PUTIN: "We are currently fighting for the freedom not only of Russia but of the entire world. We openly declare that the dictatorship of a hegemon – now apparent to all – is becoming decrepit." pic.twitter.com/gATFGtiD2u

— COMBATE |🇵🇷 (@upholdreality) November 28, 2023

A

A

The Architect of the Petrodollar is No More

Fri 01 Dec 2023 ▪

6

min read ▪ by

Getting informed

Summarize this article with:

Henry Kissinger, the Machiavellian architect of the petrodollar, has passed away at the age of 100.

From the Quincy Pact to the Petrodollar

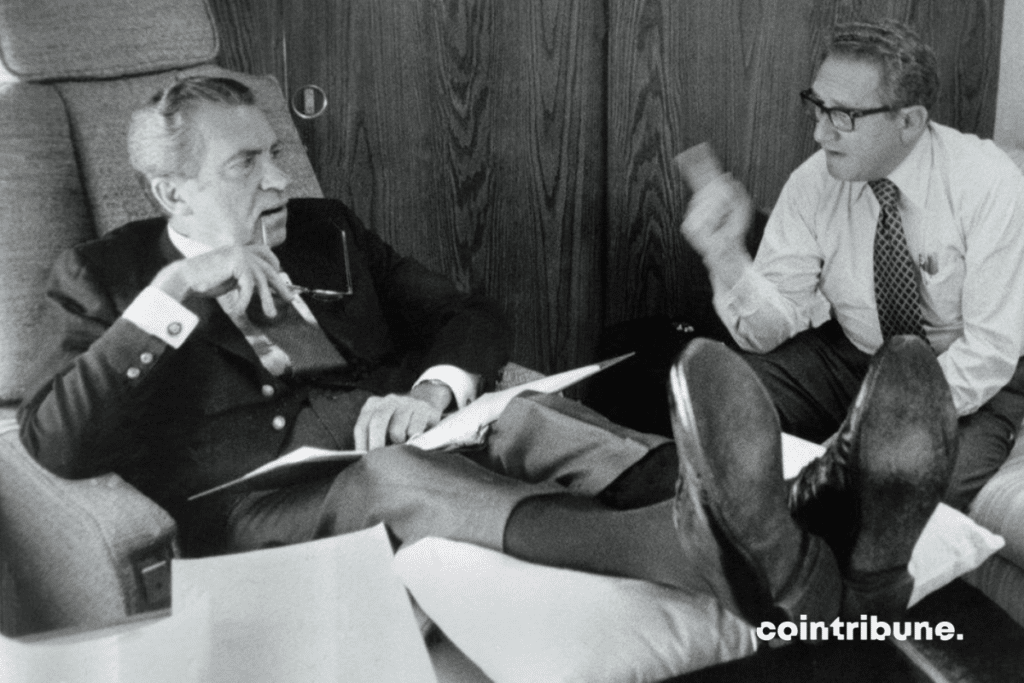

Henry Kissinger became Secretary of State under President Richard Nixon in 1973. That is, just two years after the end of the gold standard.

The collapse of the international monetary system established in 1944 at Bretton Woods should have dug the grave of the dollar. But that was without counting on Henry Kissinger and his brilliant geopolitical poker move: the petrodollar…

Indeed, the beginnings of the petrodollar date back to 1945, when American President Roosevelt, returning from the Yalta Conference with Stalin and Churchill, met with King Abdul Aziz aboard the USS Quincy.

This meeting was later called the Quincy Pact. Kranklin Roosevelt secured a guarantee from Saudi Arabia to supply American energy needs for 60 years.

Owing to current events, it is worth noting that the American president had to promise not to allow the creation of a Jewish state in Palestine. Unfortunately, or fortunately depending on one’s view, Roosevelt died two months later and his successor Harry Truman, hand in hand with the British, recognized the State of Israel immediately after its creation.

Despite this betrayal, Saudi Arabia did not sever ties. It needed Washington to counter the growing popularity of Nasser in Egypt. His pan-Arab socialist policy was indeed an existential threat to the Saudi monarchy. The United States saw an opportunity to counter the USSR, which was then allied with Cairo.

But let’s focus on H. Kissinger.

The Masterstroke

His poker move took place in June 1974 during a meeting with King Faisal bin Abdul Aziz in Saudi Arabia. It was the climax of a Machiavellian plan rooted in the Israeli-Arab War of Yom Kippur (1973).

At the time, Kissinger convinced President Nixon to intervene in favor of Israel. Henry Kissinger was indeed Jewish. In retaliation, Saudi Arabia raised the price of a barrel of oil from $3 to $12.

This is exactly what Henry Kissinger wanted, who ended up simply threatening Saudi Arabia to use force to address what he then called the “strangulation of the industrialized world”. It wasn’t a bluff. The London Sunday Times revealed in February 1975 the existence of operation “Dhahran Option Four” which envisioned invading Saudi Arabia.

King Faisal heard these drumbeats loud and clear and, by the end of 1974, reached an agreement with Kissinger, who promised unlimited arms sales and a return of Israel to its 1948 borders.

In exchange, the kingdom had to commit to two things:

- To sell its oil EXCLUSIVELY in dollars,

- To invest its dollar surpluses in US debt.

The petrodollar was born, thanks to H. Kissinger, who was undoubtedly a key player in the special relationship that the United States maintains with Israel.

The European nations that had the audacity to exchange their dollars for gold were forced to accumulate dollars again to buy the oil essential to any industrialized nation. Checkmate.

As for the agreement on Israel’s borders, it was quickly forgotten after the assassination of King Faisal a few months later…

Enter Bitcoin

Thanks to H. Kissinger, the dollar has been forcibly imposed as the quintessential international reserve currency.

Even today, 58% of reserves held by central banks are in dollars. This allows Uncle Sam to enjoy a chronically negative trade balance without the dollar depreciating.

The reason being that central banks reinvest their dollar reserves in the US public debt. In other words, the dollars that the United States spends by going into debt to pay for their hefty imports come back home, preventing the dollar from depreciating. Such is the famed exorbitant privilege of the empire.

Several countries have tried to sell their oil in a currency other than the dollar. Iran and Iraq, notably. Without success…

This monetary hegemony is, however, seriously threatened. Russia’s military demonstration apparently triggered a global defiance against the greenback. The “freezing” of $300 billion (and euros) did not go unnoticed either.

As the Russian president recently stated:

More and more nations, led by the BRICS, are moving away from the dollar, also galvanized by the rise of China.

The Middle Kingdom is at the forefront, as evidenced by the 40% decrease in its dollar reserves since 2014. The recent signing of a currency swap of 50 billion yuan between Saudi Arabia and China is another nail in the coffin of the petrodollar.

The scarcity of energy and geopolitical tensions are stoking inflation and sweeping away certainties. In this context, the world is looking for a new store of value, and the fact that gold is at an all-time high is a telling sign.

The barbarous relic, however, has competition. Stateless, uncensorable, and an absolute store of value, Bitcoin is poised to become the next international reserve currency.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

A

A

Bitcoin, geopolitical, economic and energy journalist.

DISCLAIMER

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.