The Fed Cools Hopes For A Crisis-boosted Bitcoin

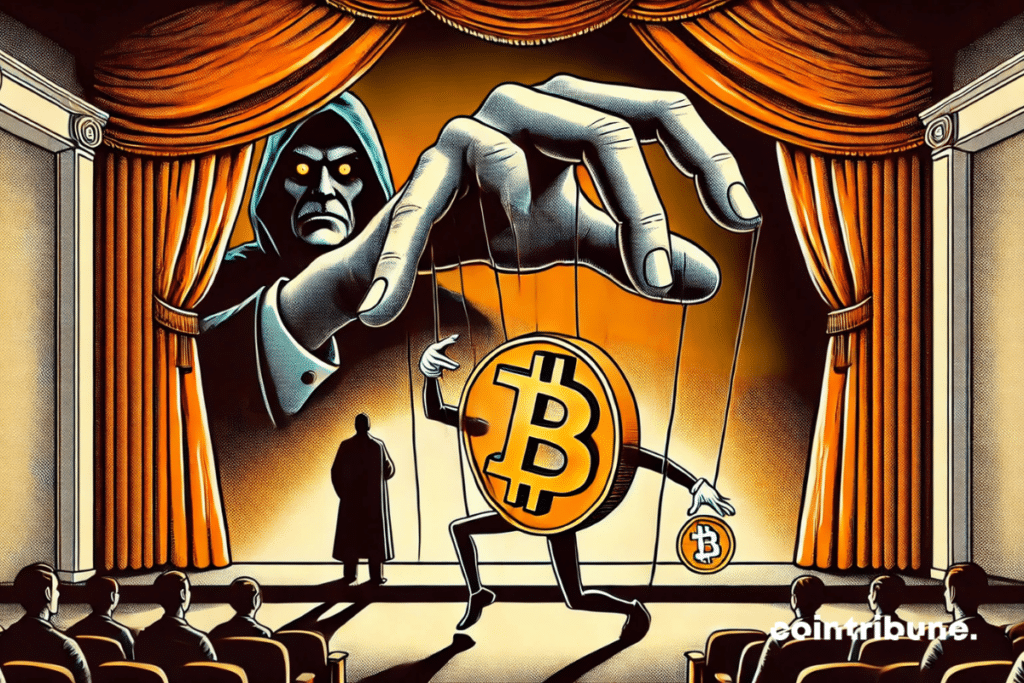

As BlackRock sees the recession as a springboard for bitcoin, the Federal Reserve cools the enthusiasm of crypto. Between bold predictions and economic warnings, the market navigates murky waters.

Why the crisis could boost bitcoin

Robbie Mitchnick, crypto strategist at BlackRock, threw a stone into the pond: a recession would be a “great catalyst” for bitcoin. An iconoclastic reasoning, but rooted in history.

Since 2008, systemic crises have often propelled alternative assets. Stimulus plans, low rates, and the explosion of public deficits traditionally fuel distrust towards fiat currencies. Bitcoin, perceived as “anti-crash insurance”, would benefit from this.

Yet, this optimistic perspective masks a darker reality. Mitchnick also mentions the risks of “social disorder” in the event of a recession.

An explosive variable, often absent from economic models. Bitcoin, a refuge in times of chaos, could capitalize on the collapse of trust in institutions. A hypothesis reminiscent of its rise during the lockdowns of 2020, where it surged against massive monetary printing.

BlackRock doesn’t stop there. Larry Fink, its CEO, openly links Trump’s trade policies to a risk of stagflation. For him, bitcoin embodies a hedge against this nightmarish scenario.

An audacious bet, even as the price dropped to $85,000 after peaking at $110,000 in January. Volatility remains king, but BlackRock’s bitcoin ETFs, which hold $50 billion, prove that the institution believes in the maturation of the market.

The Fed strikes back: a warning that cools crypto enthusiasm

Jerome Powell, chairman of the Fed, recently tempered enthusiasm. “The risks of recession have increased but remain moderate,” he stated, highlighting stubborn inflation and frozen interest rates.

A cautious speech, but heavy with implications: the Fed does not plan to play savior with hasty rate cuts. For bitcoin, often boosted by cheap credit, this is a brake.

Economists agree on this. Mark Zandi of Moody’s points to Trump’s tariffs, calling them accelerators of an “inevitable” recession. Clement Bohr from UCLA goes further: the Trump administration could lead to a “deep” crisis. These alerts, coupled with recent bitcoin turmoil, illustrate a dilemma: Does bitcoin thrive because of crises… or despite them?

In this context, bitcoin ETFs appear as an ambiguous barometer. Despite their meteoric success — $100 billion in assets in November — their growth has slowed since the Fed’s warnings. Institutional investors, torn between appetite for bitcoin and macroeconomic caution, adopt a sawtooth strategy. Nevertheless, BlackRock remains steadfast: its bet on a “recessionary bitcoin” remains intact, defying skeptics. Meanwhile, large investors are taking positions.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Fascinated by Bitcoin since 2017, Evariste has continuously researched the subject. While his initial interest was in trading, he now actively seeks to understand all advances centered on cryptocurrencies. As an editor, he strives to consistently deliver high-quality work that reflects the state of the sector as a whole.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.