The BRICS Unveil Their Revolutionary Payment System: Soon The End Of The Dollar Monopoly?

On the occasion of the BRICS Business Forum, the nations of this emerging alliance unveiled their brand new cross-border payment system: BRICS Pay. This initiative marks a deliberate effort to reduce dependency on the U.S. dollar, a currency still predominant in global transactions. As the BRICS seek to free themselves from the financial influence of the United States, the creation of an autonomous payment system could redefine the rules of international trade.

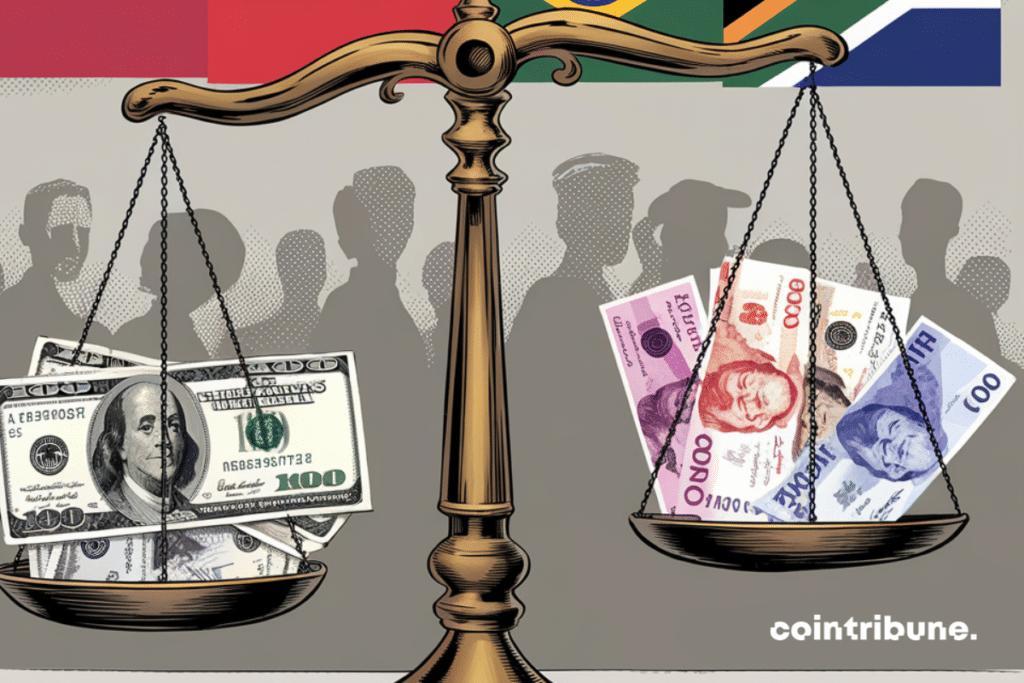

A response to the dominance of the dollar

For several years, the member countries of the BRICS have been striving to find an alternative to the U.S. dollar in their international trade. The launch of BRICS Pay is part of this de-dollarization strategy, particularly supported by Russia and China. Indeed, during the official announcement, Valentina Matviyenko, President of the Russian Federation Council, clearly expressed this desire: “BRICS Pay is no longer just an idea, it is a concrete project that is rapidly advancing.” The objective is to reduce the influence of the dollar, which still represents 58% of international payments outside the euro zone in 2022. This dominance of the dollar, coupled with economic sanctions imposed by the United States on countries like Russia, has strengthened the BRICS’ determination to set up a more resilient cross-border payment system.

The new system relies on financial infrastructures already installed in each country, such as the Mir network in Russia or the Unified Payment Interface (UPI) in India. Thanks to the compatibility of systems within a single platform, the BRICS aim to facilitate transactions without going through traditional financial circuits dominated by the West. Russian Finance Minister, Anton Siluanov, also emphasized that BRICS Pay would be “based on advanced technologies, allowing faster and cheaper foreign commercial transactions, without external interference.” A first public demonstration took place this week in Moscow, and heralds what could become this alternative to SWIFT.

A blockchain-based solution and beyond

In addition to freeing themselves from the dollar, BRICS Pay could also redefine the landscape of international payments through the integration of blockchain. According to available information, the BRICS cross-border payment system could use this technology to validate transactions, ensuring fast, transparent, and secure exchanges between member nations. Russian Minister Anton Siluanov stated that this system “would leverage blockchain to validate transactions and ensure efficient payments between countries.” This would allow the BRICS to reduce costs related to international trade, in order to free themselves from the monopoly exerted by traditional platforms like SWIFT.

Moreover, this technological advancement also opens the door to interesting prospects. Through the creation of a decentralized payment ecosystem, BRICS Pay could not only be adopted by member countries but also serve as a model for other nations seeking to reduce their dependence on the United States and the West. The project could also evolve to integrate a digital wallet capable of handling various blockchain networks and bank accounts, further facilitating the management of cross-border transactions. However, the success of BRICS Pay will depend on its ability to establish itself as a credible and viable alternative to existing systems.

The launch of BRICS Pay constitutes a significant milestone in the BRICS de-dollarization strategy. If this blockchain-based cross-border payment system manages to deliver on its promises, it could not only redefine trade between these nations but also threaten the dominant position of the dollar on a global scale. In the longer term, BRICS Pay could become an indispensable solution for many countries wishing to break free from American influence on international trade. However, it remains to be seen whether this initiative will succeed in establishing itself and disrupting the current global financial order.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Diplômé de Sciences Po Toulouse et titulaire d'une certification consultant blockchain délivrée par Alyra, j'ai rejoint l'aventure Cointribune en 2019. Convaincu du potentiel de la blockchain pour transformer de nombreux secteurs de l'économie, j'ai pris l'engagement de sensibiliser et d'informer le grand public sur cet écosystème en constante évolution. Mon objectif est de permettre à chacun de mieux comprendre la blockchain et de saisir les opportunités qu'elle offre. Je m'efforce chaque jour de fournir une analyse objective de l'actualité, de décrypter les tendances du marché, de relayer les dernières innovations technologiques et de mettre en perspective les enjeux économiques et sociétaux de cette révolution en marche.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.