The Crypto Market No Longer Follows Its Classic Cycles According To The Founder Of Polygon

A great thinker once said that by walking, one discovers the way. With cryptocurrencies, nothing is ever fixed. The crypto market follows its own rules, often ephemeral and sometimes unpredictable. The certainties of yesterday become the doubts of today. Amid geopolitical changes, economic cycles, technological breakthroughs, and tweets that shake the Nasdaq, everything can change… or remain desperately the same. But if historical benchmarks wobble, can we still believe in the four-year cycle?

Bitcoin Halving: promises down, stability up?

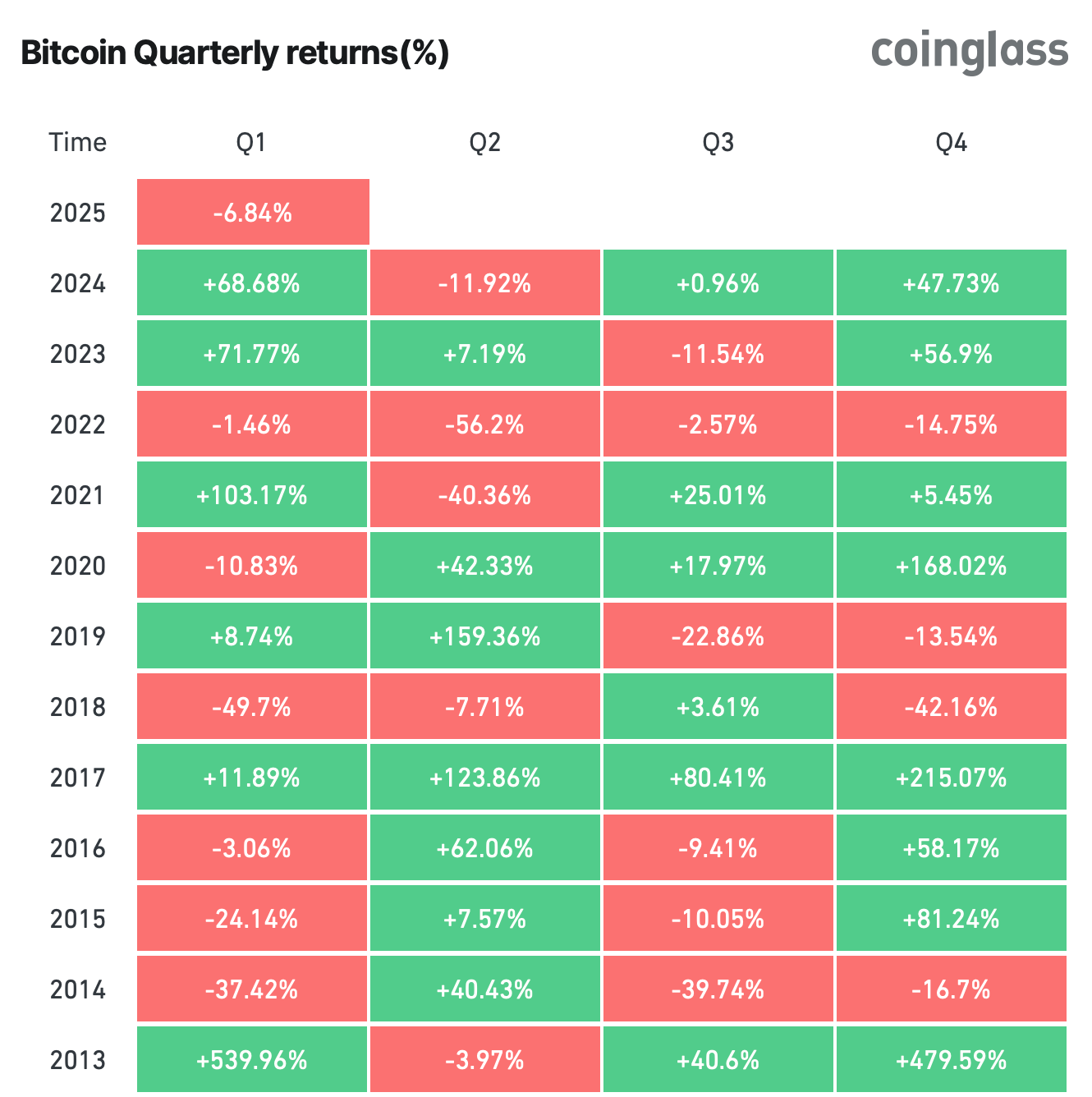

The promises of Bitcoin halving have long resonated like a prophecy in the crypto world. Every four years, the miners’ reward is halved. This newfound rarity, meant to support the BTC price, has often preceded a bull market.

But according to Sandeep Nailwal, co-founder of Polygon, this model is starting to tire.

He claims that “market corrections have become less brutal, around 30 to 40%,” far from the -90% of previous cycles. According to him, the rise of institutional players and the maturation of the crypto market contribute to this stabilization.

We are witnessing less roller coasters and more of a winding path, sprinkled with gentle slopes and unexpected turns.

- The Bitcoin price drops less severely during bear phases;

- Bull markets are longer but less explosive;

- ETFs bring stability and visibility to BTC;

- Flows concentrate on the top tier of cryptos.

Can we then talk about the end of a cycle or simply a cycle in mutation?

Analysts debate: is the crypto cycle broken or just muddled?

For some analysts, the 4-year cycle still has a lot to offer. The platform Crypto.com reminds us of the four classic phases: accumulation, rise, distribution, fall. This scheme has worked well in past Bitcoin cycles. However, some voices are rising to nuance this. Analyst Miles Deutscher, for example, thinks that bull markets are now more spread out.

Accumulation does not always lead to an immediate rise.

He also notes that flows first head towards BTC, then towards Ethereum, and finally towards altcoins, following a progressively desynchronized rotation. This weakens the idea of a regular cycle.

Other experts mention a crossroads. The Bitcoin halving rally is no longer as mechanical as it used to be. Several parameters are muddling the waters: persistent inflation, high interest rates, institutional adoption, financial derivatives. Even the BTC dominance data shows a stronger concentration of capital on just a few assets.

Consequently, the classic crypto cycle no longer seems as readable. But is it the natural evolution of a growing market or the sign of a deep disruption?

Perspectives: adapt your benchmarks to a changing crypto market

It is clear that the crypto market of 2025 is no longer that of 2013 or even 2017. The entry of institutional investors has changed the game. Derivative products, such as Bitcoin ETFs, now weigh heavily on price dynamics.

The collective euphoria has given way to calculated caution.

Moreover, macroeconomic conditions do not facilitate the emergence of a classic bull market. Rates remain high, liquidity remains low, and the United States is watching. Yet, volumes are not collapsing. BTC holds steady, anchored around $84,000 these past few days. The bear market has not disappeared, but it seems less fierce.

On X, Miles Deutscher encapsulates this sentiment well:

The cycle is not dead; it has become more blurred.

Perhaps that is the reality of the crypto game today: a treasure hunt where the markers fade one by one.

- Bitcoin ETFs drain more than $1 billion per week;

- BTC dominance is nearing 54%, a record since 2021.

The market is changing; this is a fact. But how do you chart your course when old models become obsolete? Analysts already agree that the Bitcoin halving of 2024 did not have the expected effect. According to a recent analysis, the anticipated rise in BTC is slow to materialize. The classic scenario “halving then bull run” is losing steam. Investors must now think beyond cycles, relying on a finer reading of economic data and market behaviors.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

La révolution blockchain et crypto est en marche ! Et le jour où les impacts se feront ressentir sur l’économie la plus vulnérable de ce Monde, contre toute espérance, je dirai que j’y étais pour quelque chose

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.