false signals

One of the main limitations of the RSI is the risk of generating false signals. Although the RSI is useful for identifying overbought and oversold zones, these signals are not always reliable. For example, in a strongly bullish market, the RSI may remain in the overbought zone for a prolonged period, falsely suggesting that a decline is imminent. Similarly, in a bearish market, the RSI may remain oversold longer than expected, falsely indicating that a rebound is near. Therefore, traders must be cautious and not rely solely on the RSI for making trading decisions.

Need for confirmation by other indicators

To mitigate the risk of false signals, it is advisable to combine the RSI with other technical indicators. The use of multiple indicators can help confirm RSI signals and provide a more comprehensive view of the market. For example, moving averages, Bollinger Bands, or MACD can be used in conjunction with the RSI to validate its signals. This multi-indicator approach helps reduce the risk of errors and improve the accuracy of trading decisions.

Challenges related to market volatility

Market volatility can also affect the effectiveness of the RSI. In highly volatile market conditions, the RSI may fluctuate rapidly, making it difficult to interpret signals. Additionally, volatility can lead to sudden changes in market trends, rendering RSI signals obsolete. Therefore, traders must be particularly vigilant when using the RSI in volatile markets and be ready to quickly adjust their strategies based on changing market conditions.

Conclusion

The Relative Strength Index (RSI) is a crucial technical analysis tool in the trading world. Its ability to identify overbought and oversold zones, signal potential divergences, and adapt to different trading styles makes it a favorite among traders. However, it is essential to understand its limitations, including the risk of false signals and the impact of market volatility. A judicious use of the RSI, often in combination with other indicators like moving averages, Bollinger Bands, or MACD, can greatly enhance trading strategies and help navigate financial markets more effectively.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The Cointribune editorial team unites its voices to address topics related to cryptocurrencies, investment, the metaverse, and NFTs, while striving to answer your questions as best as possible.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.