The Power of the US Over Bitcoin

The United States has significantly stirred the cryptocurrency industry, especially with the case concerning the Binance exchange platform. One might think that the US wants to control Bitcoin, but is that really the case? What are their means? We are going to examine together certain aspects regarding the US control over Bitcoin.

The Binance Case

Binance is the most commonly used cryptocurrency trading platform in the world. An investigation file by the SEC (Securities and Exchange Commission) had been opened to initiate proceedings against it. Just as a reminder, the SEC is an organization responsible for the regulation and control of financial markets. Following this lawsuit, an agreement and a settlement were reached. The CEO of Binance pleaded guilty to violating American anti-money laundering laws and will step down from his role at the company forthwith. Binance will also have to pay 4 billion dollars to the American Treasury. This kind of event, among others, has become a much-used argument to undermine the credibility of cryptocurrency. However, it should be noted that fraud and money laundering have always existed, even through traditional banks.

Consequently, is this good or bad news for Bitcoin? To tell the truth, Bitcoin did not really react to this. It was like a non-event.

This kind of non-event is probably due to the fact that we are gradually seeing an alignment of the planets (favorable) to satisfy an approval at the level of spot ETFs. The more controlled and regulated the industry is, the easier it will be to proceed with the institutionalization of Bitcoin.

The Rise of Bitcoin Remains at the Center of Debate

Bitcoin has become so popular and widely used that it has become dangerous in the eyes of some governments. Some states see potential in it and have made it an official currency, as is the case with El Salvador. Other states see it as a danger and a support for money laundering because Bitcoin is both unregulated and used by criminals. For individuals, it can be an emergency exit against inflation through monetary expansion but it can also help the population to circumvent capital controls in certain cases. On this occasion, the US has recently multiplied the different controls in order to impose a regulation.

Do the United States Have Power over Bitcoin?

For now, one might think that the United States increasingly wants to get its hands on Bitcoin and control it. Moreover, we can even observe a certain alignment in terms of regulation and anticipation of the approval of a spot Bitcoin. Everything is happening at the same time and we can see the power that the US wants to have over Bitcoin. Why? On one hand, we have various prosecutions, especially against cybercriminals. These prosecutions have allowed the US to have in its possession a wallet of 200,000 bitcoins, making the US one of the largest holders of Bitcoin. And in a more recent register, we have the recent conviction of Binance for violating American laws. As Binance remains THE major exchange platform for various cryptocurrencies, convicting it to weaken its credibility will encourage investors to turn to more traditional products like ETFs. Moreover, in the same dynamic, we have the largest ETF producers such as BlackRock or iShares who are waiting for SEC authorization to approve a spot ETF. This would allow the US to have an important position in terms of Bitcoin ownership.

The US Financial Markets on a Global Level

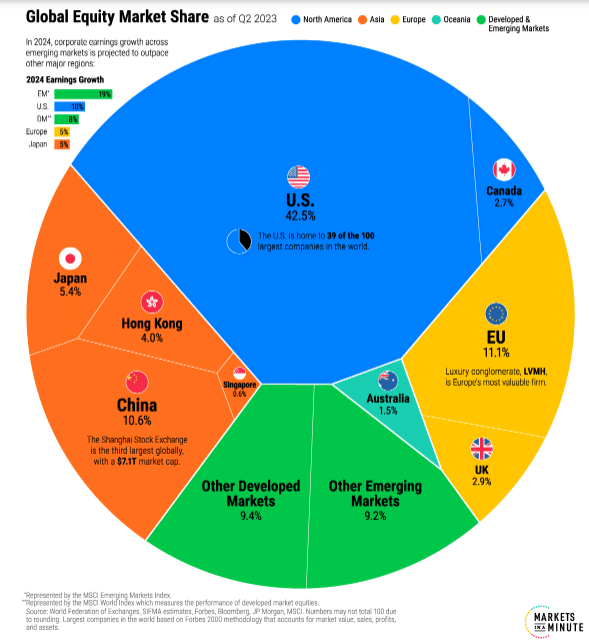

In general, the US financial markets already have an important place globally as they represent more than 42.5% of the global market. Therefore, they are a very important source of capital. On the other hand, the US dollar is the world’s reserve currency.

As a result, a very large portion of goods and services are paid for in US dollars. Given that the American market represents 42.5% of the global market and that the reserve currency is the US dollar, they remain leaders nonetheless. Adding to this, large carriers like BlackRock or iShares are buying Bitcoin in anticipation of the approval of spot ETFs. Consequently, a very large portion of Bitcoin is purchased in US dollars. We can say that the US has power over Bitcoin because they have both significant capital, hold a large number of them, and are in a position to regulate the industry. All in order to properly coordinate institutionalization.

The Effect of Institutionalization in the US

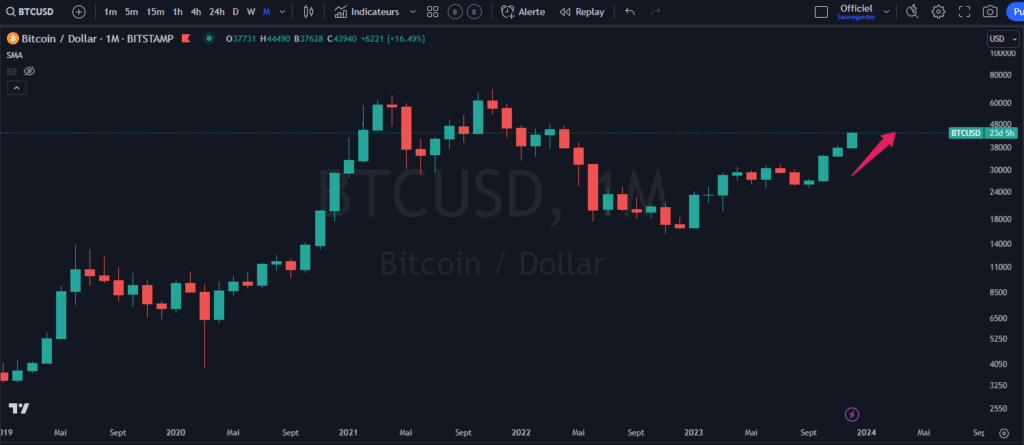

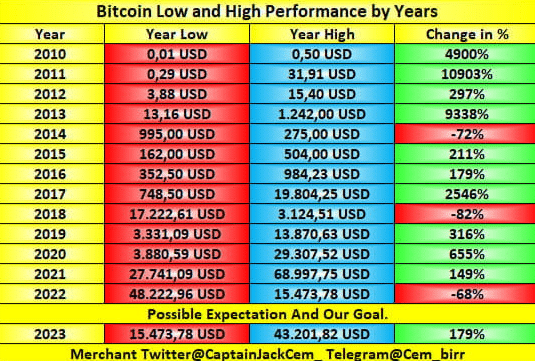

Of course, there are pros and cons regarding the institutionalization of Bitcoin. Initially, it’s the result of years of democratization efforts. Bitcoin has become quite popular and attractive due to its past performance. Even though past performance does not guarantee future results, it is important to note that it is an asset that can add performance to a portfolio.

The very principle of institutionalization comes from integrating Bitcoin into institutions. This process can have positive effects because institutions will gradually incorporate Bitcoin into their portfolio. By this same occasion, this will make the asset accessible without going through other platforms. Consequently, the demand for Bitcoin is likely to be stimulated. The negative aspect of institutionalization is that it is counter-intuitive to the initial utility of Bitcoin to stand out from institutions through decentralization.

Better to Control than to Ban

The SEC is an institution of the American Treasury, so it is important to understand the intentions behind the warnings and regulations. In this kind of context, it is better to control than to ban. Why? We know that the US are a significant source of capital on a global level. Consequently, they are an indispensable source for buying Bitcoin and stimulating demand. If the SEC authorizes Bitcoin ETFs, it will encourage large holders to buy Bitcoin and include it in portfolios like any regular asset. The act of “regulating” can reassure the most skeptical investors about Bitcoin. On the other hand, individual access to buy Bitcoin through ETFs remains centralized and regulated. It’s a win for individuals who want to seek performance without going through specialized cryptocurrency exchange platforms. And it’s a win for the American Treasury, because taxes will have to be paid on capital gains when Bitcoin performs. So it’s a win for the US as well as for the rest of the world.

The Positive Aspect of Control: Cleaning Up

Even though the act of institutionalization goes against the original utility of Bitcoin, it must be specified that the desire to control is not necessarily always negative. Why? Numerous investors have been victims of fraud in the cryptocurrency industry as was the case with FTX, for example. So obviously, the world of crypto is not just indicative of fraud or criminality. There are several positive aspects in using Bitcoin. Here are some examples:

- Protection against currency devaluation, Bitcoin is deflationary

- Cheaper money transfers

- Security

- Transaction transparency

- Integration and development of blockchain.

- Limited supply of 21 million

- Decentralized

- Store of value

So even if control is not always pleasing, it allows us to clean up and protect the investor to a certain extent, which could bolster the credibility of Bitcoin.

Conclusion

To summarize, the US holds a very important part of the global market share. As a result, they automatically have power over the evolution of assets, especially Bitcoin. Even though it contradicts Bitcoin’s initial utility (decentralization), the desire to regulate and centralize will allow for institutionalization. And the very principle of institutionalization will attract more capital, which could boost Bitcoin’s performance.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Après avoir travaillé pendant 7 ans dans une banque canadienne dont 5 ans dans une équipe de gestion de portefeuille comme analyste, j’ai quitté mes fonctions afin de me consacrer pleinement aux marchés financiers. Mon but ici, est de démocratiser l'information des marchés financiers auprès de l'audience Cointribune sur différents aspects, notamment l’analyse macro, l’analyse technique, l’analyse intermarchés…

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.