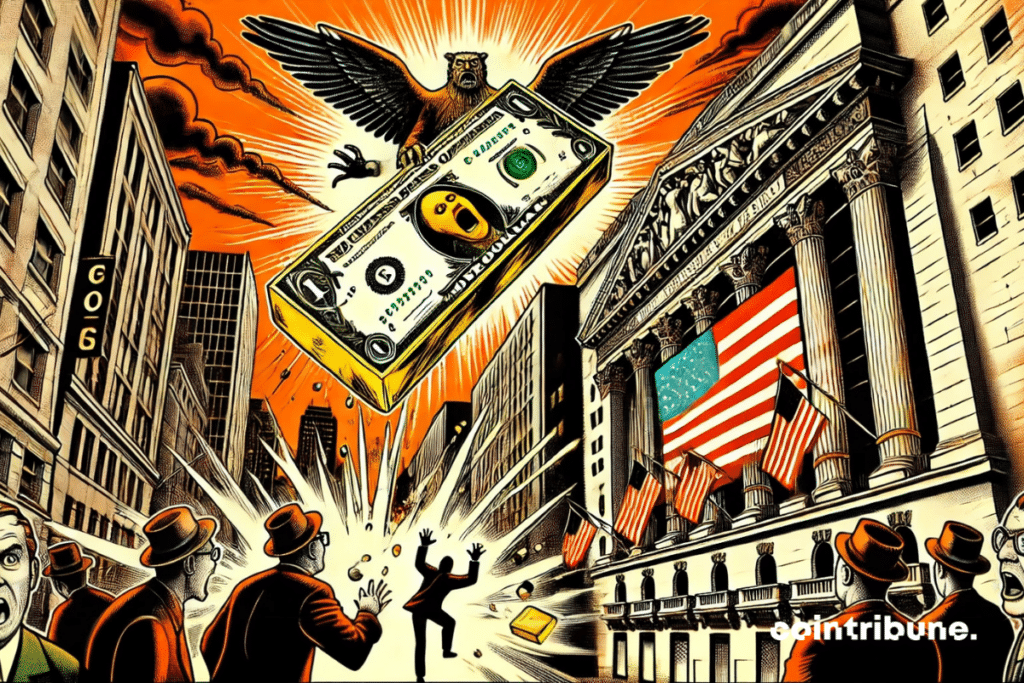

Dollar Decline, Gold Surge: Global Economy Under Pressure

April 21, 2025 marks a turning point for the global economy. The dollar plunges, gold soars, and indices waver. A look back at a revealing day of current economic fragility!

In Brief

- The dollar drops sharply, while gold reaches a peak.

- Global markets react in a mixed order.

The American Economy Under Pressure, Asia Shows Resilience

The American currency is losing ground against major currencies. The dollar has indeed reached a three-year low. This decline illustrates the doubts hanging over the health of the American economy. Currency traders now favor assets considered more stable.

The American indices are also falling sharply. Nasdaq, S&P 500, and Dow Jones have dropped by about 2.4%. These decreases reflect the tensions shaking the U.S. market. Nervousness is rising. Operators fear a lasting slowdown in activity.

In Asia, the atmosphere remains calmer. The Shanghai Stock Exchange rises slightly, while Tokyo and Seoul limit losses. This contrast illustrates the diversity of regional economic dynamics. Asian markets assert themselves as pillars of stability in the face of Western shocks.

Upstream, gold confirms its status as a safe-haven asset. It breaks a record above 3,485 dollars an ounce. This surge reflects investors’ concerns about a global economy seeking benchmarks. The Swiss franc and the yen also climb, indicating a massive retreat toward defensive assets.

Towards a New Map of the Global Economy?

The repositioning of capital is becoming evident. Flows are leaving American assets to head toward areas perceived as less exposed to economic turbulence. This recomposition reflects a defensive strategy by fund managers.

JPMorgan even paints a bleak picture. Their projections indicate a probability of recession greater than 90%. Such a scenario would disrupt global financial balance. But not only that! It would also redefine the priorities of major economic powers.

One thing is certain! The financial markets send a clear signal: confidence is wavering. The global economy is thus entering a phase of caution, marked by rising uncertainties. Meanwhile, Swiss franc, yen: these assets regain a central role. Investors have every interest in reorganizing their portfolios to face a less supportive economic cycle.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

My name is Ariela, and I am 31 years old. I have been working in the field of web writing for 7 years now. I only discovered trading and cryptocurrency a few years ago, but it is a universe that greatly interests me. The topics covered on the platform allow me to learn more. A singer in my spare time, I also cultivate a great passion for music and reading (and animals!)

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.