Behind the overwhelming losses of SHIB wallets, the infrastructure still roars. Between discouragement and rumors of resurgence, the ecosystem slowly burns, ready to reignite the speculative flames.

une

Experienced traders continue to show interest in memecoins despite the obvious signs of exhaustion in the speculative market for these particular cryptocurrencies.

A historic day on Wall Street: on April 4, 2025, American markets lost $3.25 trillion, more than the total market capitalization of crypto. This brutal drop, triggered by tariff measures from Trump, reveals a deep crisis. Bitcoin, however, endures. An analysis of an economic shift.

In a geopolitical context undergoing a major reshuffle, two significant initiatives are shaking the hegemony of the dollar. Brazil and China are making a strategic shift by favoring their national currencies for bilateral exchanges. For their part, Russia and Iran are announcing the launch of a new common currency to circumvent Western sanctions. These distinct yet converging movements illustrate a shared desire among influential BRICS members: to build a financial system that is less dependent on the greenback and to assert monetary sovereignty in the face of external pressures.

The mysterious creator of Bitcoin, Satoshi Nakamoto, celebrates his 50th birthday today, as his innovation revolutionizes global finance and now attracts major economic powers.

Bitcoin shows a surprising resilience in the face of market collapse. While gold retreats, it rises alone toward $100,000, fueled by a breakthrough narrative.

The sudden calm that falls over a network as active as XRP is never trivial. After a stunning rally at the end of 2024, Ripple's blockchain is experiencing a plunge in its activity. This drop of 65% in just a few weeks is more than just a simple adjustment. It reveals a worrying loss of momentum and raises questions about the strength of the market. Behind the numbers, an entire speculative dynamic seems to be wavering.

Bitcoin may soon have to sacrifice some of its coins to survive the quantum era. In the face of the growing threat from quantum computers, a radical plan is on the table: to permanently burn thousands of bitcoins. This controversial project, called QRAMP ("Quantum-Resistant Address Migration Protocol"), proposes a hard fork to secure the network at the cost of a partial destruction of non-migrated BTC. The Bitcoin community must now choose between immediate security and absolute adherence to the original principles of cryptocurrency.

The sentiment for bitcoin is at its lowest since the beginning of 2023. However, several analysts are identifying encouraging signs of a possible change in momentum as the queen of cryptos shows remarkable resilience in the face of recent volatility in the US stock markets.

The billionaire Trump has transformed his setbacks into financial levers. Thanks to Truth Social and his crypto projects, he is multiplying his wealth by playing with expectations and speculations.

The famous video game franchise Fortnite has just integrated a replica of a Bitcoin mining farm into its latest update. This provocative reference has propelled the game-inspired memecoin "Dill Bits" to over 200%. A crypto nod that resonates beyond the virtual.

In an uncertain macroeconomic context, a clear trend is emerging: stablecoins are entering an independent bull market, according to the asset manager VanEck in its April 2025 report. While smart contract platforms like Solana and Ethereum are experiencing a significant slowdown, stablecoins are rapidly gaining ground in the crypto ecosystem.

The crypto market may soon experience a major new phase with the impending approval of Solana ETFs. For several years, investors have been seeking to diversify their crypto portfolios through regulated financial products. The introduction of ETFs based on assets like Bitcoin and Ethereum has already shown increasing interest. Today, Solana may well follow this trend.

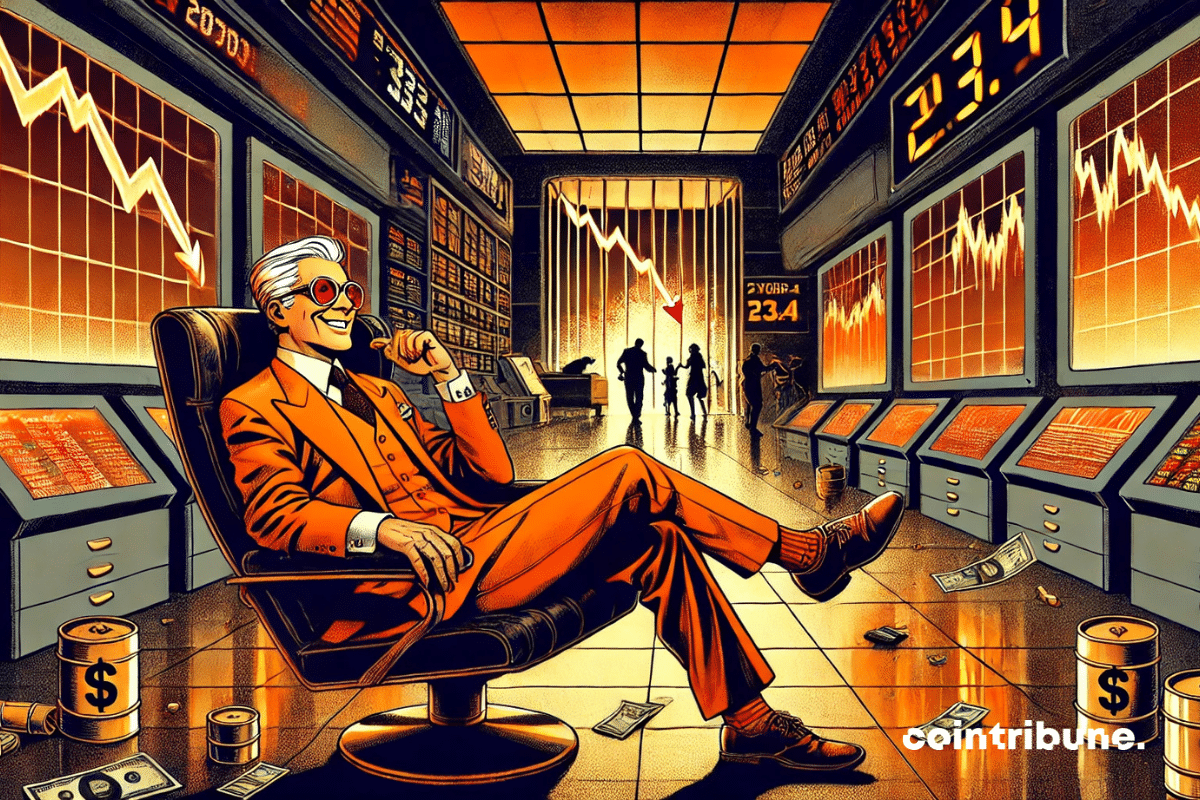

In a global market in complete chaos, Warren Buffett stands out as an exception. While the richest fortunes are recording massive losses, the American investor makes 23.4 billion dollars in just a few months. This performance contrasts with the general trend and raises the question: how does the oracle of Omaha manage to thrive where so many others falter? At the head of Berkshire Hathaway, he once again demonstrates that discipline, foresight, and rigorous management can still dictate the rules, even in times of instability.

In a single session, the euro surged 2.15% against the dollar, reaching $1.109, its largest increase since 2015. This abrupt jump exceeds the mechanics of exchange rates. It signals a sudden loss of confidence in the American currency. Through this shift, markets appear to be reassessing the balance of power among major currencies, in a context where macroeconomic signals and central bank choices are redefining monetary fault lines.

In a single session, the euro surged 2.15% against the dollar, reaching $1.109, its largest increase since 2015. This sharp rebound goes beyond the mechanics of exchange rates. It signals a sudden loss of confidence in the American currency. Through this shift, markets seem to be reevaluating the balance of power between major currencies, in a context where macroeconomic signals and the choices of central banks are reshaping the lines of monetary fracture.

As waves of economic uncertainty overwhelm the markets, the crypto universe holds its breath. Circle, the stablecoin giant, wavers between ambition and caution. Its IPO project, though firmly anchored, could sink into the murky waters of Trumpian policies. A decision that speaks volumes about the storms to come.

JPMorgan has revised its economic forecasts for 2025, raising the probability of a global recession to 60% due to the new tariffs imposed by the Trump administration. According to a report released this Thursday, titled "There will be Blood," the investment bank warns that the tariffs, which will take effect next week, risk plunging not only the United States but the entire global economy into a recession.

Bitcoin could surge to $88,500 this weekend, according to Standard Chartered. Indeed, far from a simple bullish prediction, this projection is part of a complete re-evaluation of the asset's role. For the bank, BTC no longer mimics gold. It now behaves like a leading technological asset, capable of weathering macroeconomic shocks. In a tense market, this stance redraws the lines of an asset undergoing a strategic transformation.

Donald Trump recently triggered an economic shockwave by announcing new tariffs. In response, Jerome Powell, the Chair of the Federal Reserve (FED), warned that these measures could exacerbate inflation while slowing down growth. What will be the impact on interest rates? Find out here.

Four consecutive red months for ETH. A slow, silent hemorrhage, where each absent transaction digs a little deeper into the grave of an asset in search of a second wind.

According to a recent report by Binance Research, Bitcoin could undergo a major transformation, evolving from a mere store of value to a true productive asset. This shift is driven by the rapid expansion of decentralized finance based on Bitcoin (BTCFi), whose total value locked has surged by over 2,700% in one year.

Arthur Hayes, co-founder of Bitmex and a prominent figure in the crypto ecosystem, recently expressed his support for tariff policies as a lever to strengthen assets such as Bitcoin and Gold. In an uncertain global context, marked by economic and geopolitical tensions, Hayes believes that these assets can serve as shields against inflation and market volatility.

Coinbase, a pioneer in crypto derivatives, is preparing to introduce XRP futures contracts. As regulation strengthens, the CFTC could pave the way for a new phase for XRP.

The year 2025 starts on a contrasting note for the crypto industry. While DeFi protocols suffer from a marked decline in their total value locked (TVL), decentralized applications, especially those focused on artificial intelligence (AI) and social networks, show solid growth. What are the drivers of these opposing dynamics and what prospects lie ahead for the ecosystem in the coming months?

From Brussels, the message is clear: digital giants will have to account for their actions. The platform X, formerly known as Twitter, is under investigation by the European Union for potential major violations of the Digital Services Act. The focus is on the dissemination of illicit content and the lack of cooperation with authorities. The proposed fine could exceed one billion dollars, a record that could mark a turning point in the enforcement of the new European regulation. Elon Musk, its owner, finds himself at the center of an unprecedented regulatory confrontation.

Donald Trump is once again making his mark at the helm of the United States. By launching a vast tariff offensive against almost all of the country's trading partners, the president is triggering an economic and diplomatic earthquake. Wall Street is falling, allies are worried, and Beijing is retaliating. This decision, as much strategic as ideological, marks the overt return of hard protectionism and places American economic sovereignty at the center of the global game.

Donald Trump has caused an economic shockwave by announcing significant tariffs targeting almost all countries in the world. The figures presented by the White House are being thoroughly analyzed by experts and raise questions among the United States' trading partners.

Paul Atkins takes the stage, Gensler exits through the back door, and Trumpian stablecoins dance on the blurry line between regulation and personal ambition. It's a true crypto western.

While Bitcoin has retreated by 25% from its all-time high of over $109,000, an unexpected movement is emerging: whales are returning to their purchases. These large wallets, often seen as market barometers, are marking their first real return to accumulation since August 2024, according to Glassnode. In a context dominated by distribution and a sentiment reminiscent of the lows of 2022, this strategic signal could disturb the prevailing bearish consensus and reignite investor attention on current levels.