The crypto collapses! The market loses $160 million in 24 hours!

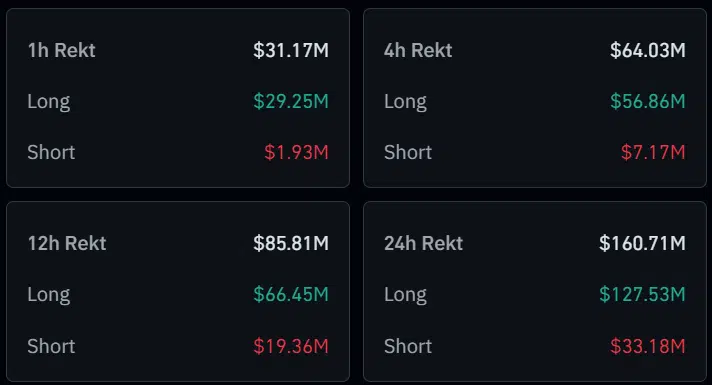

The wind is changing again in the crypto markets. In just a few hours, significant liquidation movements swept through the ecosystem, reaching a substantial total of 160 million dollars. Another reminder, if one was needed, of the unpredictable nature that continues to define this promising young sector.

Crypto: Massive Liquidations, Symptom of an Unpredictable Market

The data is clear: in the span of 24 hours, more than 160 million dollars of open positions were wiped from the crypto market. Bitcoin alone saw nearly 20 million dollars go up in smoke. But it is Ethereum that takes the crown for liquidations with an abyssal amount of 27.8 million dollars annihilated. A shock all the more severe as ETH’s price had recently set new highs, boosted by the approval of spot ETFs in the United States.

However, beyond the mastodons, this tidal wave spared no actor. Many smaller projects were hit hard by these chaotic movements. Such as Notcoin, whose nearly 6.2 million dollars of positions were wiped out in record time. In short, the numbers speak for themselves: volatility remains a major challenge for the entire crypto ecosystem, regardless of capitalization.

The Controversial Role of Major Centralized Platforms

While these recent market convulsions well illustrate the general immaturity of the market, we must not obscure the central responsibility of major crypto exchange platforms. Leading this intense quartet, Binance stands as the epicenter of the latest wave of liquidations with 75.8 million dollars of positions undone in just 24 hours. An astronomical figure that alone represents nearly half of the purges suffered across all cryptocurrencies.

Behind Binance, other heavyweights are equally impacted by this speculative tidal wave. Leading the pack are OKX with 53.9 million in liquidations, followed by Bybit (14.2 million) and Huobi (11.3 million). In the end, these four major centralized exchanges concentrate the bulk of the damage, crystallizing by themselves the excess risk exposure that plagues the crypto asset market.

Without a doubt, the recent turmoil has been an uncompromising revealer of the still prominent immaturity in the crypto market. However, rather than sounding the death knell for an emerging technology, these upheavals call for continuing the sector’s transformation towards greater maturity and stability. A titanic challenge, indeed, but essential to ensure the sustainability of digital assets as a real alternative to traditional financial systems.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The world is evolving and adaptation is the best weapon to survive in this undulating universe. Originally a crypto community manager, I am interested in anything that is directly or indirectly related to blockchain and its derivatives. To share my experience and promote a field that I am passionate about, nothing is better than writing informative and relaxed articles.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.