Altcoins on the attack! Bitcoin falters, XRP soars: an unprecedented crypto redistribution is beginning, under the worried gaze of investors.

XRP (XRP)

XRP, the cryptocurrency from Ripple, is generating a lot of interest at the end of 2024. According to forecasts, the price of XRP could reach new heights in December 2024! Discover the experts' predictions and the key factors that could propel this crypto to new records, despite the challenges in the market.

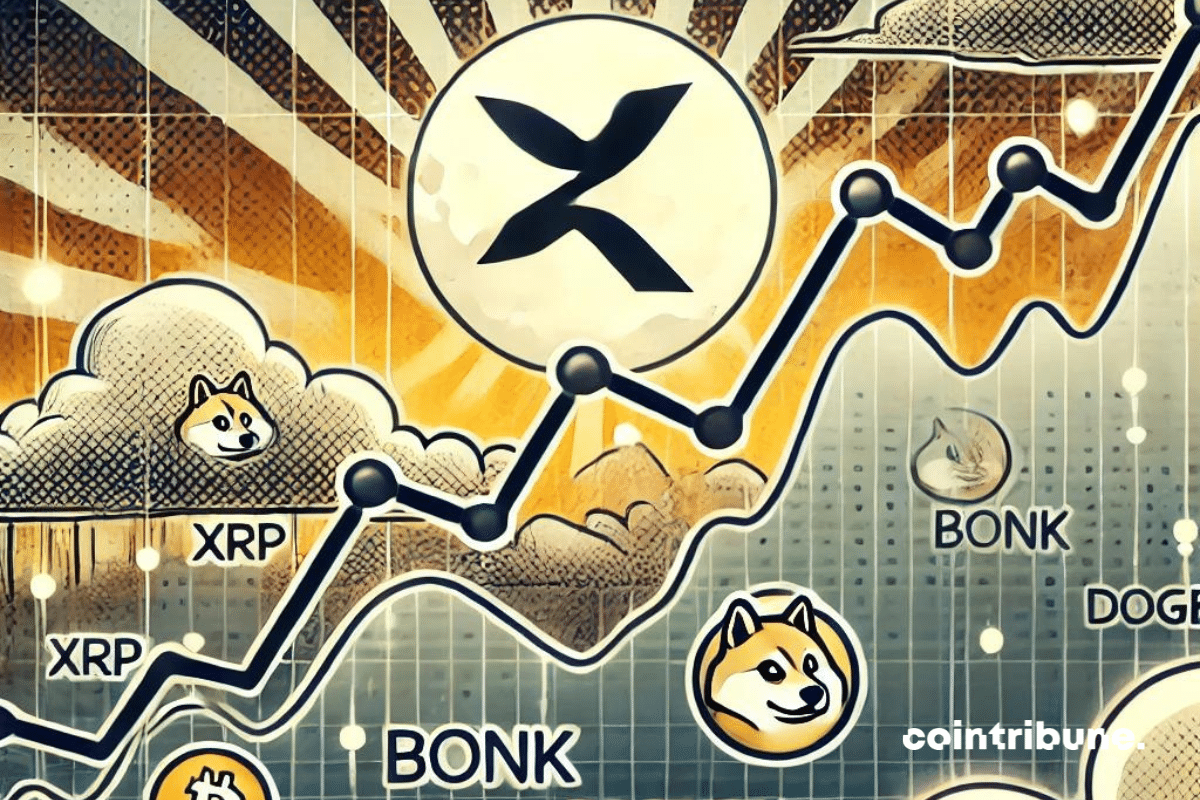

Under the spotlight of the Golden Cross, XRP is spinning. Bitcoin, beware: the tide seems to be turning!

The Bitcoin giant is faltering, and the altcoins, previously relegated to the sidelines, are making a thunderous entry onto the crypto scene.

XRP, the cryptocurrency of Ripple, has recently experienced a spectacular surge, increasing by more than 30% in just 24 hours to reach around $1.45. Several key factors could propel the price of XRP to $10 in the near future.

Ripple plays political dominos: a hint of Trump, a splash of scandal, and XRP does flips.

The crypto market has been on fire in recent days, with a spectacular 39% increase in XRP, now valued at $0.80. This dizzying rally is driven by speculation related to a potential shake-up at the head of the Securities and Exchange Commission (SEC). As rumors of its chairman, Gary Gensler's resignation surface, investors seem to anticipate a regulatory easing that could transform the crypto ecosystem.

XRP rebounds at the bottom of its consolidation and registers a performance of 50%. Let’s examine the upcoming prospects for its price. XRP Situation After reaching a peak of $0.93 in July 2023, XRP entered a long consolidation phase within a range roughly between $0.75 and $0.43. Recent fluctuations show…

As the crypto market potentially prepares for a new bull run, investors are closely examining projects that offer exceptional performance as well as solid and innovative use cases. In this volatile universe, cryptocurrencies like Solana (SOL), Cardano (ADA), and XRP could stand out, as they combine speed, scalability, and adoption in the financial sector.

Amid revolutionary announcements, technological developments, and regulatory upheavals, the crypto ecosystem continues to prove that it is both a territory of limitless innovations and a battleground of regulatory and economic conflicts. Here is a summary of the most notable news from the past week surrounding Bitcoin, Ethereum, Binance, Solana, and Ripple.

21Shares has just filed a spot ETF application for XRP with the SEC, becoming the third major player to attempt to introduce this type of financial product in the U.S. crypto market.

While the market is experiencing a resurgence, Ripple's cryptocurrency unfortunately stands out due to significant stagnation. If the soaring prices of Bitcoin and other altcoins invigorate traders' enthusiasm, XRP seems unable to keep up with the trend. Once among the most promising cryptos, it now shows the worst performance in the top 10 of the market.

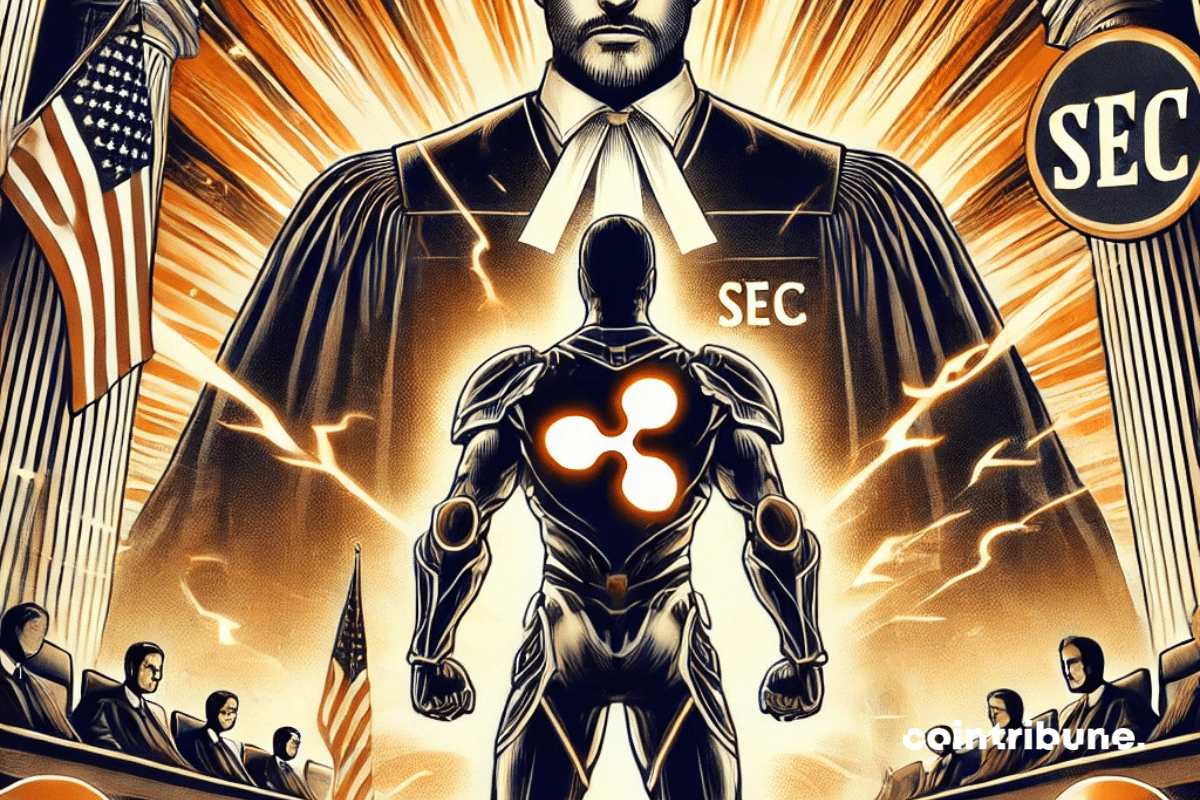

The crypto giant Ripple is intensifying its legal battle against the SEC by filing an appeal that could redefine the regulation of digital assets in the United States. This new phase of the conflict comes as the company challenges the classification of some of its XRP sales as unregistered securities.

In the shadow of the American elections, Chris Larsen from Ripple slides 10 million XRP to Kamala Harris, causing a stir in political and crypto ranks.

XRP experienced a decline of nearly 2% in just 24 hours. Indeed, it is the strategic movements of whales that are shaking the market. Their influence on prices is not negligible and can shift predictions in an instant. Yesterday, Friday, October 18, 2024, the massive sales of several million tokens by these key players reminded us of how fragile market dynamics can be.

To court the crypto electorate, Harris receives a nice "gift" from Ripple: one million in XRP. An unselfish donation?

The world of cryptocurrencies is ruthless. While some projects emerge with brilliance, others struggle to convince or sink into obscurity. This harsh reality is what Max Keiser, an iconic figure of Bitcoin maximalism, bluntly reminds XRP holders. With a statement as sharp as it is expected, he announces that "the XRP rally will never happen," attacking Ripple's cryptocurrency once again. While the XRP community still hopes for a rebound, the latest developments in the lawsuit against the SEC continue to weigh down its price. Nevertheless, optimistic voices persist and bet on a potential technical reversal.

Under the sun of the SEC, no shadow for the XRP ETF: the crypto market waits, Bitwise is brooding.

As the crypto market goes through a correction phase, some assets appear ready to reverse the trend and make a strong comeback. Among them, XRP, Aptos, and Chainlink stand out, offering investors strategic opportunities despite an increased volatility context.

XRP has fallen by more than 15% and is now at $0.51! Several factors could drive the cryptocurrency to collapse further.

Q4 2024 could witness an incredible explosion of XRP. However, its rival is preparing for a leap of 3,500% that could disrupt the crypto universe!

Bitwise sorts the heavy artillery with an XRP ETF, but the SEC is slower than a turtle on vacation.

Ripple releases 1 billion XRP, saving XRP from a 4.26% drop in 24 hours and stabilizing the crypto market.

According to recent movements, the crypto company Ripple may soon unveil its stablecoin RLUSD. Details in this article!

As the market goes through a volatile period, XRP, Bonk, and Dogecoin are at the center of attention for various reasons. XRP, after its partial victory against the SEC, is rekindling hope among investors, although the shadow of a potential appeal continues to loom. Meanwhile, Bonk, an emerging player in the Solana ecosystem, and Dogecoin, the iconic memecoin, are struggling to maintain their technical support in the face of uncertain market dynamics.

Amid revolutionary announcements, technological advancements, and regulatory upheavals, the crypto ecosystem continues to prove that it is both a realm of limitless innovations and a battleground of regulatory and economic challenges. Here is a summary of the most significant news from the past week surrounding Bitcoin, Ethereum, Binance, Solana, and Ripple.

61 Japanese banks and... still nothing! XRP seems to be moving slowly like a tortoise while adoption is speeding along like a hare.

The world of crypto is once again buzzing after a massive transaction carried out today by Chris LARSEN, co-founder of Ripple. As the market is particularly attentive to the movements of large fortunes, this transfer of several million dollars immediately caught the attention of investors. This type of transaction, rare and unexpected, reignites speculation about the future of XRP, a cryptocurrency that continues to generate as much interest as concern.

The crypto market is experiencing a new bullish phase, driven by encouraging signs of institutional adoption. Bitcoin has crossed back above $60,000, while Ethereum and XRP are recording more modest gains.

In the crypto universe, where each tweet, prediction, or technical analysis can sway the markets, a new forecast is shaking the XRP community. This time, it is not just a publicity stunt or a hype effect, but a quantified hypothesis that could change the game: XRP at 100 dollars. This estimate, proposed by a recognized researcher, is based on the idea that the crypto captures 10% of the daily transaction volume of SWIFT, the giant of interbank payments. A spectacular scenario that raises as much hope as skepticism.