The issue of Bitcoin (BTC) supply

We know that Bitcoin (BTC) reacts in the long term to profitability levels. That is to say, if the production cost is too high compared to the price of Bitcoin, it would not be sustainable. Therefore, studying the supply is crucial as it explains the behavior and, hopefully, the future of the cryptocurrency market.

The role of mining in the Bitcoin market

In a previous article, we discussed the significant role of Bitcoin’s production cost (BTC). Indeed, the long-term supply behavior can explain that of Bitcoin. However, the importance of mining in BTC is gradually declining.

Miners, income, and profitability

Bitcoin mining involves solving complex mathematical problems using powerful computers. Miners who successfully solve these problems are rewarded with a certain amount of newly created bitcoins and transaction fees. However, the mining process is highly energy-intensive and requires significant investments in hardware and electricity. Consequently, the production cost of Bitcoin is linked to these expenses.

Therefore, the production cost of BTC plays a major role in determining market bottoms. Additionally, when the price of Bitcoin falls below the average production cost, miners are unable to continue their operations. They may try to reduce their production cost or scale back or completely cease their mining activities. It should also be noted that a reduction in mining activity would weaken the network. Thus, a price of BTC below the production cost for an extended period can lead to a significant reduction in the network’s hash rate.

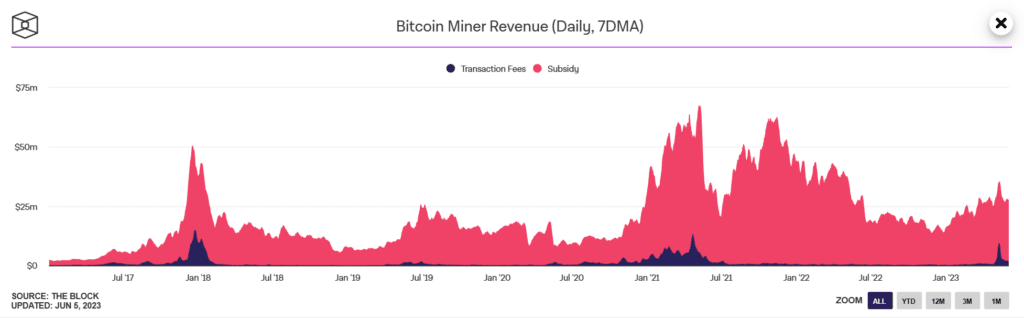

According to The Block, we can see that miners’ revenues have been relatively stable in recent years. They naturally increased during the bullish market of 2021 before reaching a minimum in late 2022. It should be noted that miners currently represent only about 5% of the total Bitcoin supply, far from the 90% in the early years following Bitcoin’s creation.

Estimating Bitcoin’s velocity

Estimate Bitcoin’s velocity

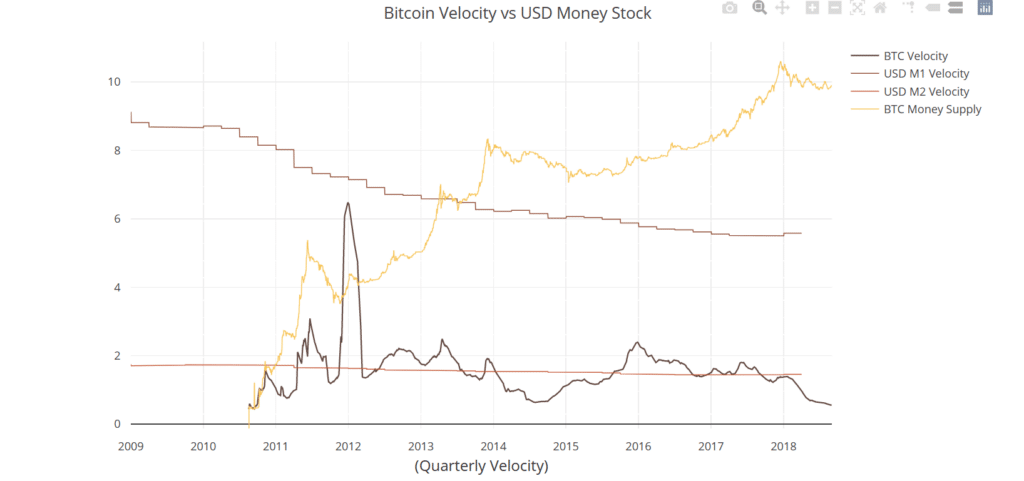

If Bitcoin is considered a currency, then, like any currency, it has both a circulating supply and a velocity. Velocity measures the speed of money circulation, indicating how many times BTC has been exchanged in a year. The velocity of the U.S. dollar is around 1.25, and the velocity of the euro is approximately 1. A currency with a higher velocity, or at least a rising velocity, is considered favorable. Let’s attempt to estimate Bitcoin’s velocity.

Approximately 330,000 bitcoins were mined in 2022. At the same time, there was a total annual trading volume of 357.5 billion dollars in bitcoins. With an average price of $28,200 in 2022, we can estimate that approximately 12.6 million bitcoins were exchanged. Since a bitcoin can be exchanged multiple times, velocity becomes crucial as higher velocity leads to more transactions and higher transaction fees. It’s also worth noting that miners accounted for 2.6% of the total supply in 2022!

Temporal evolution

In conclusion, we can deduce that Bitcoin’s velocity was around 0.66 in 2022! This means that Bitcoin’s velocity is lower than that of traditional currencies. However, it would be interesting to study the evolution of this velocity. In the long term, Bitcoin’s velocity remains relatively constant. Its average value between 2010 and 2018 was around 1.4. Thus, a velocity below 1 is considered low for Bitcoin.

In the long term, the stagnation of Bitcoin’s supply should be, at a constant price, a factor that increases velocity. However, if the price of BTC increases symmetrically, it will cause a reduction in velocity. Therefore, it is logical to observe a constancy in Bitcoin’s velocity. In fact, Bitcoin’s velocity is often minimal during the phase of price decline.

If Bitcoin’s velocity is relatively lower than its average, it means that the price of Bitcoin was higher than what the market desired in 2022. Similarly, a reduction in velocity implies a price increase for Bitcoin.

The stagnation of the number of active addresses

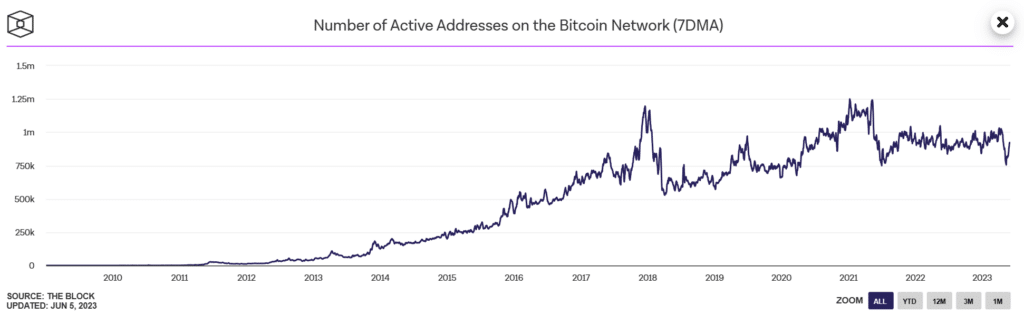

An interesting phenomenon has been observed since 2018: the stagnation of active addresses. The number of active addresses fluctuates between 750,000 and 1 million. However, at the same time, the hash rate is increasing significantly.

The evolution of velocity is more related to the intensity of address activity.

The resurgence of cost of production tensions

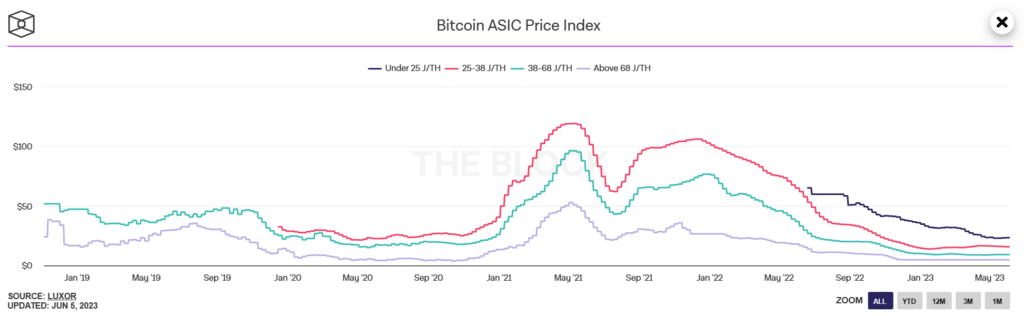

At the same time, the cost of production has recently become challenging for miners. The cost of production refers to the expenses incurred by miners to participate in the mining process. These costs include the purchase of specialized hardware such as ASICs (Application-Specific Integrated Circuits) and the electricity costs required to power these energy-intensive machines. The cost of production varies depending on factors such as the miner’s geographical location (which affects electricity costs) and the efficiency of the hardware used. The graph below shows the ASIC price index according to the hash rate.

According to data from Cambridge University and Macromicro, the average mining cost of BTC is currently close to $29,000. This average production cost (estimated) even dropped to $15,000 at the end of December 2022. In the long term, there is a strong correlation between the cost of production and Bitcoin’s price evolution, but it seems to be a paradox.

The paradox of production cost

Indeed, how can we justify the determining role of production cost if mining supply is barely influential?

There is indeed an excellent correlation between the cost of production and the price of Bitcoin. However, unlike certain precious metals like gold (which accounts for 80% of the supply), mining supply does not seem sufficient to influence the price of BTC. We are facing a true paradox.

The explanation may lie in velocity. The new supply of BTC, which is also correlated with Bitcoin’s long-term price, decreases with the influence of miners. As a result, newly mined quantities are becoming increasingly reduced, which creates scarcity of Bitcoin and upward pressure on velocity. The marginal demand for mining also increases. However, this crucial demand can only be satisfied at an increasing production cost. The rising production cost is a consequence of the limitation of Bitcoin’s supply. The market seeks to increase the supply of Bitcoin, and this comes at an ever-higher production cost.

Therefore, it is not the miners who determine the market price through production cost. The production cost is a kind of major support because it represents the minimum price at which the market can afford to sell. And it is not just about selling bitcoins; it is also about operating an entire network!

Conclusion

In conclusion, we have seen that the income of BTC miners tends to be relatively stable in the long term. At the same time, the number of active addresses has stagnated since 2018. We then attempted to estimate Bitcoin’s velocity, which was around 0.66 for BTC in 2022. The evolution of Bitcoin’s velocity, or its circulation speed, is pushed downward by the price increase and pushed upward by the limitation of the Bitcoin quantity.

Bitcoin’s velocity is often highest during Bitcoin’s price decline phases. This reflects the idea that the market approaches the “fair price” or at least the lowest price determined by miners’ production cost. Any sale below the cost of production would cause difficulties in the network and ultimately lead back to that level. The now negligible influence of miners is not the cause of the significance of production cost.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The Cointribune editorial team unites its voices to address topics related to cryptocurrencies, investment, the metaverse, and NFTs, while striving to answer your questions as best as possible.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.