The trading volumes on Bitcoin ETFs launched by BlackRock, Fidelity, Ark Invest, and others are phenomenal.

une

Asked on Twitter, the ECB considers it highly unlikely to ever acquire bitcoin. However, the idea is gaining ground in the United States.

Leading up to the 2024 elections, OpenAI is committed to combating the misuse of AI and promoting transparency.

The Bitcoin spot ETFs generated nearly $10 billion in trading volumes in 3 days, driven by Grayscale, BlackRock, and FBTC.

The Binance Coin has regained its former resistance around $337. Let’s explore the upcoming outlook for BNB. Situation of Binance Coin (BNB) The BNB price ended the year 2023 on a positive note, recording an impressive increase of over 40%. This movement confirms the bullish scenario…

The Wall Street icon, Howard Lutnik, defends Tether against skeptics, stating that they own the announced 95 billion dollars.

The hegemonic position of the US dollar as the pivot of the global financial system is facing new challenges with the rise of crypto, according to a recent report by Morgan Stanley. This digital currency has both the potential to weaken and strengthen the role of the greenback.

At the 2024 World Economic Forum in Davos, China demonstrated economic strength that shook the foundations of Western forecasts. With an announced economic growth of 5.2%, surpassing the government's target of 5%, China not only defended its position as a global economic power but also implicitly challenged Western economic models.

Grayscale has transferred thousands of bitcoins worth hundreds of millions of dollars to Coinbase addresses.

The Nikkei index recently surpassed 36,000 points in the stock market, returning to its highest level since 1989.

A reduction in the Fed rates in 2024 could encourage crypto investors to turn to DeFi returns and stablecoins.

The research arm of the crypto exchange Binance has compiled, in a report, what it considers to be the crypto themes with high growth potential in 2024. Here, in the following few lines, is what can be concretely retained from it.

Explore the radical shift in perspective of BlackRock on Bitcoin, going from severe criticism to support for ETFs

The World Economic Forum in Davos is in full swing for its 54th edition. Bringing together global political, economic, and intellectual leaders, this annual summit aims to discuss current global challenges and find common solutions.

The latest Kaiko report on crypto liquidity reveals the superiority of XRP over BNB, Solana, and Cardano.

Explore how artificial intelligence has surpassed crypto at Davos 2024, signaling a turning point in the world of high-tech.

The TUSD stablecoin, linked to Justin Sun, collapsed below its US dollar peg on January 15, reaching a low of $0.984 amidst a wave of massive selling on the Binance crypto exchange exceeding $330 million.

Coinbase is at the center of Bitcoin ETFs. In addition to generating desire, the dominance of the crypto exchange presents certain risks.

Bitcoin has experienced a decrease of over 15% after reaching a new high. Let's together examine the future prospects for the BTC price.

The new Saga 2 version of Solana promises similar features to the initial version but at a more affordable price.

After nearly 10 years of rejection, 11 Bitcoin ETFs have been approved and started trading this week, marking a turning point in the history of Bitcoin. With the halving scheduled to take place within a few months, all the conditions are in place for a massive bull run and widespread adoption.

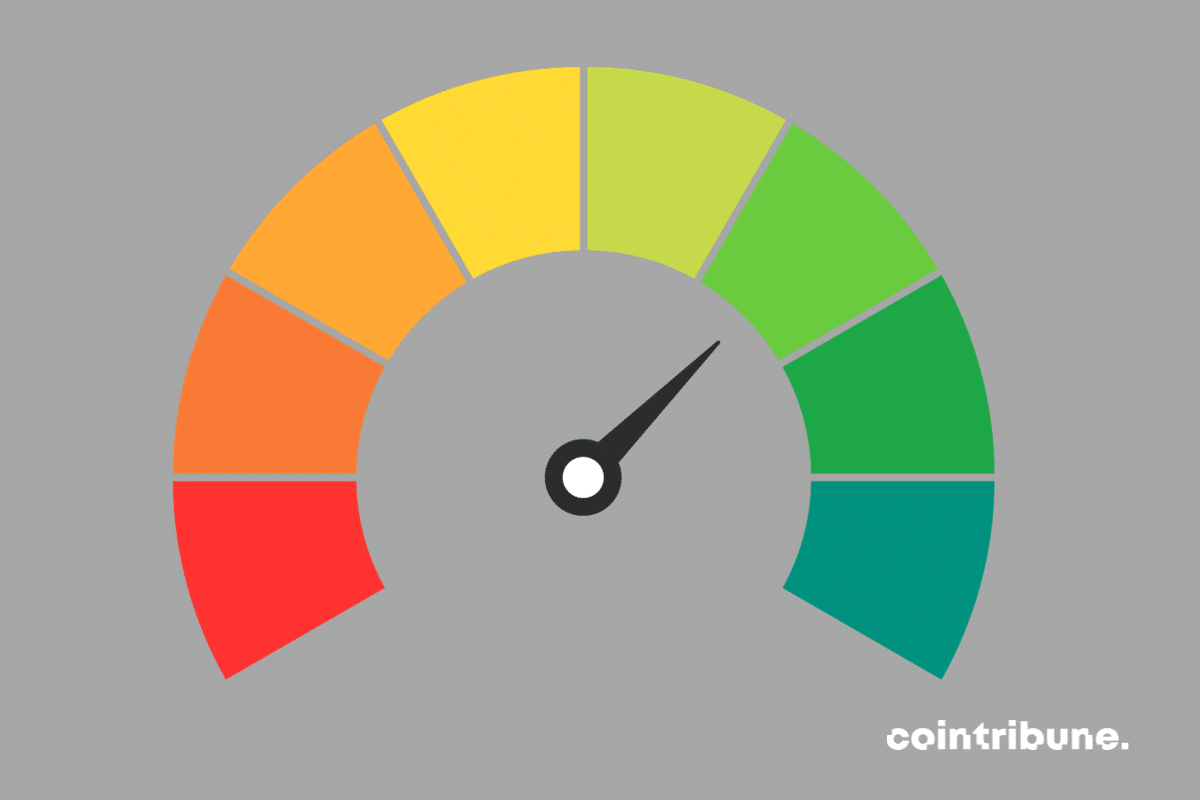

Thanks to the Crypto Fear and Greed Index, crypto analysts are able to gauge the market participants' perception of the dynamics of this industry. The latest news shows that this crypto indicator is displaying unusual mixed performance.

Binance has just revealed its 44th crypto project: the Manta Coin (MANTA), an innovative altcoin accompanied by attractive staking offers.

Despite the high-profile launch of ETFs, the bitcoin has returned to its level at the beginning of the year, above $40,000. Why?

Bitfinex thwarted a $15 billion XRP attack, preventing a major cryptocurrency theft from its vault.

USDT is the preferred stablecoin for criminals according to the UN, especially for laundering money from sophisticated scams.

Week after week, the world of cryptocurrencies continues to captivate and redefine the boundaries of digital finance and blockchain technology. This week was no exception, bringing a host of major developments, innovations, and surprises. In our weekly recap, we delve into the most significant and influential stories that have shaped the crypto ecosystem. From the historic approval of Bitcoin Spot ETFs by the SEC, to Standard Chartered's bold prediction on the price of Bitcoin, to the resilience of Binance Pay in the face of regulatory challenges, the outlook for Ethereum and XRP ETFs, and the explosion of development activity on Solana, we will review the highlights from the past week.

The artistic and intellectual production of man must take precedence above all? French publishers are taking a stand.

"The 2024 season of the economic calendar has just begun. What are the events that will shake up the crypto market this year?"

As the price of bitcoin stabilizes around $40,000, leverage sell positions are resurfacing in the market.