The FED will cut rates by another 25bps in 3 days!

— Crypto Rover (@rovercrc) December 15, 2024

Super bullish for #Bitcoin! pic.twitter.com/DfNtMMTdJr

A

A

The Fed Ready To Lower Rates Despite Inflation

Sun 15 Dec 2024 ▪

4

min read ▪ by

Getting informed

▪

Event

Summarize this article with:

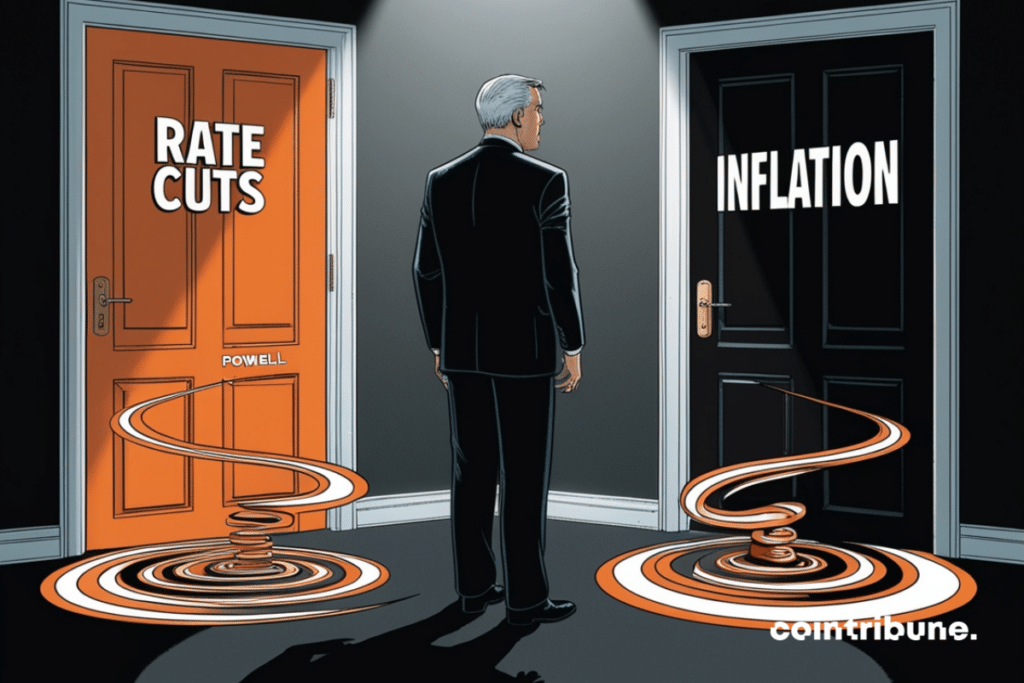

Inflation doesn’t evaporate with a snap of the fingers, and the American Federal Reserve (Fed) knows this well. Under Jerome Powell’s leadership, it juggles between interest rate adjustments and precautions to avoid an uncontrolled surge. Yet, despite these maneuvers, the results are struggling to convince. And as Donald Trump prepares for his return, the debate over economic policies intensifies. In this context, the Fed is preparing for a new rate cut, and opinions diverge.

The Fed, between caution and pressure

The American Federal Reserve is about to take another step towards a rate cut, despite worrying inflationary signals. With the current benchmark rates hovering between 4.50% and 4.75%, the institution could opt for a quarter-point reduction that could change everything in December. This decision, anticipated by a large majority of investors, is still controversial.

Jerome Powell, chairman of the Fed, is playing a balancing act. The American economy, supported by vigorous consumption, seems robust, but inflation figures muddle the picture. In November, the CPI index jumped to 2.7%, reminding us that the fight against rising prices is far from over.

Worse, producer prices have reached a peak, driven by factors such as avian flu, according to the PPI index.

Faced with this complexity, economists are calling for caution. Diane Swonk, chief economist at KPMG, warns against excessive zeal:

“We are still a long way from declaring victory in the war against inflation.”

Despite these warnings, Powell remains confident in the Fed’s ability to manage the situation through a measured approach.

Key points of the situation:

- Rising inflation after an encouraging decline;

- American consumption stronger than expected, fueling growth;

- Debate over rates: caution or economic stimulus?

- Probable opposition within the Fed committee regarding the expected cut.

The American economy in the eye of the Trump storm

Donald Trump’s return to the White House promises to disrupt economic dynamics. With his proposals for 25% tariffs on Canadian and Mexican imports, the former president could revive inflation. These protectionist measures, combined with tax cuts and deregulation, worry analysts.

For the Fed, this new context is likely to be thorny. Trump’s policies, although favorable to growth in some sectors, are likely to further complicate the mission to bring inflation down to 2%. Michelle Bowman, one of the Fed governors, highlights that inflationary risks are now more concerning than those related to unemployment.

This situation could lead the central bank to lower its ambitions for 2025, both on rates and on its economic forecasts.

But the challenges don’t stop there. Powell will also have to navigate a tense political environment, with a White House that could openly criticize his decisions. The Republican has never hidden his animosity towards the Fed chairman, whom he accuses of slowing down the economy. Between political pressure and economic uncertainties, the path ahead looks winding.

Furthermore, Donald Trump is not shy in accusing the Fed of hindering the American economy. Jerome Powell, whom he had appointed himself, proves to be reluctant to yield to criticism. However, the showdown between these two visions risks redefining the contours of American monetary policy in the years to come.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

A

A

La révolution blockchain et crypto est en marche ! Et le jour où les impacts se feront ressentir sur l’économie la plus vulnérable de ce Monde, contre toute espérance, je dirai que j’y étais pour quelque chose

DISCLAIMER

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.