The American Economy Facing Inflation: What Do The September Figures Hide?

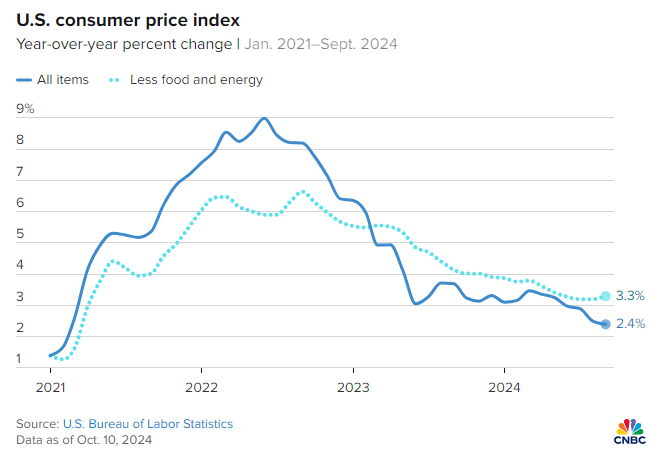

The barons of the American Central Bank can be satisfied: their relentless efforts against inflation seem to be paying off. In September, the figures showed a slight drop in inflation to 2.4%, a figure below expectations. However, behind these seemingly reassuring statistics, other data disrupts the economic picture. Indeed, the labor market shows unexpected signs of weakness, leaving room for doubts about future stability.

Inflation: between decline and persistent concerns

Inflation, which was 2.5% in September, finally reached 2.4%, a figure certainly below predictions, but worthy of close examination. Granted, the drop in energy prices, down 1.9%, contributed to this lull.

But beware, the increase in food and housing prices has been a spoiler: +0.4% for food and +0.2% for shelters. More worrying still, core inflation, which excludes these volatile categories, remains at 3.3%, a figure more difficult to tame.

So, why this persistence? The answer might well hide in the subtleties of the market. Despite slowing inflation, some sectors like medical care (+0.7%) and clothing (+1.1%) continue to see their prices rise.

It’s important to remember that more than a third of the inflation calculation rests on housing costs, and these, although down 4.9% over the year, remain higher than expected.

Key elements of this inflation:

- Increase in food prices: +0.4%;

- Decrease in energy prices: -1.9%;

- Prices for used vehicles: +0.3%.

Needless to say, despite the effectiveness of the Fed’s policies, some inflation trends remain stubborn, partly due to external factors such as climate events and supply chain disruptions.

Economy: Shocks in the employment market

While inflation seems to be stabilizing, the labor market is starting to wobble. The number of unemployment benefit claims reached 258,000 for the first week of October, a surprising increase compared to previous weeks. The reasons include the double hit of Hurricane Helene and the Boeing workers strike. These two events have heavily impacted certain states, notably Florida and Michigan, where unemployment figures have surged.

This casts doubt on the short-term solidity of the American economy. Upon closer inspection, experts wonder if this fragility could hinder the upcoming interest rate cuts planned by the Federal Reserve. As a reminder, it observed a 50 basis points decrease at the beginning of September.

With a weaker labor market than expected, it might risk reducing rates too quickly, even though some predict that it remains inevitable by November.

Moreover, while monetary policies seem to have a positive impact on inflation, it is becoming increasingly clear that other aspects of the economy, such as consumption, might be affected. The prices of used cars and healthcare continue to rise, and household spending, although less volatile than energy or foodstuffs, could be hampered by the rise in unemployment.

Thus, despite encouraging signs, some analysts surprisingly suggest that we should love inflation. Paradoxical, isn’t it?

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

La révolution blockchain et crypto est en marche ! Et le jour où les impacts se feront ressentir sur l’économie la plus vulnérable de ce Monde, contre toute espérance, je dirai que j’y étais pour quelque chose

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.