The Securities and Exchange Commission (SEC) announced a roundtable titled "Between a Block and a Hard Place: Tailoring Regulation for Crypto Trading" on April 11, 2025, in Washington, D.C. This event will bring together key figures from the crypto industry and traditional finance to discuss the development of a regulatory framework tailored to crypto trading.

Uniswap (UNI)

After reaching a peak of $19.5, the price of Uniswap has fallen, bringing it below $10. Check out Elyfe's analysis and break down the technical outlook for the UNI token.

Uniswap takes a major new step with the launch of Unichain, its Layer 2 blockchain on Ethereum. This announcement comes just a few days after the successful deployment of its version 4 on twelve major networks.

Uniswap, the leader of decentralized exchanges, is launching its version 4 on twelve major blockchains. This strategic evolution strengthens its position in an increasingly competitive DeFi market.

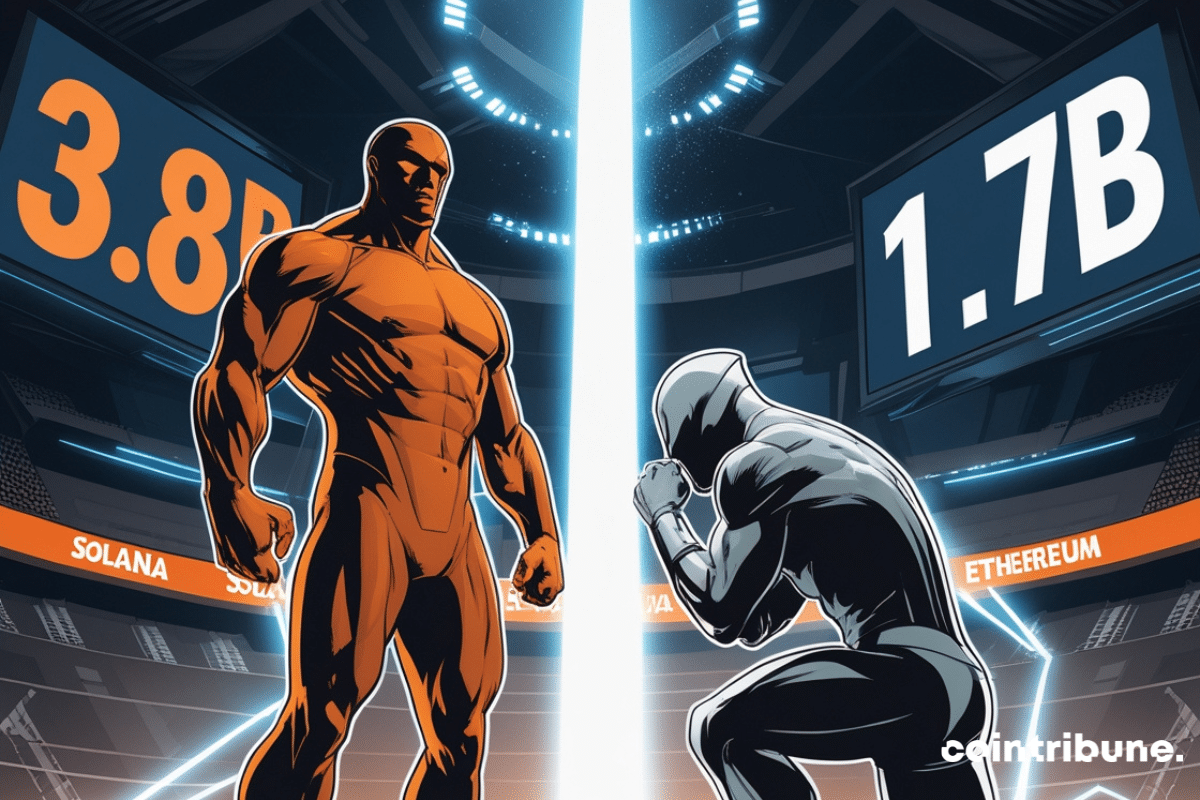

Solana, the audacious blockchain, humiliated Ethereum in broad daylight: 3.8 billion in 24 hours, leaving its rivals stunned. A memorable slap in the crypto arena.

Amidst the tumult of whales and the shine of profits, Uniswap dances with the hope of a rise... or a plunge.

In November 2024, Raydium, a decentralized exchange (DEX) native to Solana, surpassed Uniswap in terms of monthly volumes for the second consecutive month, according to a crypto report. Discover the impressive figures behind this success!

In November, DeFi tokens saw a spectacular increase of over 50%, pushing the total value locked (TVL) to levels not seen since 2021. On November 25, the TVL reached $118.4 billion, marking a strong comeback for the decentralized finance sector.

Decentralized finance (DeFi) has revolutionized the world of blockchain and cryptocurrencies, offering unprecedented investment and financial management opportunities. However, with the rapid emergence of numerous DeFi platforms, choosing the one that best suits each user’s personal needs can be complex. This choice involves considering various key factors. In this article, we explore these main aspects to help you select the platform that best aligns with your financial goals and investment style.

Uniswap unleashes the heavy artillery: its multi-chain bridge lands, burying the woes of crypto transfers... or almost.

Uniswap launches Unichain and promises $468M per year to UNI holders. Discover why this crypto blockchain could disrupt DeFi.

By abandoning Ethereum, Uniswap seems to say "Unichain for all, and ETH for no one!" The crash is looming...

Uniswap Labs, the creator of the renowned decentralized crypto exchange protocol, unveils Unichain, its Layer 2 blockchain based on Optimism's OP Stack technology. This innovation promises faster and cheaper transactions, strengthening its position in the DeFi ecosystem.

Uniswap, the giant of decentralized finance, has just announced a significant upgrade to UniswapX. This technical evolution comes amid turbulence for the UNI crypto, facing regulatory challenges and downward pressure on the markets.

Bitcoin is going through intense fluctuations, going from selling pressure to a slight recovery, reaching $61,826 with a 1.3% increase in 24 hours.

Crypto airdrops are still making waves in 2024, attracting increasing attention in the world of cryptocurrencies. Several projects stand out particularly in this trend, with numbers that are downright impressive, hinting at significant gains for users. As the year progresses, the excitement around airdrops shows no signs of slowing down, promising many more surprises and opportunities for participants.

Uniswap has revealed its substantial crypto holdings while announcing a crucial vote on a new fee mechanism!

The recent approval of Ethereum ETFs by the United States Securities and Exchange Commission (SEC) paves the way for broader institutional adoption and increased exposure of digital assets to traditional investors. Since the successful introduction of Bitcoin ETFs earlier this year, all eyes were on Ethereum, the second-largest crypto by market capitalization. Now that Ethereum ETFs have been given the green light, the market is buzzing, anticipating a new wave of massive investments. This new investment opportunity could transform market dynamics and offer significant benefits not only to Ethereum but also to several other cryptos closely related to its ecosystem. In this article, we will explore the three cryptos best positioned to capitalize on this approval of Ethereum ETFs.

Decentralized Finance (DeFi), threatened by the Biden administration, could become illegal. This affects investors' trust and financial autonomy.

Receiving a legal notice from the Securities and Exchange Commission (SEC) plunges Uniswap, a flagship of decentralized finance, into the heart of a regulatory storm. This news, occurring in a context of increasing cryptocurrency regulation, raises crucial questions about the future of DeFi and highlights the compliance challenges that these platforms must now confront.

Like Binance or Coinbase, Uniswap Labs could face legal action initiated by the Securities and Exchange Commission (SEC). This is at least the warning sent by the regulator to the crypto company without much information on the reason. The Uniswap community has not remained indifferent to this somewhat concerning development.

Discover the three cryptos that defy market trends and offer promising opportunities to savvy investors

Solana and Chainlink ignite the DEX market, promising a bull run for altcoins. Analysts anticipate a fruitful Q1.

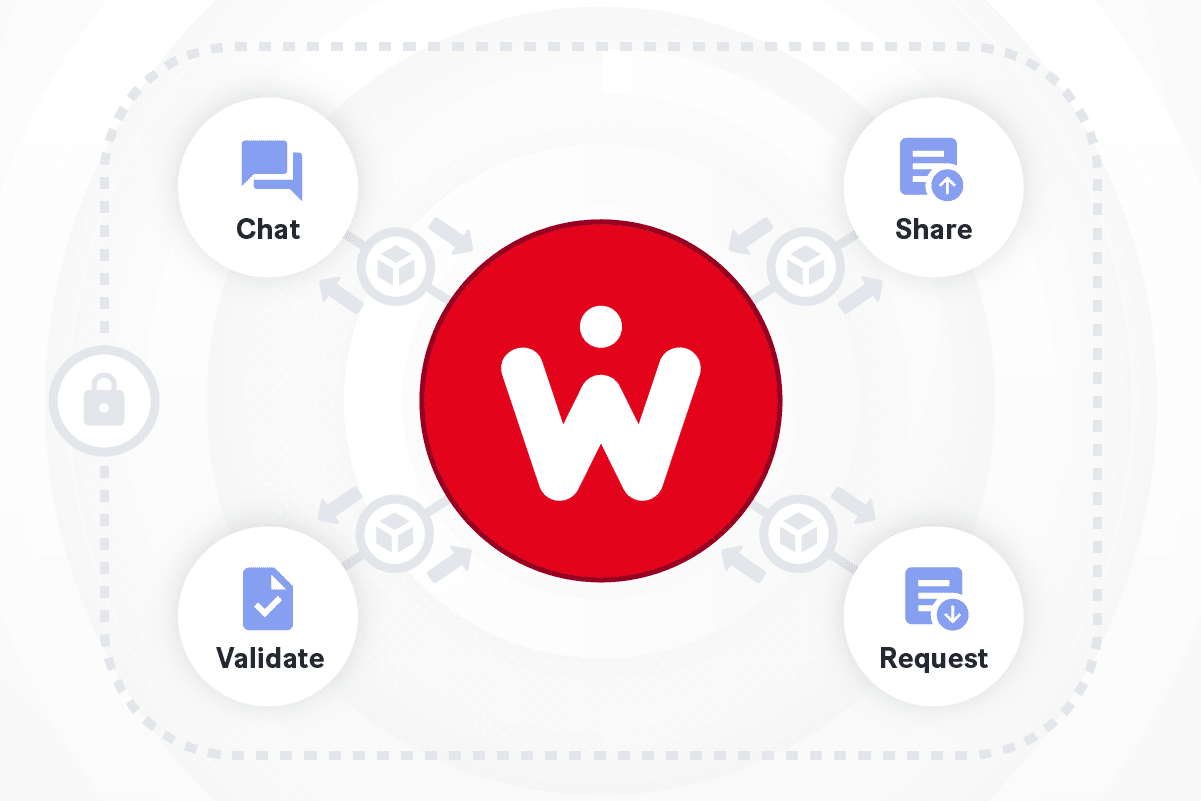

After successfully entering Bitstamp with great success and experiencing a meteoric rise, the Wecan Token is ready to take a new significant step. Wecan Group's cryptocurrency will soon also be available on the Uniswap exchange. A listing that promises to offer new perspectives for investors.

Barely launched, Friend.tech is setting new records. In just 24 hours, the decentralized social networking platform has generated 1.12 million fees. These statistics are beyond all comprehension: they surpass those of Uniswap and the Bitcoin network.

Remember decentralised finance? The sector, more commonly known as DeFi, has recently exploded and become the latest unavoidable trend in the cryptocurrency market. After Bitcoin (BTC) and altcoins, DeFi actually seems to be a little more than a trend. In the DeFi sector, which today weighs in at more…

If you want to invest in Uniswap, it is important to know how to buy UNI tokens securely, and for a good price. Similarly, when you want to part with your investment, you also need to do it properly. In this article, we’ll explain the different options available to you…

Uniswap (UNI) is a decentralised exchange (DEX) that has blown up in popularity over the last few months. Unlike other exchanges, there is absolutely no intermediary exchanging tokens between individuals. As a result, there are no order books, which you might find on DEXs like IDEX or Binance DEX. Instead,…