JPMorgan, one of the largest American banks, has just completed a historic transaction: a 50 million dollar commercial paper fully managed on the Solana blockchain. Galaxy Digital, Coinbase, and Franklin Templeton participated in this pioneering operation settled in USDC.

USD Coin (USDC)

Circle, the issuer of the famous USDC, takes a decisive step by developing USDCx, a stablecoin designed to offer banking privacy to companies and institutions. Developed in partnership with Aleo, this project answers a growing demand: how to benefit from blockchain without exposing transactions to the public?

Solana’s lending sector is dealing with one of its most visible internal disputes of the year, raising concerns about how public conflicts may affect trust in the ecosystem. A tense exchange between Kamino Finance and Jupiter Lend has now pulled in Solana Foundation president Lily Liu, who urged both projects to direct their energy toward growing Solana’s overall lending market.

While many eyes remain fixed on Bitcoin and Ether, Solana is currently playing a much subtler game. The SOL crypto still holds above the 120 dollar area, but this level is not just a technical support: it is supported by a real shift in liquidity and on-chain supply. However, trader-side demand remains surprisingly timid. And as long as this gap persists, Solana's structural advantage is not fully reflected in the price.

Momentum around Coinbase is rising as the company enters a new phase of financial stability and public-sector experimentation. Latest data show revenue increasing while costs remain controlled. And as expected, this combination has created a sturdier foundation than in earlier market cycles.

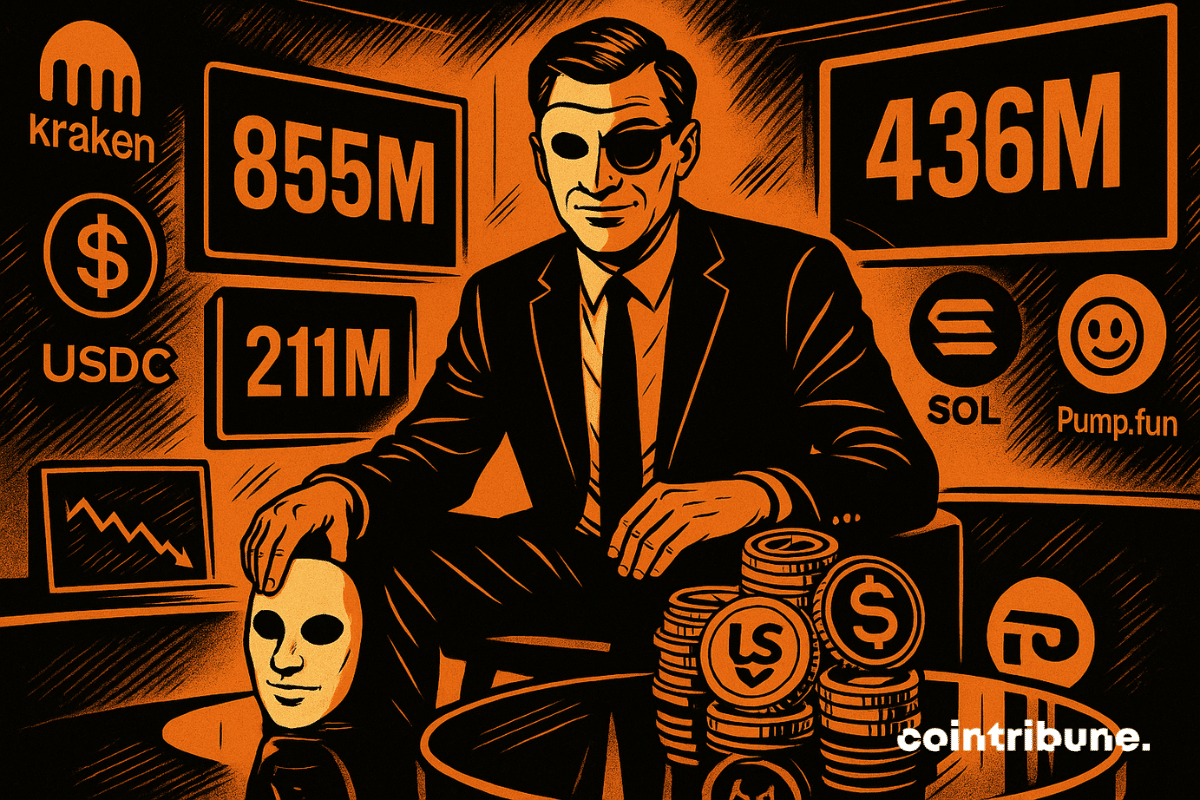

An explosive case shakes the crypto world: Pump.fun accused of siphoning $436M. The founder denies, but doubts remain.

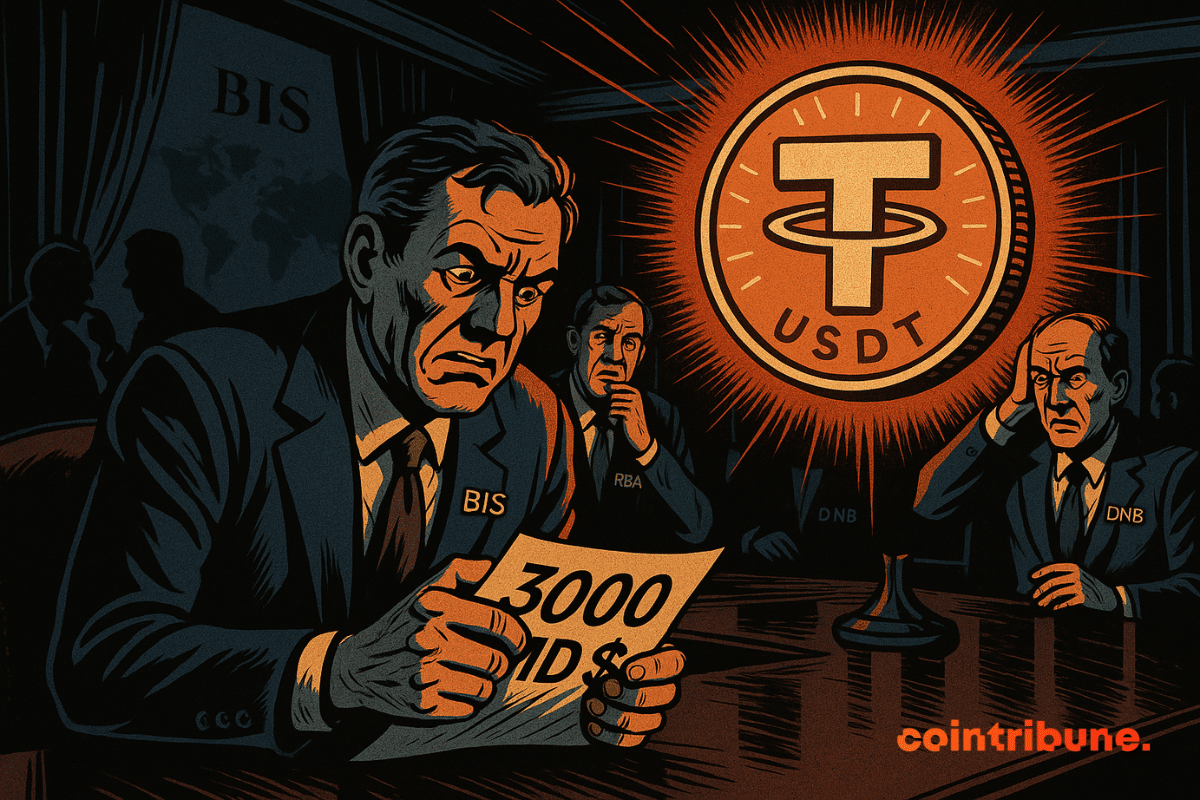

When tokens want to play treasury bonds, the BIS panics. Crypto-confidence or crypto-catastrophe? Finance views stablecoins as a Pandora's box ready to open.

Cash App is preparing one of its biggest updates yet as parent company Block sets a timeline to add stablecoin operations to the platform. New tools for both Bitcoin and digital dollar payments are being prepared for rollout, with early 2026 cited as the target window. Essentially, Block is pushing to expand access to digital payments while keeping Bitcoin at the center of its ecosystem.

Polymarket is regaining momentum after a long cooldown period as trading activity climbs again. User participation is also on the rise, with renewed interest from both crypto-native and mainstream audiences. Recent data shows the platform nearing the trading volumes last seen during the peak activity surrounding the 2024 U.S. elections.

The boundary between crypto and politics is becoming clearer. By now allowing the legal purchase of firearms with USDC, Circle brings the issue of financial neutrality to the forefront. This decision, praised by some and contested by others, reveals tensions between the promise of decentralization and institutional realities, while reigniting the debate on what crypto can or cannot allow within a legal framework.

Ripple’s US dollar–pegged stablecoin, RLUSD, has rapidly climbed the ranks to become one of the top ten stablecoins by market capitalization. Less than a year after its December 2024 launch, RLUSD has surpassed the $1 billion mark—a milestone that reflects growing confidence in Ripple’s expanding digital asset ecosystem.

The cryptocurrency ecosystem has just experienced a major turning point with the announcement of a strategic partnership between Kraken, one of the most respected exchange platforms in the world, and Circle, the undisputed leader in stablecoins. This alliance, formalized in September 2024, promises to transform the user experience for the USDC (USD Coin) and EURC (Euro Coin) stablecoins on the Kraken ecosystem.

Coinbase, the well-groomed crypto exchange, is cooking up a Base token. JPMorgan sees billions there. Should we worry when banks applaud tokens they do not control?

Wall Street trembles, BlackRock applauds, and the dollar digitalizes without asking the Treasury's opinion… Stablecoins are taking hold, while crypto weaves its planetary monetary web.

The third quarter of 2025 marked a major milestone for the stablecoin market, reflecting growing global adoption and institutional use. Fueled by record DeFi activity and greater regulatory clarity, stablecoins reached historic highs in both supply and transaction volume, solidifying their role as a core pillar of the digital asset economy.

When Christine Lagarde brings down the regulatory hammer, even the crypto giants tremble. The digital euro advances masked but clearly targets stablecoins too comfortable in Europe...

Recent chatters within crypto chat rooms indicate that prediction platforms Polymarket and Kalshi are exploring ways to raise capital, with Polymarket aiming for a higher valuation than Kalshi. Interestingly, this comes as decentralized betting begins to catch the eyes of top firms within the crypto space.

In the crypto arena, Binance sits like a central banker: 67% of stablecoins under lock. Historic record, guaranteed concern, and dry powder ready to explode.

While some still dream of Bitcoin at $200,000, Mastercard slips the USDC under the rug and pays the bill in stablecoin... Quietly, but surely.

The announcement of the launch of mUSD, Metamask's native stablecoin, marks a strategic milestone for the crypto ecosystem. Indeed, by partnering with Bridge, a Stripe subsidiary, and the decentralized infrastructure M0, Metamask is not just adding a feature: it is reshaping the contours of decentralized finance as we know it.

Digital assets have transcended the corridors of financing, entering the realm of space exploration. In a recent update, Jeff Bezos’s Blue Origin has joined forces with American firm Shift4 Payments to offer crypto payment services for expeditions to outer space.

The future of stablecoins is taking shape in this colorful and often unpredictable world of cryptos. Records are breaking one after another, driven by massive adoption and piling innovations. And while some see it as a simple fad, others bet that this wave will not stop anytime soon. The numbers speak for themselves... and they have rarely been so eloquent.

In 2024, salaries paid in crypto have tripled, marking a decisive turning point in the digital work landscape. Nearly 10% of professionals in the sector are now paid in stablecoins, notably USDC. This is a sign that crypto is establishing itself as a reliable, structured payment method, increasingly recognized by institutions.

Digital assets are creeping into the corridors of mainstream finance, and this time, stablecoin issuer Circle is joining forces with a Florida-based fintech firm to bring USDC to more retail customers and businesses. This partnership aims to offer U.S. citizens a trusted digital dollar option for both local and cross-border transactions.

Just one week after the U.S. passed its first comprehensive crypto legislation, the stablecoin market has added over $4 billion in fresh supply entering circulation. The newly signed GENIUS Act is already changing the sector. By providing a federal framework for fiat-backed stablecoins, it gives banks, asset managers, and fintech startups a regulatory greenlight. It allows for new capital, new players, and a clear path forward for tokenized dollars.

Polymarket wants to launch its own stablecoin. The crypto prediction platform, which currently uses USDC for all its transactions, is considering creating its own stable currency to capture the revenues currently received by Circle. Two options are on the table: a sharing agreement with Circle or an in-house stablecoin.

Tether is taking down its posters of abandoned blockchains to better align with crypto stars: while some lament Omni, others are already celebrating on Ethereum and Tron.

Jack Ma's financial empire is regaining momentum. Ant International, the international branch of the Chinese giant Ant Group, formerly a subsidiary of Alibaba, is preparing to integrate Circle's USDC into its blockchain. A strategic move that could reshape the landscape of the global digital payment ecosystem.

Ripple wants to become a banker, XRP attempts a spectacular comeback, and Wall Street applauds. The once rebellious crypto is settling into the plush chairs of regulators. How far will it go?

Ethereum is stumbling, ETFs are exploding, big holders are accumulating, and retail is asleep. What if Ethereum's crypto is quietly preparing for a major upheaval? Here's a behind-the-scenes look.