The crypto market experienced a genuine Christmas rally on December 25, 2024, with Bitcoin soaring to $98,000, resulting in an overall increase that added more than $100 billion to the market's total capitalization.

Trading Exchange RSS

BlackRock's Bitcoin ETF is going through a tumultuous period marked by unprecedented capital outflows. The asset management giant recorded its largest daily outflow on December 24, contributing to a downward trend that has seen U.S. Bitcoin ETFs collectively lose over $1.5 billion in just four days.

Under the spotlight of speculation, memecoins attract and terrify. Solana leads the dance, Coinbase follows, while traders oscillate between golden dreams and cold sweats.

MicroStrategy, a global leader in Bitcoin holdings, is proposing a massive stock increase to finance the purchase of more bitcoins. This initiative, aiming to raise $42 billion, reflects the company's ambitious strategy to strengthen its position in BTC treasury management.

L'ETF Bitcoin de BlackRock traverse une période tumultueuse marquée par des sorties de capitaux sans précédent. Le géant de la gestion d'actifs a enregistré sa plus grande sortie quotidienne le 24 décembre, poursuivant une tendance baissière qui a vu les ETF Bitcoin américains perdre collectivement plus de 1,5 milliard de dollars en seulement quatre jours.

BlackRock's Bitcoin ETF is undergoing a tumultuous period marked by unprecedented capital outflows. The asset management giant recorded its largest daily outflow on December 24, in a bearish trend that has seen U.S. Bitcoin ETFs collectively lose over $1.5 billion in just four days.

A crypto analyst, Michael van de Poppe, predicts that Ethereum (ETH) could surpass Bitcoin (BTC) in January 2025. This prediction is based on a key factor, which could trigger an "altcoin run" and attract more investments into the Ethereum ecosystem.

China is at a pivotal economic turning point. As the combined effects of weak consumption, an intensified real estate crisis, and high unemployment hinder its development, Beijing has just announced an ambitious budget policy for 2025. The stated objective is clear: to stimulate domestic demand and stabilize an economy under significant pressure. To achieve these ambitions, the government plans a significant increase in public spending, coupled with a revision of its fiscal priorities. These measures, detailed during a national conference, reflect a firm commitment to support local communities, expand social benefits, and strengthen resources for struggling businesses. Such a strategy, centered around innovation and strategic technologies, also aims to revitalize trade exchanges in order to adapt debt rules. With this comprehensive approach, Beijing intends to lay the groundwork for more resilient economic growth and to address the structural challenges that hinder its trajectory.

Tether is the crypto version of 2025: BTC for real life, private AI for discretion, and Rumble to dethrone YouTube. That’s all there is to it!

In December 2024, Bitcoin experienced a slight decline of 2.4%, raising questions about the end of the bull market. Despite this drop, BTC remains a winning asset for the year, with an increase of nearly 50% in the fourth quarter.

The recent events on the Hyperliquid platform have highlighted a growing threat in the crypto universe: the involvement of North Korean hackers. Over $256 million was withdrawn from the platform in record time, triggering major concerns among investors and industry observers. Hyperliquid: a platform in crisis facing an unprecedented cyber…

The crypto market, characterized by sustained volatility, continues to surprise with the failure of predictions. While massive sell-offs have dominated trading in recent days, a report published by CoinShares highlights a singular phenomenon: institutional investors have significantly increased their positions in crypto products. Indeed, with net inflows reaching $308 million in a week, these investments sharply contrast with the general downward trend. This institutional support, although counterintuitive in an environment of strong economic pressure, reflects a strategic confidence in the potential of cryptos. Concurrently, the data reveals marked divergences among products, reflecting a reconfiguration of investment priorities. This dynamic paves the way for an in-depth analysis of the motivations of institutions and their implications for the future of crypto markets.

The "Santa Claus rally" seems to have hit a snag this year, with Bitcoin reaching its lowest price of December 2024 at $92,442. This unexpected drop has surprised investors, calling into question the historical trends of rising prices during the holiday season.

Solana, like a Phoenix, rises from the ashes of FTX. With a 2,000% increase, it makes Bitcoin and Ethereum look outdated, showing record volumes and spectacular inflows.

The year 2024 was marked by significant advancements in the world of cryptocurrencies, with several exchange platforms standing out for their performance, security, and innovation. Here is an overview of the three crypto exchanges that dominated this year.

The world of crypto could experience a historic change with Donald Trump's return to the White House. Indeed, the elected president, already known for his divisive stances, has placed crypto at the heart of his economic priorities. He aims to propel the United States to the status of a global leader in this rapidly expanding sector. Among his promises are the creation of a strategic reserve of bitcoins and the establishment of policies favorable to crypto businesses. These initiatives, which demonstrate a desire for a break from the previous administration, evoke a mix of hope and skepticism within the industry. While his supporters praise a bold vision for the future of crypto, observers remind us of the many obstacles that will arise in the realization of these projects, whether political, economic, or regulatory. Donald Trump's next term could thus mark a decisive turning point in the evolution of cryptocurrencies in the United States and on the international stage.

Former FTX CEO Sam Bankman-Fried, sentenced to 25 years in prison for fraud, could he benefit from a presidential pardon? This possibility, linked to his political connections, is sparking intense debate in the crypto community and beyond.

In December, Solana continued to outperform Ethereum in the decentralized exchange (DEX) industry for the third consecutive month. Thanks to the growing popularity of memecoins, Solana recorded record transaction volumes, thereby consolidating its position against crypto giants like Ethereum.

On Wall Street, the rumor is growing: 2049, Bitcoin soars, the debt collapses. A grand bet, a shaken America.

Nokia, the Finnish telecommunications giant, is heading towards a new digital era with a patent dedicated to the encryption of digital resources. This project could mark a significant advancement in securing crypto assets and blockchain technology.

As the year comes to a close, the bitcoin market finds itself at a decisive stage. Investors were hoping for a period of stability to end 2024 on a positive note after a series of significant fluctuations. However, several major technical indicators are countering these expectations and pointing towards a possible significant correction. Among these signals, the formation of a bearish pattern on the weekly charts and the erosion of critical support levels are raising serious concerns. Concurrently, macroeconomic conditions, marked by a decline in global money supply and a tightening of policies by the U.S. Federal Reserve, are increasing pressure on risk assets. These combined elements are fueling the most pessimistic projections. Thus, some observers even suggest that the price of bitcoin could drop by $20,000. A thorough analysis of these dynamics reveals both the challenges and the opportunities of a market in search of new certainties.

International economic dynamics always attract marked interest, particularly when coalitions like the BRICS are perceived as a threat to the hegemony of the American dollar. However, the recent statements from Russia, India, and South Africa have clarified their position. Indeed, these countries assert that no plan aims to weaken the American currency. They firmly reject the accusations of "de-dollarization" and emphasize their willingness to maintain stable relations with the United States.

Since its launch, Solana has distinguished itself as one of the most innovative blockchains in the industry. With its execution speed and some of the lowest transaction fees, it has attracted a dynamic ecosystem of developers and users. However, December 2024 marked a critical period. The Total Value Locked (TVL) in its DeFi ecosystem recorded a dramatic drop of $1.1 billion, reaching a critical level of $8.01 billion. This decline reflects weakened activity on the blockchain, as evidenced by a 7% decrease in the number of daily active addresses. At the same time, network revenues also fell by 24%, intensifying concerns about the sustainability and attractiveness of this leading platform. These numbers raise questions about Solana's ability to maintain its position in an increasingly competitive environment.

The cryptocurrency market has recently been shaken by a record fund outflow of 73 million dollars from BlackRock's Bitcoin exchange-traded fund (ETF) (IBIT). This event marks the largest fund outflow since the ETF's launch in January 2024.

Amid revolutionary announcements, technological advancements, and regulatory turbulence, the crypto ecosystem continues to prove that it is both a territory of limitless innovations and a battleground for regulatory and economic disputes. Here is a summary of the most notable news from the past week surrounding Bitcoin, Ethereum, Binance, Solana, and Ripple.

In a strategic move amid a volatile crypto market, large investors, commonly referred to as "whales," have accumulated over 250 million Dogecoin (DOGE). This significant acquisition occurred while the price of dogecoin was declining, drawing market attention due to its timing and magnitude.

MicroStrategy, a leader in institutional Bitcoin acquisition, has recently reached a historic milestone by surpassing the purchase volumes recorded during the 2021 bull market. These moves reflect a bold strategy and an unwavering commitment to the flagship cryptocurrency.

When a former footballer dons the jersey of innovation, and Trump orchestrates, the crypto-sphere stirs: a promise of growth or just a bluff?

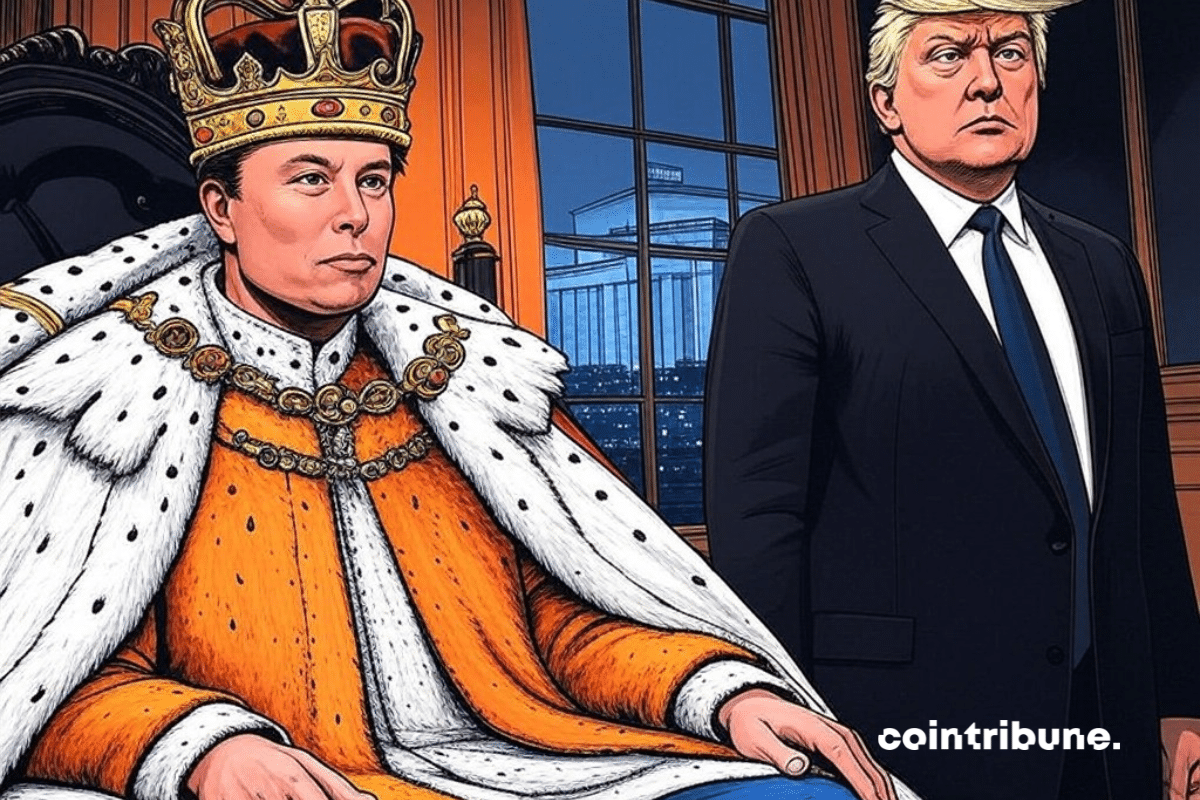

Elon Musk is shaking Washington. Between his influence on social media and his hundreds of millions of dollars in donations, Elon Musk is increasingly establishing himself as the true master of the White House.

"Great news awaits holders of a Livret d'Épargne Populaire (LEP). Starting December 31, 2024, more than 2.5 million French citizens will benefit from the annual payment of interest. Discover the details and the impact of this measure on their purchasing power."