The Fed Lower Its Rates: Bitcoin (BTC) Ready to Take Off

It seems that everything is set for Bitcoin to experience an explosive year in 2024. This week has been more significant than most when it comes to the state of the markets. Two major events unfolded simultaneously with the release of the latest inflation data and the December meeting of the Federal Reserve which announced an anticipated rate cut.

Inflation Is Down

Inflation has fallen from 3.2% in October to 3.1% in November. However, the core price index (excluding food and energy) remained unchanged from last month at 4.0%.

If we look closer at the CPI data, we see that the “housing” component continues to keep the overall figure high, while energy continues to record a significant drop.

Just a month ago, Federal Reserve Chairman, Jerome Powell, stated at the podium: “The fact is that the committee is not thinking about lowering rates right now. We are not talking about lowering rates.”

Rates Will Fall

It’s incredible what can happen in a month. At the last press conference, Jerome Powell apparently did a 180-degree turn by stating that the timing of upcoming rate cuts “is definitely a subject of discussion in the world and a subject of discussion for us at today’s meeting.”

Federal Reserve officials now expect at least two rate cuts of 0.25% to take place next year.

The message from Jerome Powell at the press conference can only be described as incredibly dovish. He suggested that the Fed is “probably at or near the peak rate for this cycle”.

The market is now predicting even more significant rate cuts than those announced by the Fed officials. Futures contracts now imply rate cuts of around 1.4% by the end of 2024.

Markets Begin to Rally

The market reaction to Powell’s speech was noticeable across all assets. The animal spirits of investors have returned in full force. The stock market recovered, bond yields fell dramatically, and gold and bitcoin soared.

While the markets risked soaring and causing new inflationary pressures, the President of the New York Federal Reserve, John Williams, backtracked the next day by stating: “We are not really talking about lowering rates right now.”

But the damage is probably already done. The markets generally consider Powell’s comments as the “Fed pivot” they have long been waiting for.

Why Now?

The question arises: why now? While inflation remains above the Fed’s target, the unemployment rate is still at a decades-low, GDP remains high, and stocks are near their all-time highs, why does the Fed choose to send a message of policy easing today?

A possible explanation is that its monetary policy decisions are increasingly influenced by fiscal policy. This tendency is observed worldwide.

As central banks around the world began easing their policies, fiscal deficits as a percentage of GDP remain high.

An Unsustainable Fiscal Situation

For Treasury officials, higher rates represent a challenge for financing their massive fiscal deficits.

31% of the outstanding US public debt will mature within the next year. This debt will need to be refinanced and, with current rates, it will be a very expensive endeavor.

Already, the interest expenses on the outstanding US public debt have exploded with the skyrocketing of interest rates.

In other words, the Treasury needs rates to come down, and so probably welcomed Powell’s dovish speech seeing the 10-year yield drop below the 4% mark, its lowest level since August.

The Treasury Encourages the Fed to Lower Its Interest Rates

One can only speculate, but it is hard to believe that these fiscal dynamics are not on the minds of Federal Reserve officials when they consider the future interest rate policy.

In the longer term, the fiscal situation seems unsustainable, especially in an environment with higher interest rates.

That’s probably why we heard Treasury Secretary Janet Yellen sharing her thoughts on inflation.

In a recent interview, she stated she believed inflation was diminishing “significantly” and that it wouldn’t be difficult for the Fed to complete the “last mile” in bringing inflation down to its 2% target.

The Worst Is Yet to Come?

The other possible explanation for this turnaround is that the Fed is concerned about the lag effect of its rate hikes.

So far, we have not seen the impact of the interest rate hikes on the overall economy, but this could change if rates remain high for longer and more and more businesses and households have to refinance their debt.

In 2024, about 4% of S&P 500’s debt will mature. By 2030, about 38% of the S&P 500’s total debt will have matured.

Smaller and medium-sized businesses have less leeway than the larger corporations. By 2030, about 52% of their debt will have matured.

A debt that will need to be refinanced at much higher rates than those seen over the last decade.

This is a point to watch, especially if we start to see an increase in bankruptcies amongst small and medium-sized businesses.

Overall, however, it appears that companies have considerable leeway when it comes to their debt.

The same holds true for American households regarding their mortgage borrowings.

Households and businesses have taken advantage of the low-interest rates to refinance their debt, giving them leeway to survive in a higher interest rate environment.

This data suggests that it is probably the dynamics of public debt that is compelling the Fed to ease off, despite rising asset prices and a buoyant economy.

In Reality, the Fed Is Not Independent

If this thesis is correct, then the Fed is not as independent as it likes to claim, and if the Fed isn’t independent in its policies, then that means a third tacit mandate for the Fed in the future is to maintain the government’s ability to continue having significant fiscal deficits.

Should One Buy Bitcoin, Gold, and Stocks?

In a future where budget deficits are measured in trillions of dollars, real assets like Bitcoin and gold are likely to perform better.

The unsustainable fiscal situation in the long term makes holding assets that operate outside of the traditional financial system an appealing proposition for investors.

In addition, Bitcoin has other endogenous factors that could act as a catalyst for its price and help push its adoption to new heights in the coming years.

One such factor is the acceptance of new accounting rules by the FASB, which will make it easier for companies to hold Bitcoin on their balance sheets.

Until now, companies were facing difficulties when attempting to put Bitcoin on their balance sheet, due to the way Bitcoin was treated on balance sheets.

Towards a Revolution in Bitcoin Accounting?

Companies have to classify Bitcoin as an intangible asset, which means that if the price of Bitcoin drops, they have to write down its value in their balance sheet, and if the price increases, they cannot record the gain unless they sell the Bitcoin.

In the event of a Bitcoin price drop, those companies face a significant loss of value on their balance sheet. It results in a situation where a company may have to list Bitcoin on its balance sheet below the current market price simply because they hold it.

This accounting update will facilitate the adoption of Bitcoin as a corporate treasury reserve asset.

Industry leaders, like David Marcus, former PayPal President and CEO of Lightspark, have come forward to highlight the significance of this rule change.

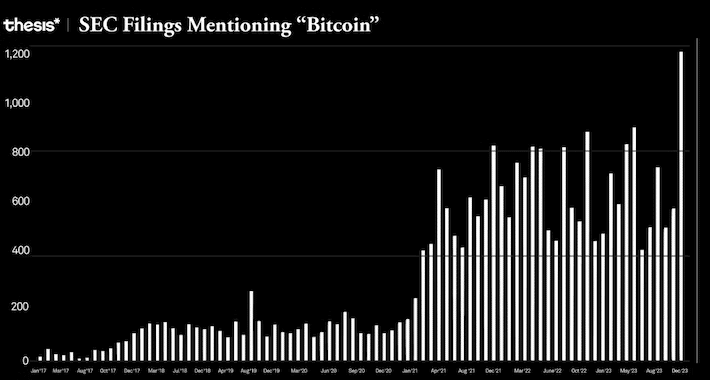

This rule change comes as the recent rise in Bitcoin appears to be on companies’ radars.

In November, SEC filings mentioned Bitcoin over 1,000 times, marking an increase of more than 30% from the same month last year.

Companies Are Poised to Buy Bitcoin

Companies are watching. It’s about to become much easier for them to put Bitcoin on their balance sheets.

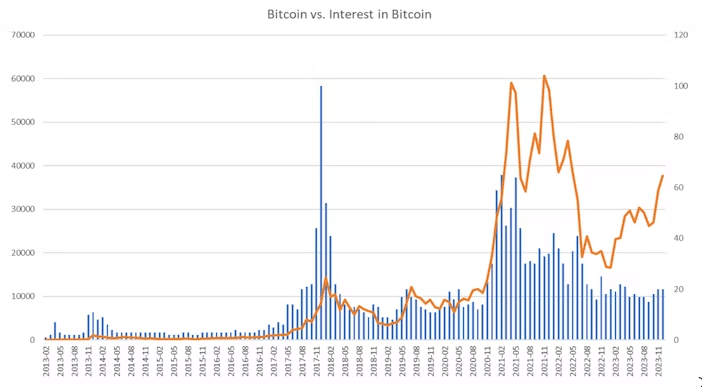

Google Trends Suggest the Imminence of the Bitcoin Bull Run

Despite this positive development, interest in Bitcoin, as measured by Google Trends, remains at levels last seen before the last bull run in 2019.

The general public still seems unaware that Bitcoin has risen by more than 140% from its lowest level last year.

This lack of public interest, despite Bitcoin’s impressive performance this year, suggests we are at the very beginning of this bullish cycle.

It seems that all the conditions are in place for Bitcoin to experience an explosive year in 2024. We have increased institutional adoption, potential ETF approval, the halving, more favorable FASB accounting rules, and the government will likely have to continue to run massive fiscal deficits. It’s only a matter of time before Bitcoin begins to attract public attention, and when that happens, the real bull market will truly begin to gather momentum.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Chaque jour, j’essaie d’enrichir mes connaissances sur cette révolution qui permettra à l’humanité d’avancer dans sa conquête de liberté.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.