Talen Energy Corporation has just acquired 100% of Nautilus Cryptomine, a 200-megawatt mining farm in Pennsylvania. This operation marks a turning point in the use of nuclear energy for mining, paving the way for a greener exploitation of Bitcoin. Nuclear Energy, a New Engine for Bitcoin Mining On October 3,…

Trading Exchange RSS

Ripple has just reached a new milestone by issuing 4.5 million RLUSD in just 24 hours. This strategic move aims to place Ripple at the heart of the stablecoin ecosystem and compete with the well-established leaders in the crypto sector. The RLUSD, backed by the US dollar, was designed to…

This case is just one piece of the vast puzzle of economic sanctions against Russia, but it highlights the difficulty of tracking and seizing assets acquired through sophisticated financial arrangements. As French justice intensifies its efforts, international pressure for greater financial transparency is mounting. The next steps in this investigation, and those to come, could redefine the tools for combating transnational financial crime. Thus, the implications for Russian oligarchs and their networks in Europe are immense, and such actions could inspire other jurisdictions to act.

Larry Fink made bold statements regarding Ethereum. According to him, the second largest crypto will grow spectacularly and…

CoinGecko, the reference platform for cryptocurrency data, has just released its highly anticipated report on the crypto industry for the third quarter of 2024. This in-depth analysis reveals a resilient market in the face of strong volatility, maintaining a total capitalization of around $2.3 trillion despite global economic turbulence.

The price of Bitcoin (BTC) soared by 5% this Monday, approaching $66,000. This increase reignites investors' hopes of seeing the leading cryptocurrency reach new highs in the coming weeks.

The 2024 Nobels sound the alarm: economic inequalities would be the rotten fruits of our failing institutions.

Uniswap launches Unichain and promises $468M per year to UNI holders. Discover why this crypto blockchain could disrupt DeFi.

The Taiwan Strait is once again boiling, and tensions between China and Taiwan are reaching a critical threshold. At the beginning of this week, Beijing intensified its show of military force by deploying fighter jets and warships all around the island, in what is described as a direct warning to Taiwanese "separatists." This surge in tension comes in a context where relations between Beijing and Taipei have continued to deteriorate since Lai Ching-te came to power in 2024, raising fears of an escalation with unpredictable consequences.

France is undergoing an unprecedented budget crisis. The deficit is likely to exceed 6% in 2024. France now risks bankruptcy, which would plunge the entire euro area into the abyss.

"Decentralized finance, Trump’s new craze! The sale of WLFI promises mountains and wonders to investors… or not."

While Bitcoin, the most emblematic of cryptocurrencies, is experiencing a period of relative calm in the media, memecoins are emerging as true stars of the moment. A drastic drop in Google search volumes for Bitcoin reflects this unexpected dynamic. Meanwhile, memecoins, driven by platforms like Solana and Tron, are attracting unprecedented attention. Is this shift indicative of a lasting change or merely a passing situation?

After a period of relative stability, Bitcoin awoke with a bang, crossing the $64,000 mark and triggering a wave of liquidations in its wake. This sudden movement hit traders who had bet on a market decline hard, causing short position liquidations exceeding $100 million. For many observers, this unexpected rise…

The EUR/USD exchange rate recently dropped to around 1.0900, influenced by an increasingly accommodative market sentiment towards the European Central Bank (ECB). This bearish trend, observed for four consecutive sessions, is primarily due to expectations of an interest rate cut by the ECB during its upcoming financial meeting scheduled for this Thursday.

The era of secure cryptography may well be living its last days. Chinese researchers, using the capabilities of a quantum computer produced by D-Wave Systems, have recently reached a milestone: for the first time, a quantum computer has concretely threatened current encryption systems. Could the global crypto-system be shaken on…

This week, the price of bitcoin could experience a significant increase due to several major economic and geopolitical events. Here are the four main factors to watch to understand why bitcoin might explode in the coming days.

The Avalanche Foundation is set to buy back nearly 2 million AVAX tokens sold to Terra just before its collapse in 2022. This transaction, which awaits approval from a bankruptcy court, marks a new chapter in the tumultuous history of the crypto market.

Amid revolutionary announcements, technological evolutions, and regulatory turbulence, the crypto ecosystem continues to prove that it is both a territory of limitless innovations and a battleground of regulatory and economic disputes. Here is a summary of the most significant news from the past week surrounding Bitcoin, Ethereum, Binance, Solana, and Ripple.

When Bitcoin rises, traders tremble: the golden beast ascends, but the shadow of the bears is never far away.

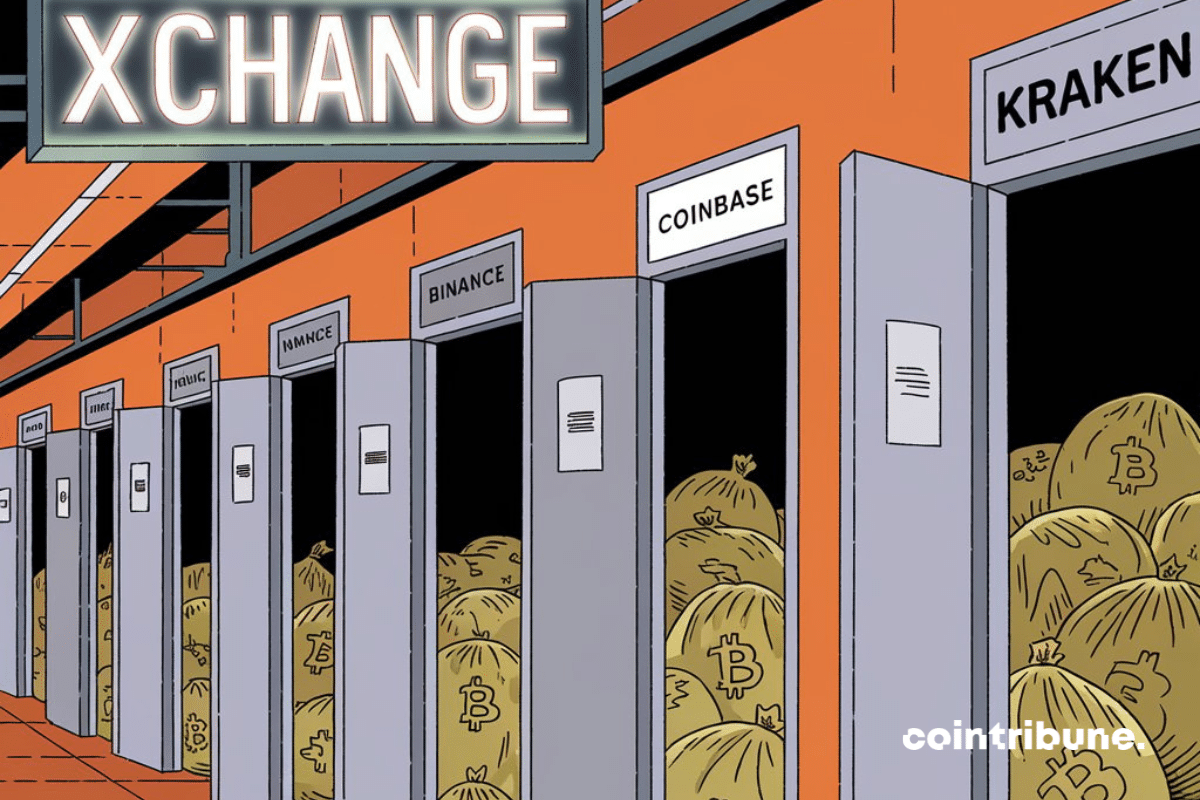

Traders are leaving exchanges: Bitcoin now prefers the calm of a cozy wallet to the stress of turbulent markets.

The upcoming BRICS summit, which will take place in Kazan, Russia from October 22 to 24, appears to be a key milestone in the ongoing international reshaping. By bringing together several rising powers and strategic partners at the same table, this summit aims to strengthen the bloc's influence on global economic, political, and diplomatic issues. The presence of Antonio Guterres, Secretary-General of the United Nations, at the heart of these discussions is a strong sign of recognition of the growing importance of the BRICS. More than just a diplomatic trip, his participation reflects a desire for openness and the integration of this group into global governance.

What if social networks became paid? Republik and Cointribune explore this idea, and here’s why you might soon be paying.

By abandoning Ethereum, Uniswap seems to say "Unichain for all, and ETH for no one!" The crash is looming...

Craig Wright, the self-proclaimed Satoshi Nakamoto, is intensifying his legal battle against the Bitcoin ecosystem. Despite a crushing defeat in British courts, Wright is launching a new showdown against the developers of Bitcoin Core, demanding an astronomical sum exceeding one trillion for the alleged unauthorized use of the $BTC ticker.

As large market capitalizations like Bitcoin and Ethereum seem to have reached a certain maturity, the attention of some savvy investors is now turning to another category of assets: low-priced cryptos, often overlooked, but which harbor an unexpected growth potential. Priced at less than $1, here are 5 assets that could explode during the next bull run and transform modest investments into spectacular gains.

Discover China's new economic measures and why they leave investors skeptical about the real estate crisis.

October starts on a lukewarm note for bitcoin, which, at $63,110, struggles to initiate the much-anticipated “Uptober” rally. Yet, despite this calm, bullish prospects are not lacking. Indeed, macroeconomic factors and market trends suggest that bitcoin could hold surprises for investors this month. Let’s explore the five reasons why October…

Ethereum co-founder Vitalik Buterin recently addressed the thorny issue of transaction fees on layer 1 and layer 2 of the network. In the face of growing congestion, he proposes innovative solutions to balance costs and maintain the attractiveness of the crypto ecosystem.

Shiba Inu struggling against new competitors: is the future of the famous crypto meme threatened? Discover it here.

The Bitcoin bull cycle is still ongoing and the crypto queen is expected to experience a sustainable explosion in 2025!